The ULTIMATE Beginner's Guide to Investing in Stocks (2024 Edition)

A Blueprint for Beginner Investors

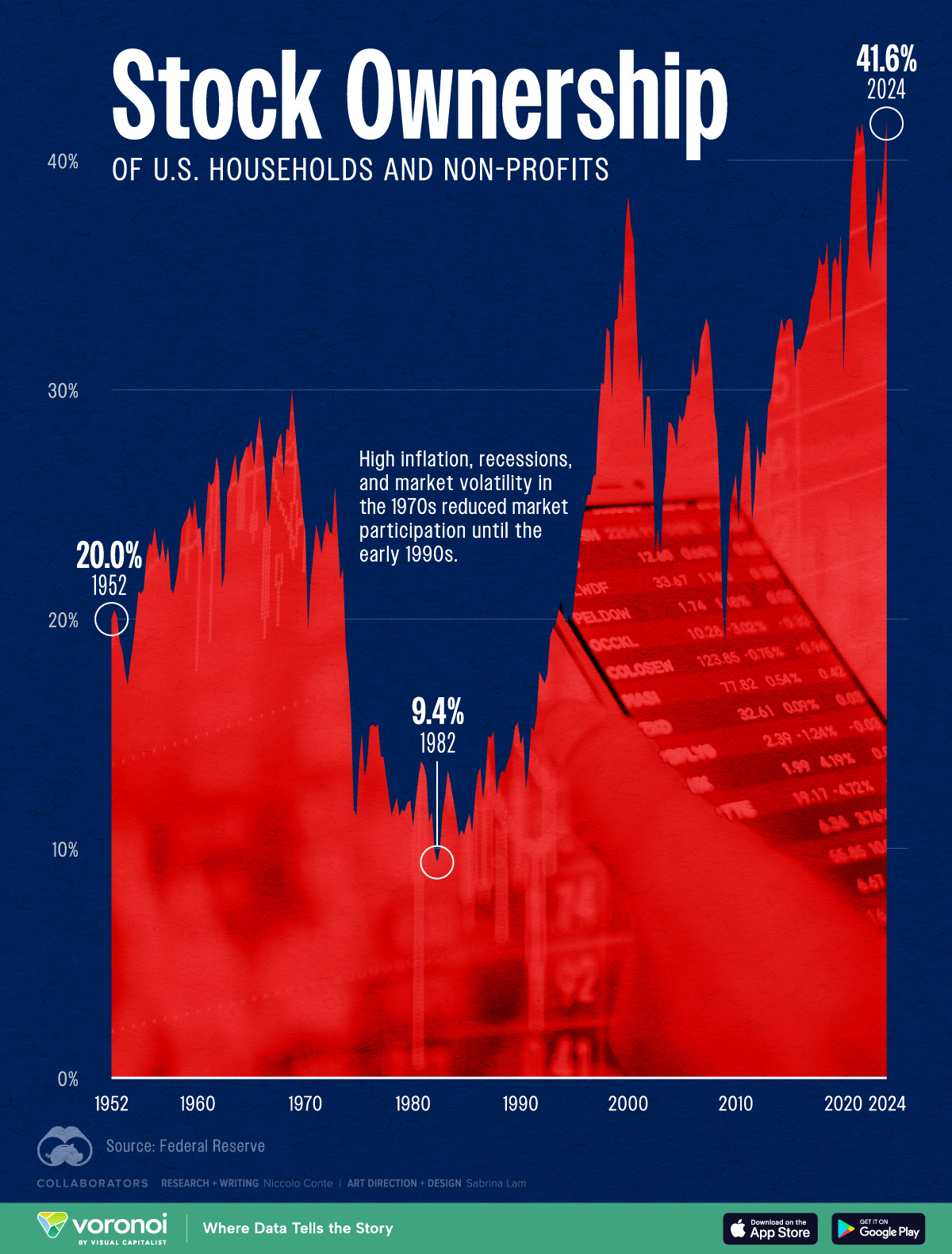

Did you know that more than 50% of Americans own stocks? In fact, in 2024, American stock ownership rates are back at all-time highs:

(Image Source: Visual Capitalist)

However, despite the growing number of investors, many remain uncertain about how to buy individual stocks and build a portfolio that actually represents a meaningful part of their net worth.

If you find yourself in this situation, you're not alone. In this blog post, I’ll share a blueprint that simplifies the process of buying your first (or next) stock.

Whether you’re a beginner or already own a few shares, I’m certain this guide will help you approach stock investing in a more structured and thoughtful way. So let’s get started!

Step 1: Understanding Your Financial Goals and Investment Horizon

Before buying any stock, the first step is to understand why you want to invest. Are you looking to grow your wealth for retirement? Do you want to achieve financial independence and retire early? Whatever your reason, having clear financial goals will help guide your investment decisions and keep you committed during tough market periods.

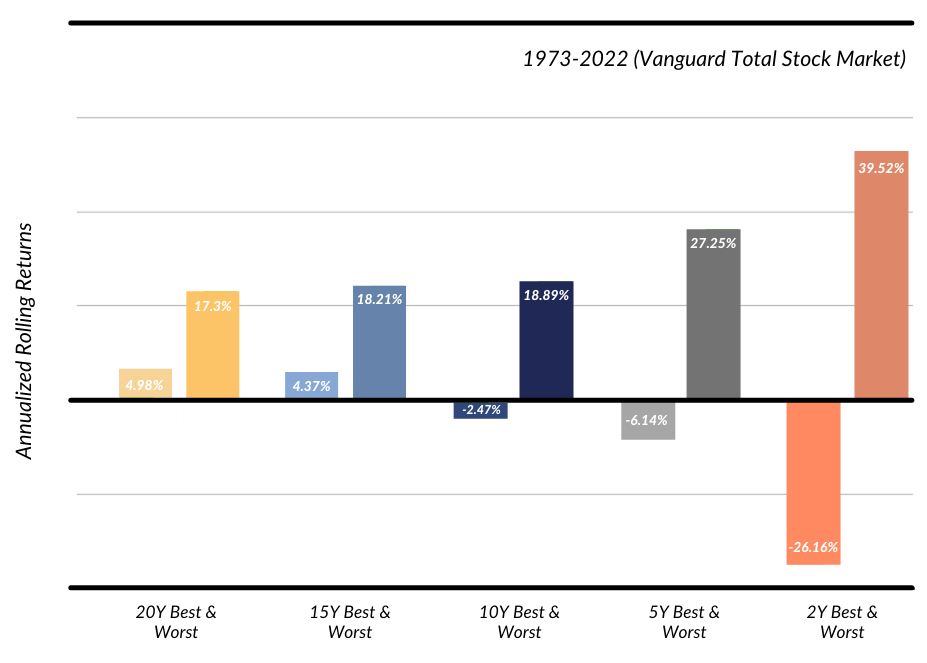

Equally important is your investment horizon—how long you plan to keep your money invested. Stocks are a long-term investment, and short-term volatility can make stocks risky if you need the money in the next few years.

If you are planning to cash out in less than a years, you may want to reconsider investing in individual stocks or the stock market as a whole. However, with a long-term horizon (5 years or more), volatility becomes less of a risk, and the chances of growing your wealth increase. As you can see in the chart above, it’s difficult to lose money in stocks one you extend your time horizon to ten years plus.

Key takeaway: Investing in stocks is a long-term endeavor. If you can’t handle volatility or need the money soon, consider a different approach.

Step 2: Understanding What a Stock Really Represents

When you buy a stock, you’re not just purchasing a ticker symbol on a screen—you’re buying a piece of a company.

In the process of “going public,” usually via an Initial Public Offering (IPO), companies sell ownership stakes to the public, and these shares are then traded on stock markets. As a shareholder, you become a part-owner of the company.

It' simplifies things if you simply pretend to buy the entire company when you buy a share of a publicly-traded business.

This ownership mindset is crucial. If you buy 100 shares of Apple, you’re a part-owner of Apple’s business. It’s not gambling or speculation. You should understand why you’re buying a particular stock and what the company does to make money. This is what you’d do if you were to buy the entire company.

Step 3: Understanding Why You Want to Invest in Stocks

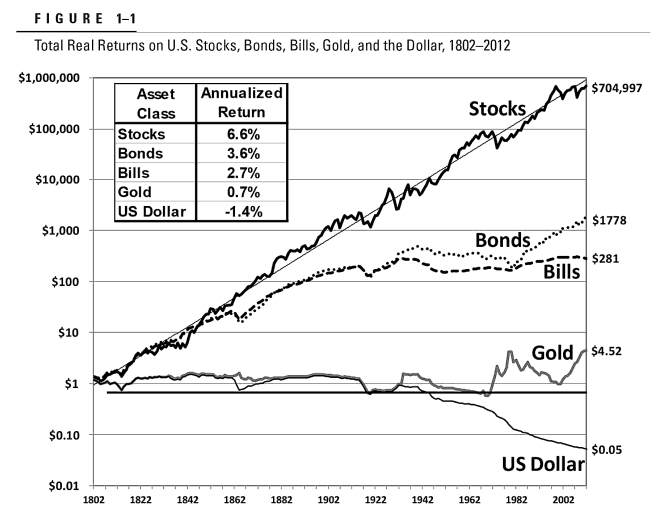

Historically, stocks have outperformed most other asset classes over the long term, particularly in the United States, and especially if you exclude the use of leverage.

(Source: Jeremy Siegel “Stocks For the Long Run“)

Over the last century, U.S. stocks have generated better returns than bonds, real estate (excluding leverage), and other asset classes. While real estate can offer strong returns, especially with leverage, stocks are – in my opinion – the most straightforward way to grow wealth without taking on debt.

Key takeaway: Stocks are a proven way to build wealth over the long term, but you need to understand the company you’re investing in.

Step 4: How to Research a Stock

When you buy shares, you’re essentially buying a small portion of a business, so you should approach the process as if you were buying the entire company. This means performing due diligence, researching the company’s business model, competitive landscape, and management team.

This process is referred to as fundamental analysis.

Steps to Research a Stock (some Examples):

Understand the business model: How does the company make money? For example, if you’re considering investing in Chipotle, start by understanding how it earns revenue, the major costs the business incurs, the profitability on a cash flow basis and a unit basis (in the case of Chipotle a unit could be a meal served or an individual store) and how sustainable growth is.

Speak to customers and employees: A great starting point is talking to people who use the product or work for the company. This "boots-on-the-ground" research can give you insights that financial reports may not.

Read the company’s annual report: Public companies must file annual reports, detailing their financials, business risks, and competitive environment. At first, reading these reports might seem daunting, but over time, you’ll learn to focus on the most relevant sections.

Monitor quarterly reports and earnings calls: Quarterly updates provide ongoing information about the company’s performance and any changes in its business environment. Listening to earnings calls can also offer a wealth of insight into management's thinking (if you have limited time, you may want to jump straight to the Q&A part of these calls – those tend to be the most insightful).

Look for write-ups from other investors: Sometimes, fund managers or analysts will share their own research on specific companies. These can provide additional context and ideas you may have missed.

Key takeaway: Researching a stock involves understanding its business model, talking to customers, reading reports, and staying updated on its BUSINESS performance.

Step 5: Invest in Quality Stocks … But Wait … What is a High-Quality Company?

Not all stocks are created equal. Some companies are of higher quality than others, meaning they are better positioned to grow over the long term.

Characteristics of High-Quality Companies:

Competitive advantages: Companies like Apple have strong brands and ecosystems that create a "lock-in" effect, making it difficult for customers to switch. Other competitive advantages include network effects (common in social media), scale advantages, and intellectual property like patents.

Consistent revenue and profit growth: High-quality companies consistently grow their revenues and profits over time.

Financial health: Avoid companies with too much debt. Look for businesses with strong balance sheets that generate substantial free cash flow (the money left after (maintenance) capital expenditures).

Return on equity (ROE) and return on invested capital (ROIC): These metrics show how effectively a company uses its capital to generate profits. Higher returns usually indicate a more profitable, well-run, and higher quality company.

Key takeaway: Look for companies with competitive advantages, solid financials, and a history of consistent growth.

Step 6: Valuing a Company: Why Price Matters

Once you’ve identified a high-quality company, the next step is to make sure you're not overpaying for it. Even the best companies can be bad investments if you pay too much for their shares. The stock market history is littered with examples of great businesses that performed poorly over an extended period of time simply because they were too richly priced at some point.

I’d argue that VALUATION IS EVERYTHING in investing!

Valuation is both art and science and there are many different valuation techniques to choose from. As a beginner, you’ll likely first encounter the Price-to-Earnings (P/E) ratio which is one of the most commonly cited valuation metrics. A company trading at a P/E of 10, for example, means you’d earn your investment back in 10 years, assuming no revenue growth, a constant level of profitability, and the business would pay out all of its profits directly back to shareholders.

Broadly speaking, and I'm highly simplifying things here, the lower the valuation multiple a company is trading at, the cheaper it is.

But of course, this is highly simplified because there are other variables you have to take into account.

One would be growth. Faster-growing companies can justify higher P/E ratios. A company that's trading at a P/E of 10 that is not growing over 10 years is more expensive than a company trading at a P/E of 30, but that is able to 10x its revenue over the next 10 years.

Another variable would be return on invested capital (ROIC): A company with a high ROIC can grow without requiring large amounts of capital, making it more efficient and justifying a higher multiple as the business will be able to distribute more of its profits back to shareholders.

Generally speaking, high-quality companies rarely trade at cheap valuations. You will have to be patient and wait for opportunities when their stock prices dip to more attractive levels.

Key takeaway: Price matters. Look for high-quality companies, but make sure you’re not overpaying by focusing on valuation metrics like the P/E ratio and ROIC.

Step 7: Executing Your First Stock Purchase

After doing your research, you’ll need to open a brokerage account to make your first stock purchase.

Choosing the right broker can seem daunting, especially with so many options available, but a few key factors can help you make the right decision.

Key Considerations When Choosing a Broker:

Access to Markets: If you plan to build a diverse portfolio over time, choose a broker that gives you access to a wide range of markets and securities, including international stocks, ETFs, and other assets. Some brokers limit your ability to invest in certain markets, which can restrict your options in the long term.

Fees and Commissions: While many brokers today offer commission-free trading for stocks and ETFs, you still want to check for hidden fees. Some brokers charge for things like account maintenance, inactivity, or access to specific data. Pay close attention to these fees, as they can eat into your returns, especially if you're making frequent trades (which I advise against ;-)) or working with smaller sums of money.

User Interface and Experience: For beginners, it's important to choose a platform that is easy to navigate and use. Some brokers offer clean, intuitive platforms with educational resources, while others are more complex, targeting advanced traders. A smooth, user-friendly experience can make a big difference when you're learning the ropes of stock investing.

Customer Service: Good customer service is often overlooked but can be vital, especially if you run into issues with your account or have questions about trades. Look for brokers with responsive customer service, ideally available through multiple channels like phone, email, or live chat.

Reputation and Security: Lastly, ensure that your chosen broker is reputable and regulated. Look for established brokers with a history of trustworthiness. You'll want your investments to be safe, so ensure the platform you select is protected by government insurance programs, such as SIPC (Securities Investor Protection Corporation) in the U.S., which safeguards your assets if the broker goes out of business.

Market vs. Limit Orders

When buying stocks, you’ll typically have two options: market orders and limit orders.

Market orders: Buy the stock at the current market price, regardless of its fluctuations.

Limit orders: Buy the stock only if it reaches a specific price that you set, which allows more control over the purchase.

I recommend using limit orders, especially for beginners, so you don’t overpay for a stock during volatile market conditions.

Step 8: Monitoring Your Investments

Once you've bought your first stock, you’ll need to monitor the company’s performance. This doesn't mean constantly checking prices but rather reviewing quarterly reports, staying updated on news, and making sure your original investment thesis is still intact. Avoid the temptation to sell quickly due to short-term fluctuations or panic during market corrections. Successful investing often requires sitting still and allowing your investments to grow over time.

Final Thoughts

Buying your first stock can be an exciting yet overwhelming experience. Remember that it’s a learning process, and your analysis may not be perfect at first. The most important thing is to start. With time, experience, and continued research, you’ll become a more confident and successful investor.

If you want to dive deeper into business analysis, competitive advantages, or portfolio management, consider checking out my mentoring program. We work closely with a small group of investors, providing personalized guidance on how to succeed in the stock market.

Take the first step today, and happy investing!