Playing Devil’s Advocate: What Could Derail Meta’s Growth?

In my previous blog post titled “Meta's Path to a $10 Trillion Market Capitalization: A Bold Thought Experiment?“, I delved into a thought experiment exploring the potential for Meta Platforms (formerly Facebook) to achieve a $10 trillion market capitalization.

While that analysis painted a picture of opportunity, it’s only half the story!

To guard against confirmation bias and maintain intellectual honesty, investors must also always examine and be acutely aware of the counterarguments and risks—some existential—that could derail Meta’s trajectory.

The intent of this post is in no way to predict doom but to balance optimism with caution. Once you start investing significant sums of money (a multiple of your annual savings rate), the stakes are high, and so are the risks.

Hence, here are 6 risks to be aware of:

1. The TikTok Threat: Disruption Could Be Only a Swipe Away!

The meteoric rise of TikTok serves as a stark reminder of how quickly new social media platforms can upend the status quo.

TikTok’s unique value proposition—a focus on algorithmically curated short-form video—, which quickly gained widespread popularity, exposed how fragile Meta’s position as THE dominant social media company can be and forced it to adapt rapidly (e.g., launching Reels).

The success of TikTok was one of the contributing factors leading to the 76% (!) decline in Meta’s stock.

Going forward, Meta faces two significant challenges:

Adaptability vs. Profitability: The transition periods to counter such threats can come at the cost of lower profitability. For example, newer ad monetization strategies on Reels for quite a long time generated lower revenue per user than legacy products like Instagram Stories.

Revenue Concentration Risk: Today, almost 100% of Meta’s revenue is derived from advertising. A platform-level disruption that siphons off user attention could threaten not just one product but the entire company.

Counterpositioned platforms like TikTok highlight Meta’s vulnerability to external competition, particularly as user preferences shift. This demands constant vigilance and innovation to stay ahead (which fwiw is one of the reasons I’m invested in Meta).

This a great transition to the second key risk …

2. Key Man Risk: The Zuckerberg Dependency

Mark Zuckerberg has been the engine driving Meta’s innovation, growth, and relentless ambition for nearly two decades. His seemingly endless ambition and willingness to take audacious bets, such as the pivot to the metaverse, has shaped Meta’s culture.

However, this dependence comes with risks:

Focus and Commitment: Should Zuckerberg lose interest in the day-to-day operations of Meta or divert his energy elsewhere, the company’s “move fast and break things” ethos could falter.

("Move fast and break things" - Mark Zuckerberg onstage at the F8 conference 2014.)

Leadership Transition Risk: If an unexpected event sidelines Zuckerberg (cue: his MMA passion is something to be aware of), the company could struggle to maintain strategic momentum. Investors often underestimate the role of visionary leaders in sustaining innovation cycles.

Meta hopefully has an emergency succession plan (but then again, the C-suite of Meta is excellent and filled with many executives who have been with the company forever and that, for instance in the case of Andrew "Boz" Bosworth, share the visionary thinking of Zuck (I recommend checking out his podcast).

3. Regulatory Risks: Antitrust and Data Privacy Clamps

Meta’s dominant position in social media and digital advertising has placed it squarely in the crosshairs of regulators worldwide. Potential threats include:

Antitrust Actions: Governments and antitrust agencies could— just like in the case of Google— force divestitures of key assets like Instagram or WhatsApp. These platforms are critical growth engines and their separation could dilute Meta’s network effects and related synergies.

Data Privacy Regulations: Stricter rules such as GDPR in Europe and potential US federal privacy laws could limit Meta’s ability to collect user data—undermining its core ad-targeting capabilities.

Regulatory pressure isn’t a new phenomenon for Meta (and so far Meta has navigated this minefield well), but it is an ever-present threat that could fundamentally reshape its business model at some point in time.

4. The Platform Shift Risk: A New Paradigm of Computing

The internet will inevitably evolve into new computing platforms, whether through AR/VR, AI, or something unforeseen.

Meta has made significant investments in AR/VR through its metaverse initiatives, but success in the next platform isn’t guaranteed.

Transition Challenges: Meta’s dominance when it comes to connecting people online (i.e. social media) and the corresponding ad business model is unparalleled. However, dominance in traditional social media doesn’t ensure success in a fundamentally different paradigm. For example, advertising in AR/VR may operate differently than on mobile platforms and pose a substantial thread to Meta’s core business.

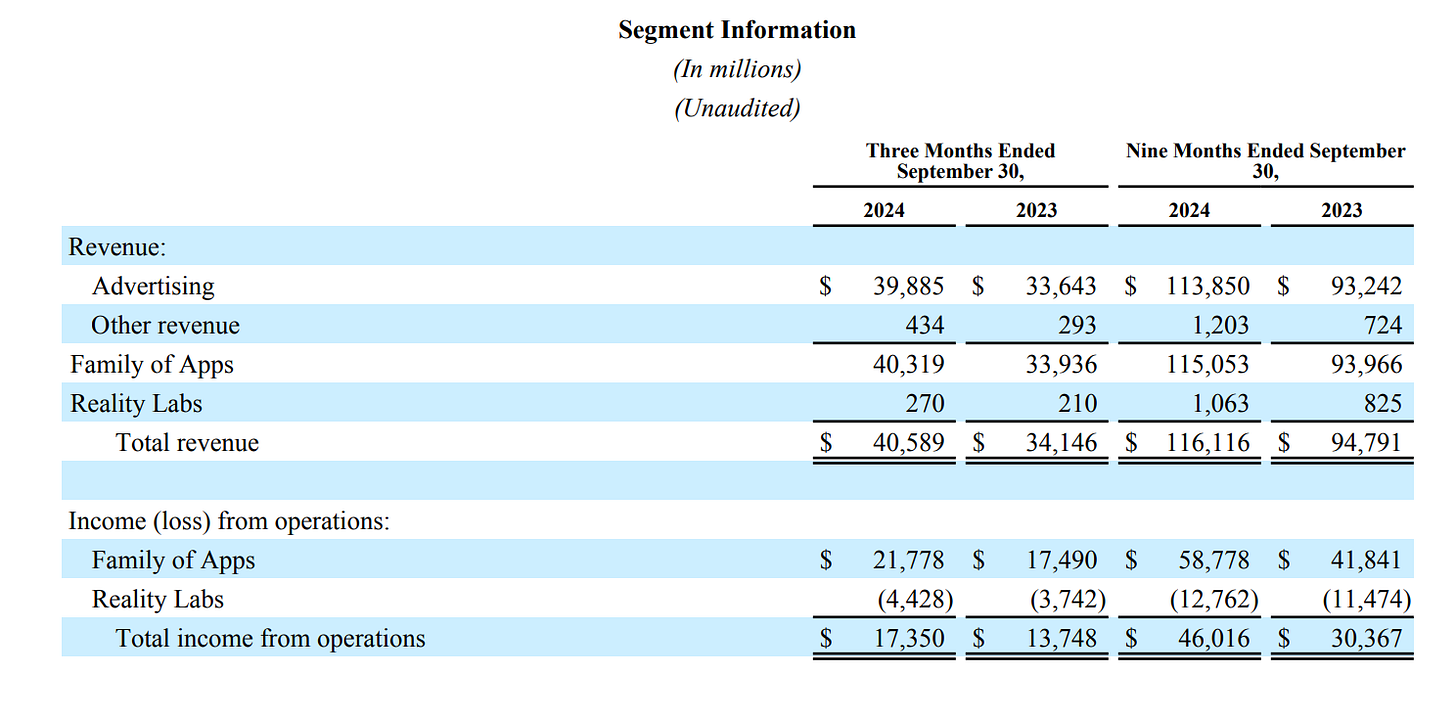

Competitive Pressure: Other players like Apple, Microsoft, and startups are also vying to define the next platform. Meta’s multibillion-dollar bets (the company has spent around $50B on the Metaverse ambitions since 2021) could yield suboptimal returns if its vision doesn’t align with consumer preferences.

Success in AR/VR or other emerging platforms requires not only technology but also consumer adoption—two areas with substantial uncertainty.

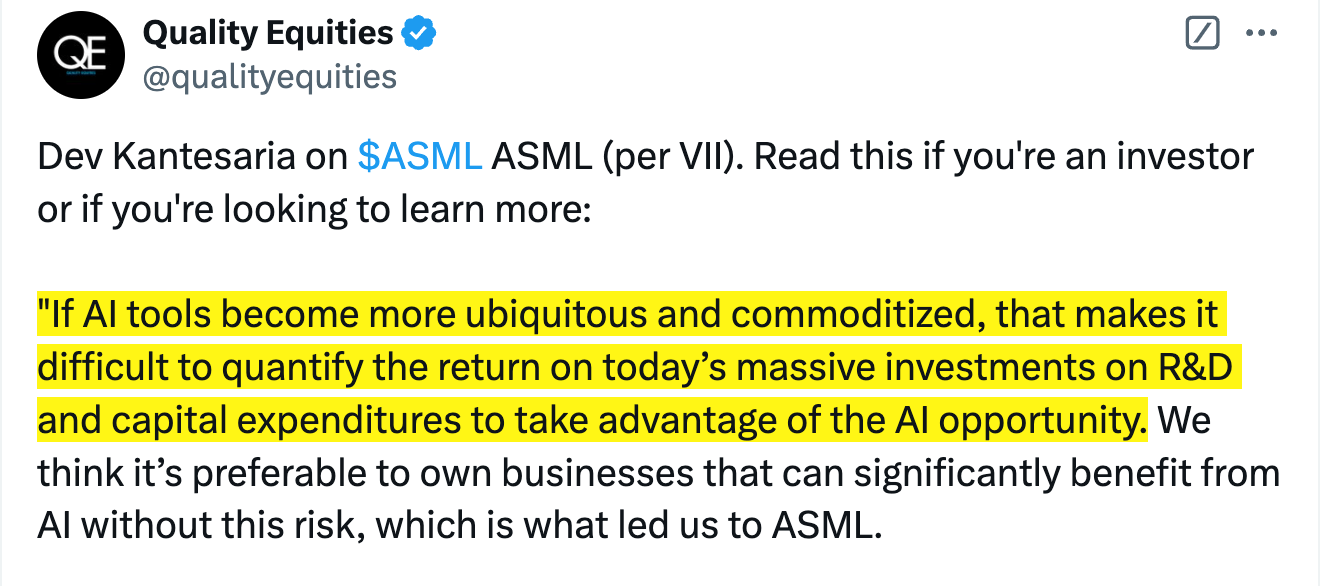

5. The Commoditization of AI

Meta is spending tens of billions annually on AI initiatives, betting on its transformative potential. However, some seasoned investors like Dev Kantesaria argue that AI could become a commoditized technology with limited monetization opportunities. If this view holds true, Meta’s massive CapEx could fail to generate attractive returns.

Meta’s ability to maintain differentiation in AI-driven advertising and user experiences will be critical. Commoditization risks turning AI into a costly endeavor with little competitive advantage.

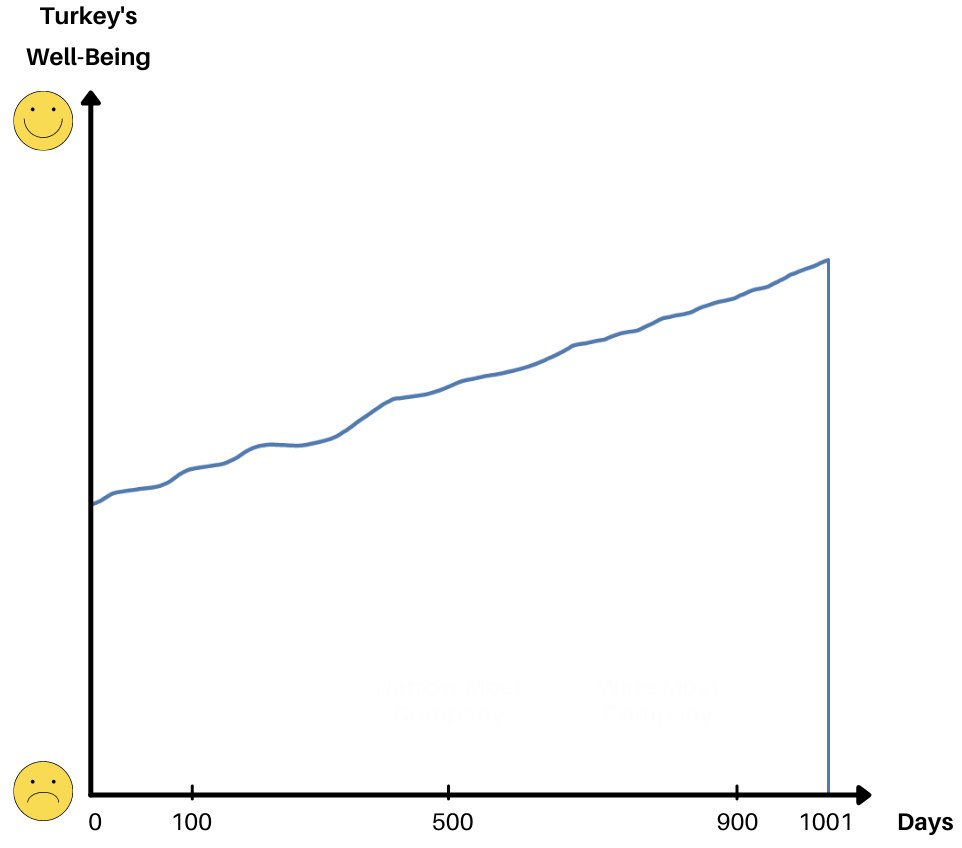

6. The Unknown Risk: Black Swans and Tail Risks

As with any complex business, the greatest dangers often lie in what we can’t foresee. Black swans—unpredictable, high-impact events—can destabilize even the most resilient companies.

Whether it’s a geopolitical crisis, a major data breach, or a cultural shift away from social media, these unknown unknowns can trigger panic selling and long-term damage.

Investors often discount well-known risks but fail to prepare for the unknowable. This is especially true during periods of overconfidence, when soaring prices obscure underlying fragility.

The Paradox of Confidence: Lessons from Q3/Q4 2022

One thing is certain: overconfidence grows as stock prices rise. Investors were FAR more pessimistic during Q3 and Q4 of 2022 (the level of pessimism can hardly be expressed in a written blog post, but trust me, everyone seemed to hate Meta’s stock) when Meta’s share price plunged 76%, presenting attractive buying opportunities for those looking a few years out and reading the conference calls closely (a good chunkg of Meta’s labeled “Metaverse spend” went into AI).

Thus, the current environment, with Meta’s stock on a tear, demands caution.

Let me be clear: Acknowledging risks doesn’t mean dismissing Meta’s potential. Instead, it emphasizes the importance of skepticism, humility, and a balanced perspective—especially when the market narrative grows one-sided.

Final Thoughts

I still consider my $10 trillion thought experiment (“Meta's Path to a $10 Trillion Market Capitalization: A Bold Thought Experiment?“) an intriguing exercise, but achieving such a valuation is contingent on overcoming formidable and unforeseen risks.

By identifying and confronting these challenges early and head-on, investors can better assess Meta’s long-term potential.

The higher the price, the steeper the expectations—and the more critical it becomes to challenge the narrative.

What do you think? Are there other risks we haven’t discussed here? Let’s continue the conversation in the comments section.