Meta's Path to a $10 Trillion Market Capitalization: A Bold Thought Experiment?

Unlike some of my peers, I rarely focus on labeling stocks with grandiose labels such as "This is the next 10x stock!" or even "A stock with 100x potential.!"

Instead, I prefer more grounded targets, such as a doubling over five years, which implies an attractive compounded annual return of roughly 15%.

However, for the sake of intellectual curiosity, I recently explored an intriguing scenario involving Meta Platforms (NASDAQ: META 0.00%↑ ) and its potential to reach a $10 trillion market cap over the next 10-20 years (a 6.5x).

Here’s a breakdown of my reasoning, framed as an engaging thought experiment rather than a definitive prediction.

Meta Today: A Snapshot

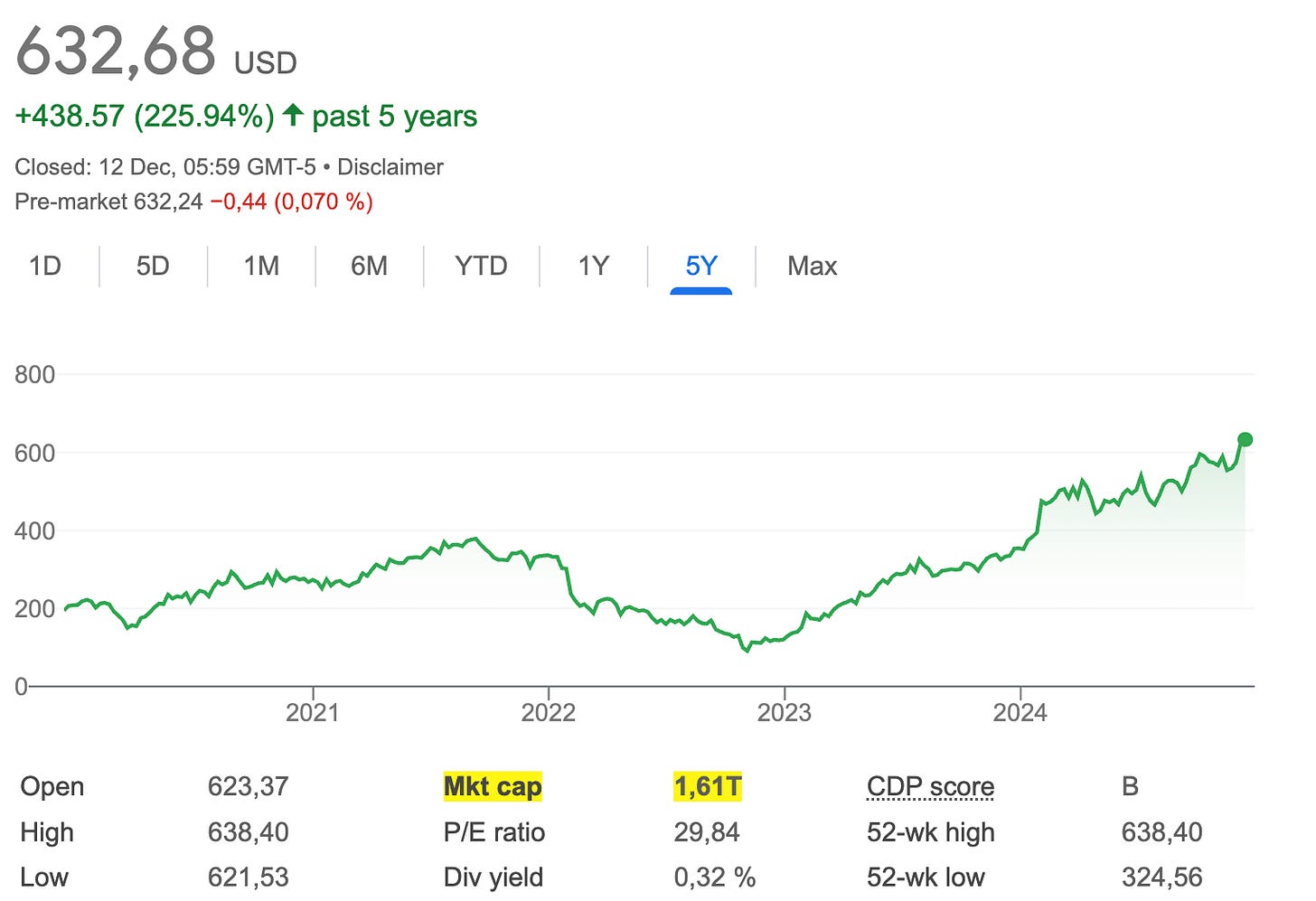

Meta Platforms currently boasts a market capitalization of approximately $1.6 trillion.

The company is well-known for its dominance in social media through platforms like Facebook, Instagram, Threads, and WhatsApp, as well as its emerging focus on virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) – even though these segments don’t represent meaningful portions of Meta’s overall revenue yet.

Here’s why I believe Meta has the potential to reach a $10 trillion valuation over the next 10-20 years – I’ll highlight five factors worth tracking:

1. AR as the Next Computing Platform

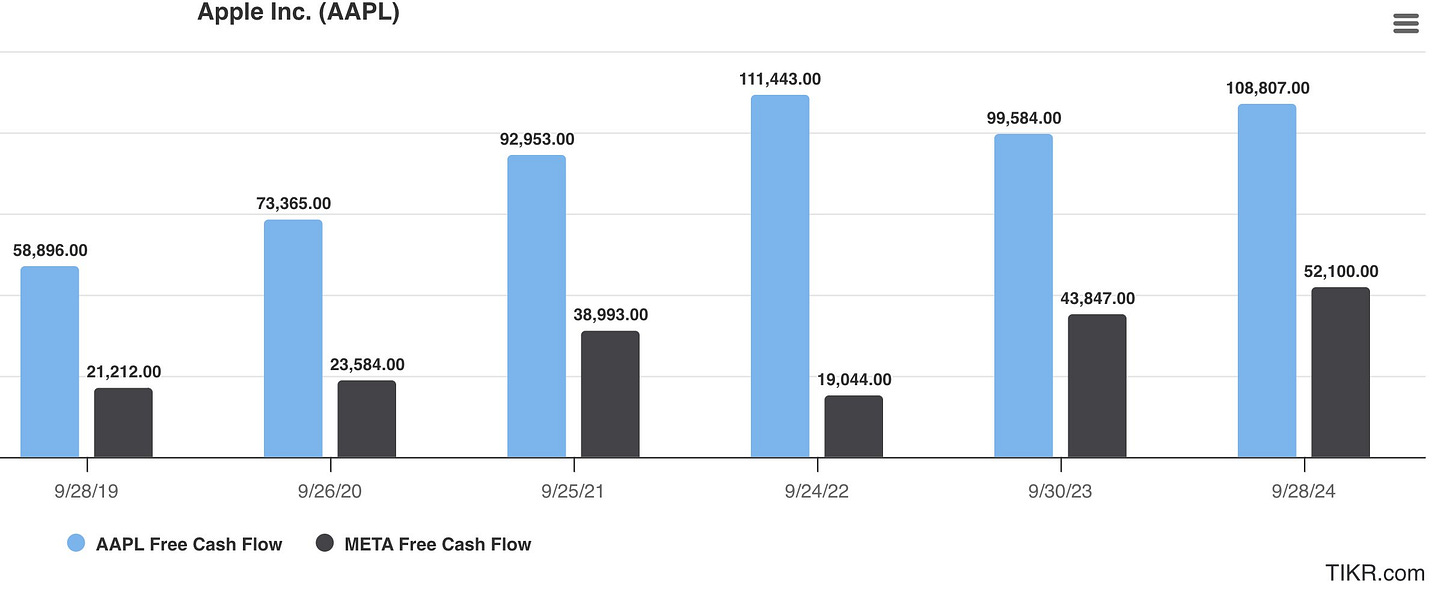

I am optimistic about Meta's role in augmented reality, which I believe will become the next major computing platform. While Meta might not achieve margins similar to Apple (which thrives on squeezing maximum profit from hardware sales), its philosophy of owning the platform could lead to substantial free cash flow (FCF) growth.

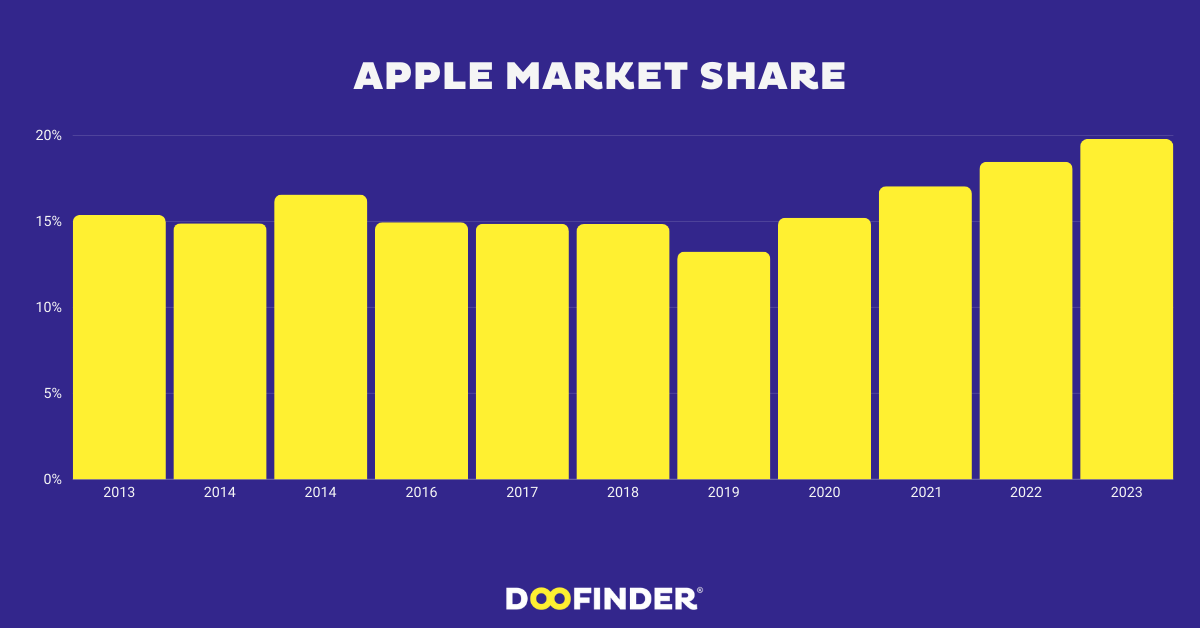

For context, Apple generated $108 billion in FCF over the last twelve months …

…. with just around a 20% share of the smartphone market (depending on which dataset you look at).

Meta's AR glasses are currently best-in-class (litereally unmatched!), and as AR adoption grows, Meta could capture a larger share of this emerging market.

If you’re not convinced of how far ahead Meta is ahead of its competition, I recommend you check out both MKBHD’s recent comparison video of Meta & $SNAP's AR offerings …

… as well as videos highlighting how amazing Meta’s Orion glasses are (“Our First True Augmented Reality Glasses“):

If AR becomes the dominant computing platform, it could unlock billions of dollars in additional FCF for Meta.

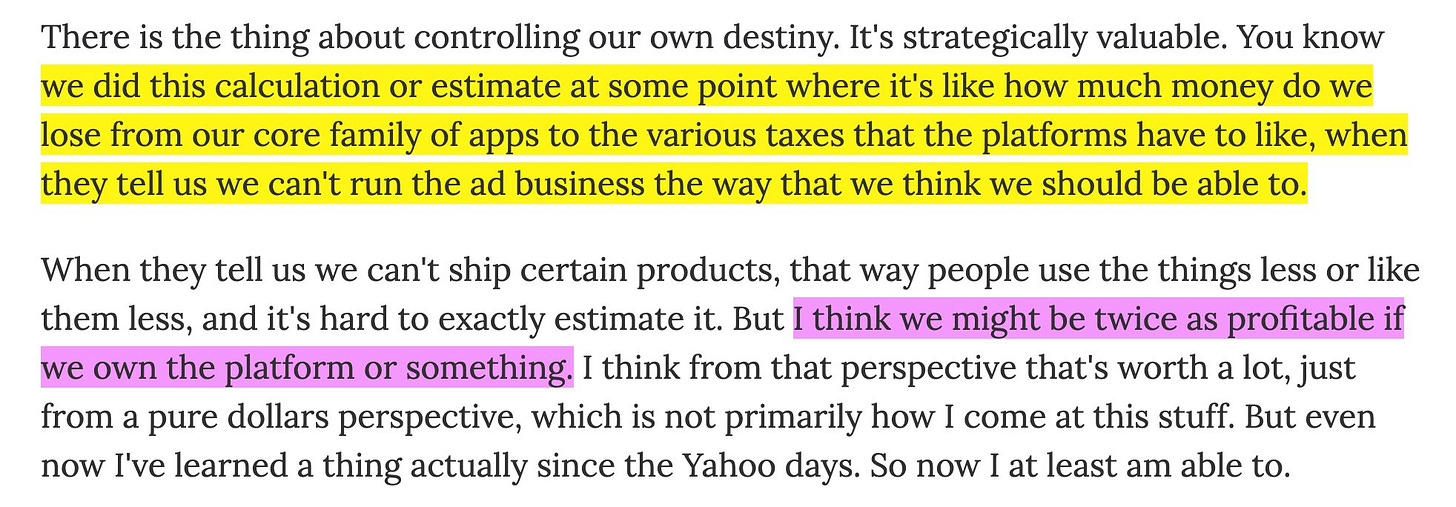

2. Owning the Platform: Doubling Profitability

During a recent interview on the Acquired podcast, Mark Zuckerberg mentioned that Meta could be twice as profitable if it owned the underlying platform. Applying this logic, Meta's current market cap could potentially double to $3.2 trillion, assuming its valuation multiple remains steady.

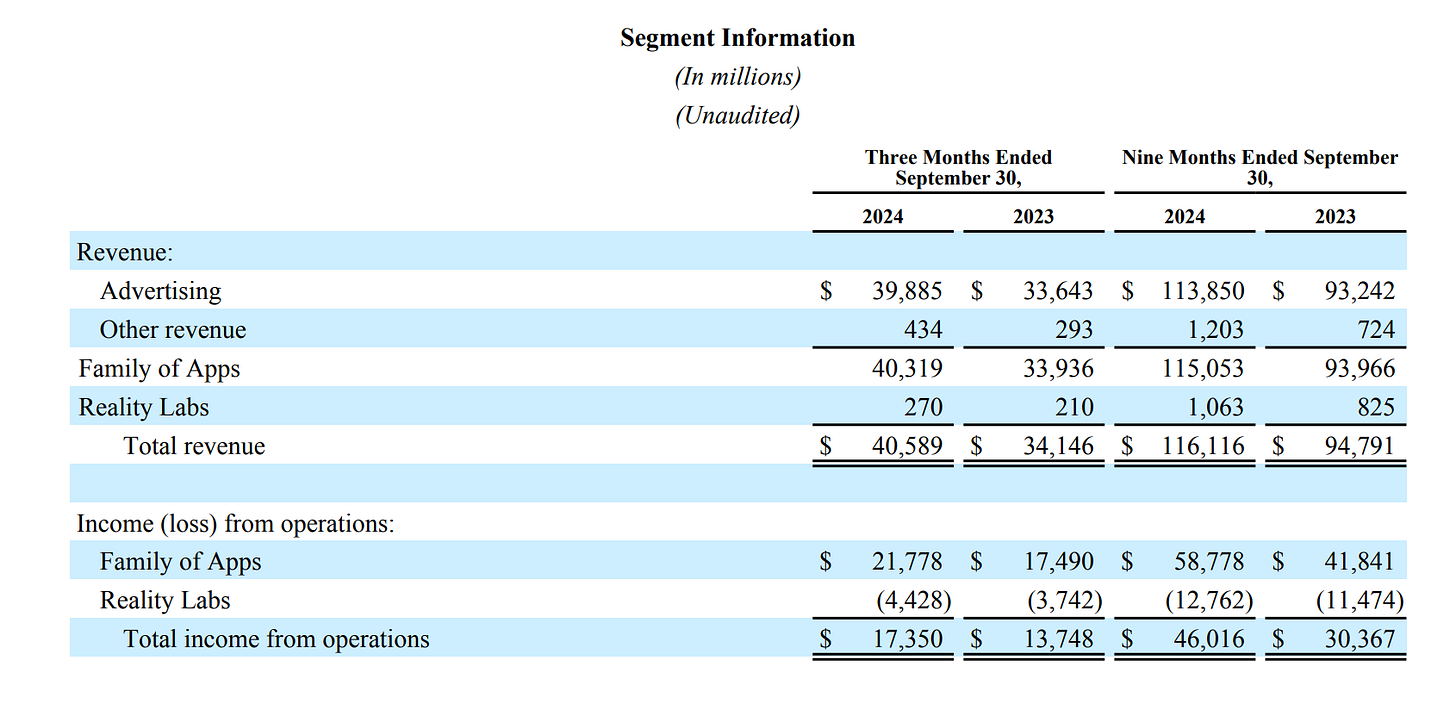

3. Core Ad Business Growth

Meta's core advertising business is another powerful growth engine. Even with conservative assumptions—such as revenue growing in line with inflation at a 3.5% compound annual growth rate (CAGR)—Meta's FCF could reach $73 billion by 2035.

However, this conservative outlook overlooks several potential growth drivers, including:

Increased time spent on Meta platforms

Higher ad efficiency and pricing power

A growing user base

Monetization of WhatsApp and Threads

Each of these factors could drive significant upside beyond inflation-adjusted growth. If Meta can grow its FCF at a 15% CAGR, for example, we’re looking at 210 billion in FCF in 2035.

4. AI Monetization Potential

AI is a wild card for Meta. While the specifics of monetizing their AI solutions beyond the core business remain uncertain, Meta has a history of building large user bases first and figuring out monetization later.

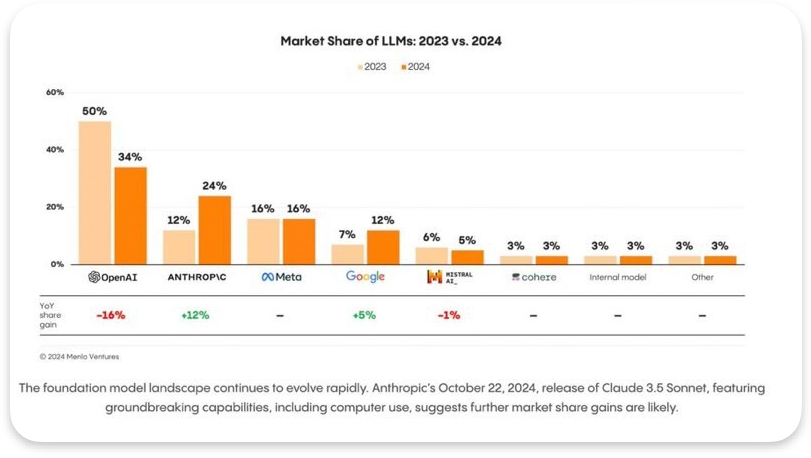

Meta AI already boasts 600 million monthly active users (MAUs), and the company holds an estimated 16% market share in large language models (LLMs).

If Meta succeeds in integrating AR with AI, it could dramatically expand its market share. Google yesterday boasted about their “personal AI assistant” and the progress they’ve been making in this field.

However, as I highlight in the tweet below, AI assistant will ultimately be embedded in smart glasses and not smart phones!

How much would you pay for a personal AI assistant that knows you incredibly well? (this is going to be a super stick product) $50/month easily I assume…

My friend Andrew shares this sentiment:

“Meta AI Smart glasses are this but better in my opinion because you don't have to hold anything up, you can just look and talk / listen ^ I think this is more of the future Zuck was expecting... However, paying for an assistant or some extra features may be something a long the Amazon prime analogy that I discussed separately with you 😉”

Additionally, licensing AI algorithms to enterprises could become a lucrative revenue stream on top of this.

5. Multiple Expansion

Meta currently trades at 23x next-twelve-month (NTM) EBIT. Over time, it’s possible that the company could command a valuation multiple exceeding 30x, adding another 50%-ish to its market capitalization.

On the other hand, one should probably highlight that the 23x multiple is based on record-high (41%) EBIT margins.

But then again, Meta’s core business produces 50% margins.

A higher multiple would reflect the company’s transformation into a multi-faceted tech powerhouse with dominant positions in social media, AR, tech infrastructure, and AI.

Conclusion, Challenges and Risks

Of course, reaching a $10 trillion valuation won’t be easy. The road ahead is filled with uncertainties, and the business world is notoriously unpredictable.

Meta will face both known and unknown challenges, including regulatory pressures, competitive threats, changing consumer habits, and the inherent risks of executing on ambitious technology bets.

I’m hesitant to assign specific numbers to all of these ambitious endeavors (hardware revenue, AI, Threads, WhatsApp etc.), as any projections made today are likely to look wildly inaccurate a decade from now. However, it’s clear that these initiatives have the potential to make significant contributions to Meta’s topline growth and cash flow generation over time.

Earlier I highlighted that if Meta’s grows its FCF at a 15% CAGR over 10 years, we’re looking at 210 billion in FCF in 2035. Compound that figure at a 10% CAGR for another 5 years, and you get to roughly $270 billion in 2040. Margin expansion and new segments may or may not already be reflected in these numbers (remember that Apple is producing $108B in FCF today with “only” a 20%-ish market share in its core segment: iPhones). If you’re getting to $330 billion-ish by 2040, you’d “only” need a 30x multiple to get to 10 TRILLION DOLLARS.

But again, now I’m literally just throwing numbers around that will likely be ridiculed with the benefit of hindsight ;-).

While this analysis is far from a definitive prediction, it illustrates the immense potential Meta holds as it ventures into AR, AI, and other growth areas. As always, this is largely a bet on Zuckerberg’s bold ambitions.

Whether or not Meta reaches a $10 trillion market cap, I believe the company is undoubtedly positioned to deliver meaningful long-term returns for investors who believe in its vision – despite the seemingly “fair” multiple Meta is now trading at.

This thought experiment is a reminder of the importance of investing with a long-term perspective while acknowledging the inherent unpredictability of markets and business dynamics.

Let me know what you think in the comments down below: Will Meta hit $10T in market cap? And if so, by when?

Disclaimer:

I do own Meta stock. As of today, Meta has the highest weighting in my portfolio. I think this is important to take into account when reading this post as I might very well be biased. Moreover, my analysis may be flawed and/or critical information may have been overlooked.

The content provided on this blog should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities.

The stocks and funds discussed on this blog are examples only and may not be appropriate for your individual circumstances.

It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, or stock mentioned.

You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.