The Bubble Quietly Forming in Quality Stocks!

Are Investors Overpaying for Predictability & Resilience?

Today, let’s explore an often-overlooked topic in investing: a potential bubble quietly forming around the world’s top “quality” stocks.

And to be clear, we’re not talking about the usual suspects, the high-growth tech names or the latest AI disruptors.

Instead, this discussion centers on companies prized for their resilience, solid fundamentals, and consistent, modest growth, all of which have led investors to flock to them for stability.

However, as demand for safe, high-quality stocks rises, the premium investors are paying has reached historical highs.

So, are we overpaying for quality?

And if so, what might this mean for returns over the next decade?

In this article, we’ll highlight some examples, examine their performance and valuation metrics, and discuss how today’s market environment could impact their future.

What is a Quality Stock?

To start, let’s clarify what we mean by “quality.” We’ll have to simplify the discussion here as you can write entire books on this topic; “Quality Investing: Owning the Best Companies for the Long Term” by Lawrence A. Cunningham is one of my favorites:

Put simply, quality stocks share certain characteristics that make them appealing for long-term investors. Typically, these stocks belong to companies with:

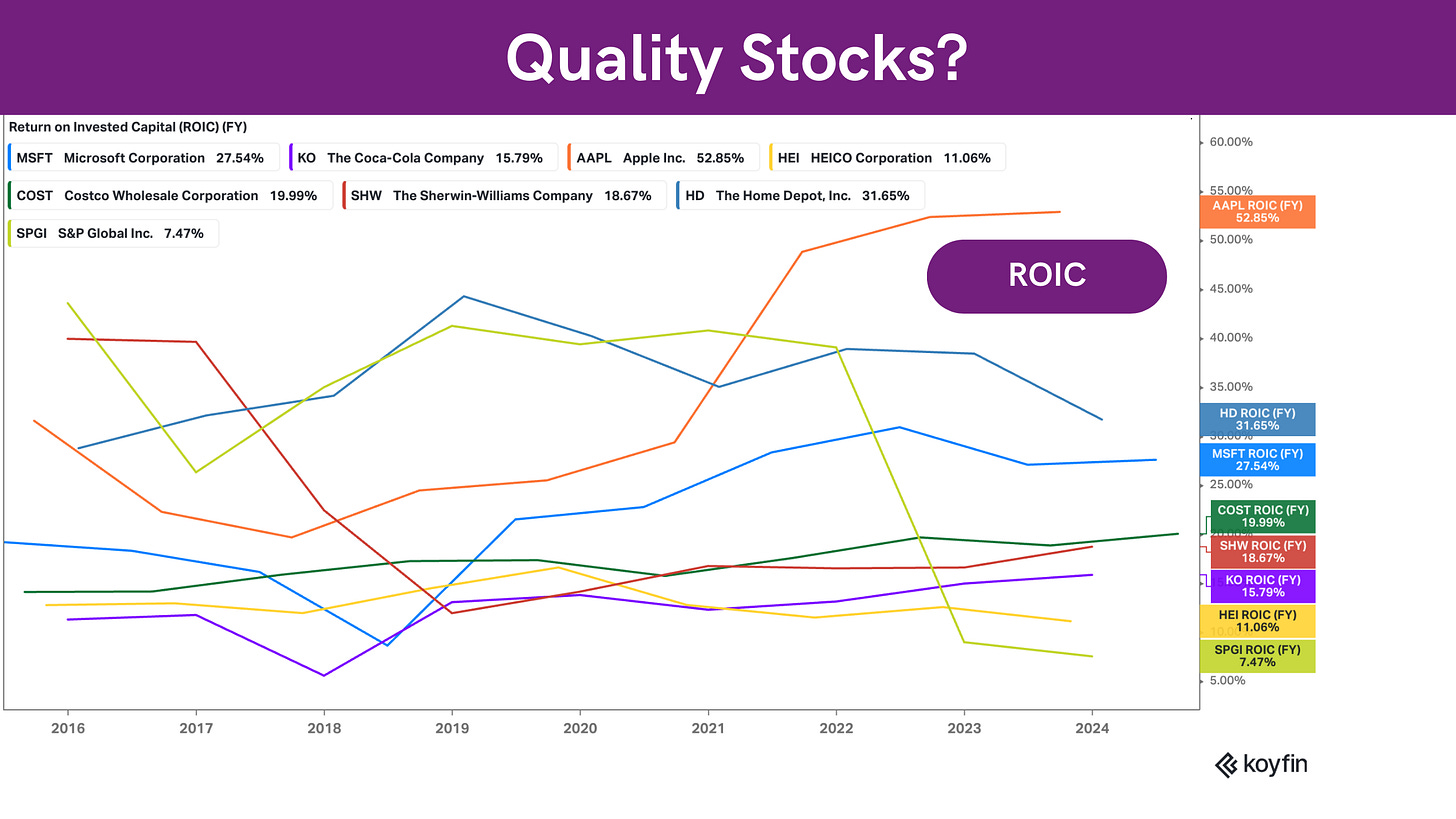

High Return on Invested Capital (ROIC): Quality stocks often show ROIC above 15%, a sign of efficient capital use.

Consistent Revenue and Earnings Growth: These companies demonstrate predictable earnings and solid growth (often 10-15% or more) over long periods of time even through economic downturns.

Competitive Moats: Quality companies usually have strong competitive advantages, protecting the above-average returns they earn on reinvestments and protecting them against competitors.

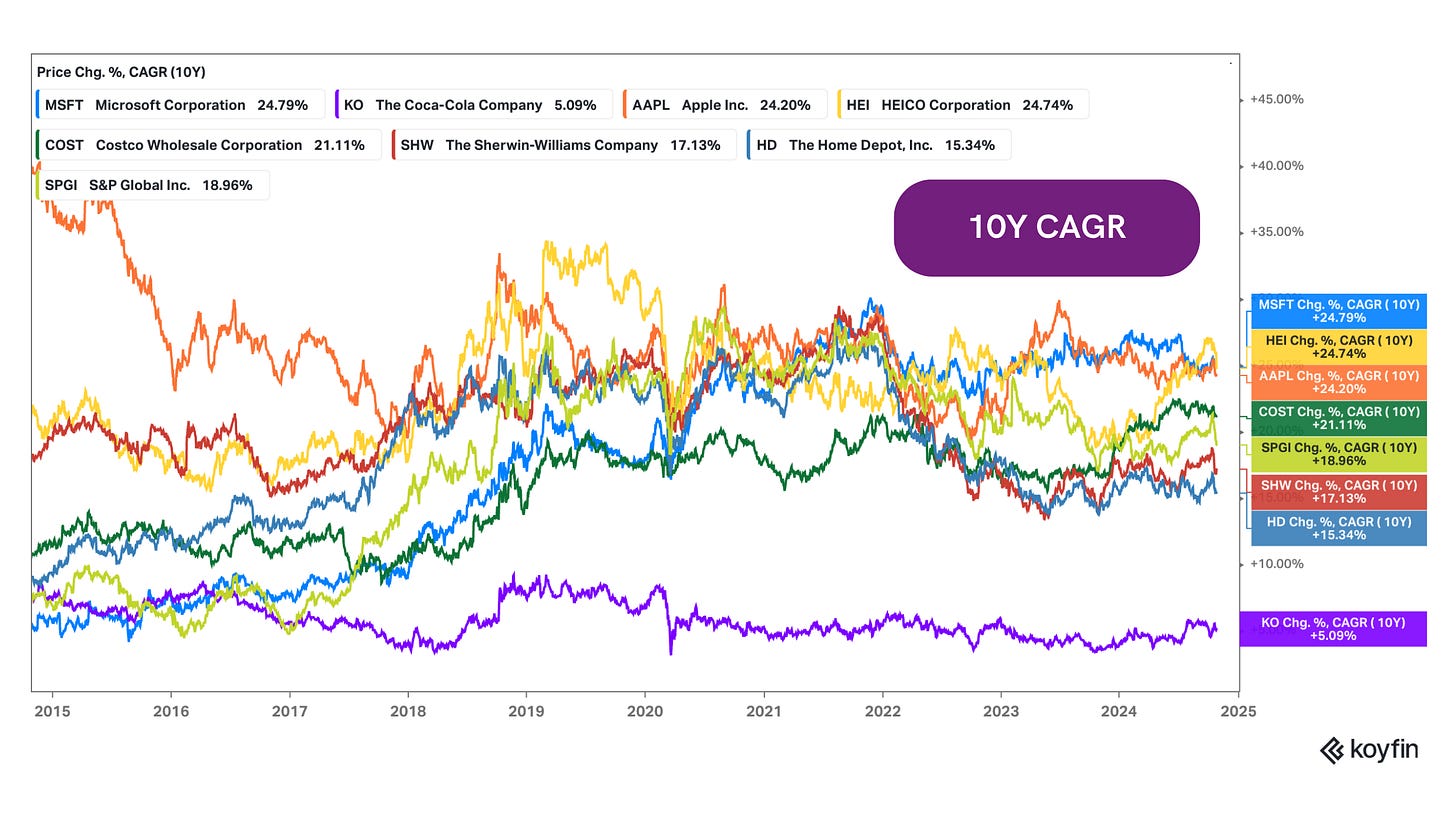

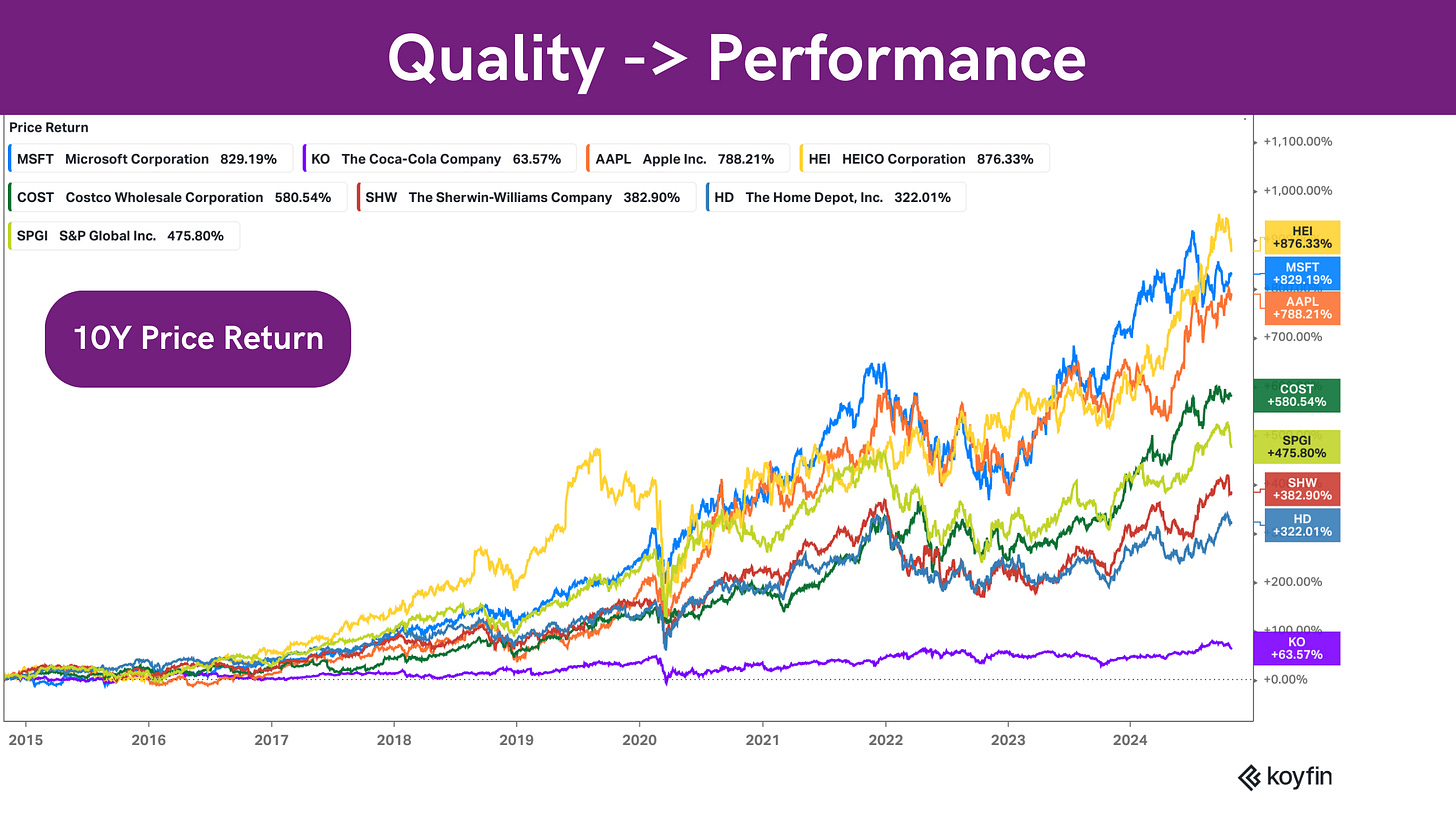

These characteristics have made certain stocks attractive to investors seeking safety, especially during periods of market volatility. Names like Microsoft, Costco, Apple, and S&P Global have delivered impressive capital gains over the past decade, consistently outpacing the broader market:

As shown above, Microsoft, for instance, has compounded at a rate of almost 25% per year over the past decade.

As shown below, Costco has increased nearly 6x over ten years.

Heico delivered over 800% in price returns (that’s not the total return!), and Sherwin-Williams is approaching 400%.

Despite these stellar returns, we must consider whether these high-performing stocks can sustain such gains in the next decade at their current valuations. Let’s dive deeper into their financial metrics to assess the sustainability of these high valuations.

However, with quality comes a price, and the question is whether that price has risen too high.

A Look at the “Quiet Bubble” in Quality Stocks

The concept of a bubble often brings to mind volatile, high-growth sectors, but this “quiet bubble” in quality stocks is more subtle.

While there’s a justified premium for predictability and resilience, some of these stocks are now trading at historically elevated multiples, potentially limiting future returns.

What I keep reiterating on my social channel is that in investing, valuation is everything. Let me repeat it …

VALUATION. IS. EVERYTHING.

Even the best businesses can lead to disappointing returns if they’re purchased at too high a price. Let’s explore some common valuation metrics for the quality stocks I referenced above:

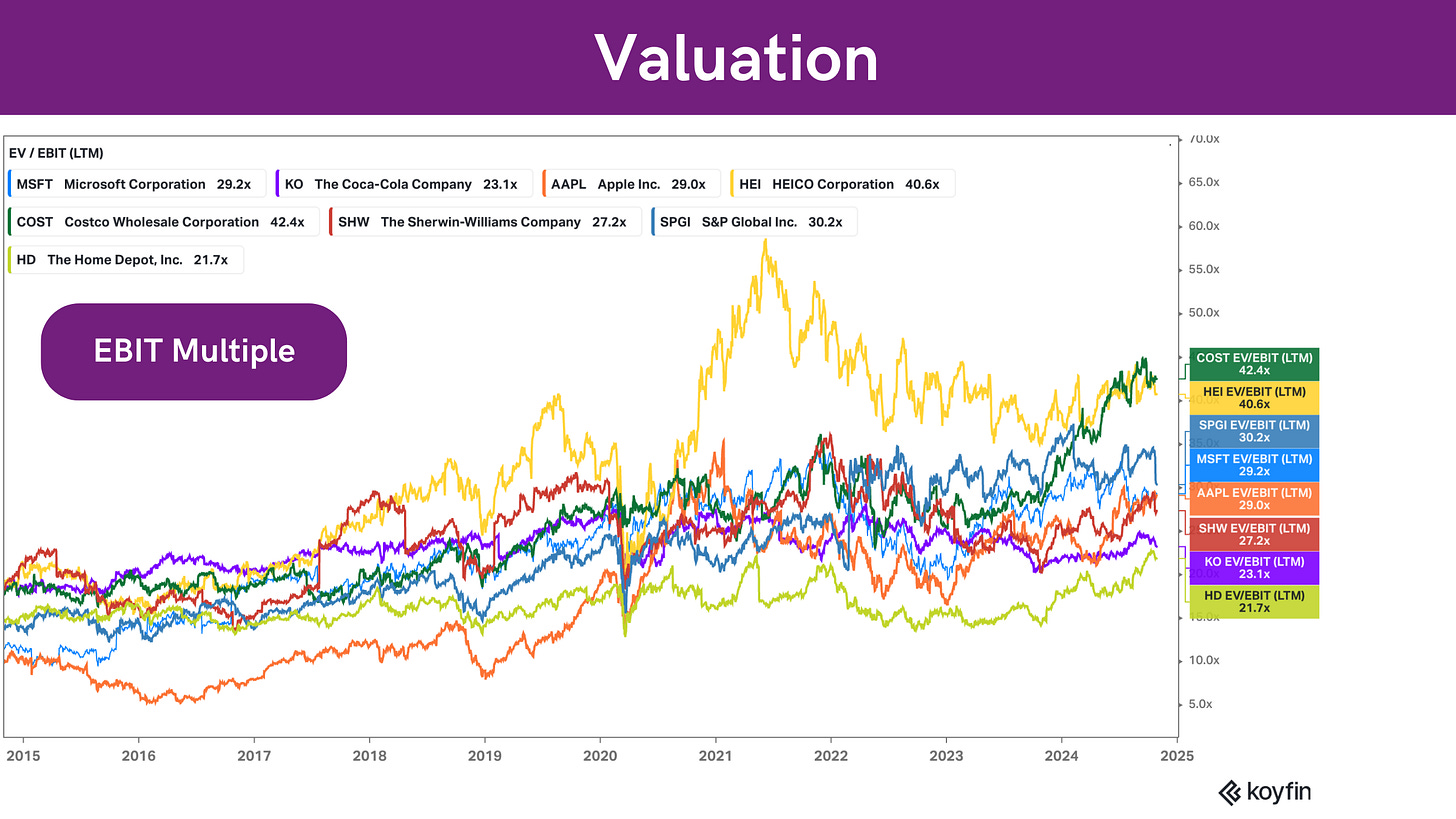

Many quality names are trading at high operating income multiples, often around 30x EV/EBIT.

This ratio reflects the market’s willingness to pay a significant premium for quality stocks, but it also indicates heightened risk if growth slows or if the market’s appetite for quality shifts.

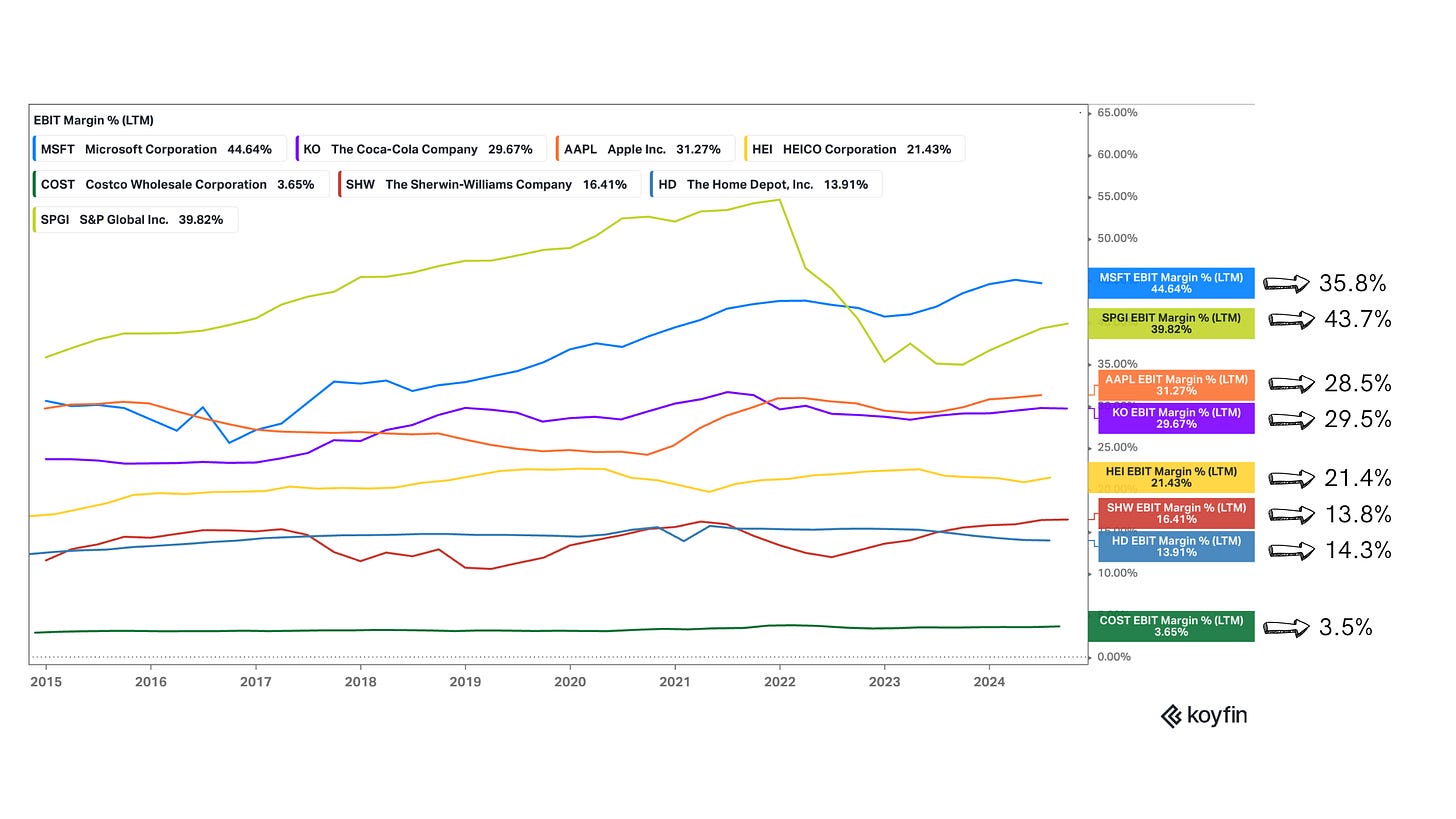

I’ve also attached the 5-year median EBIT margins of the business below; it’s not like these businesses trade at high multiples due to cyclically depressed earnings …

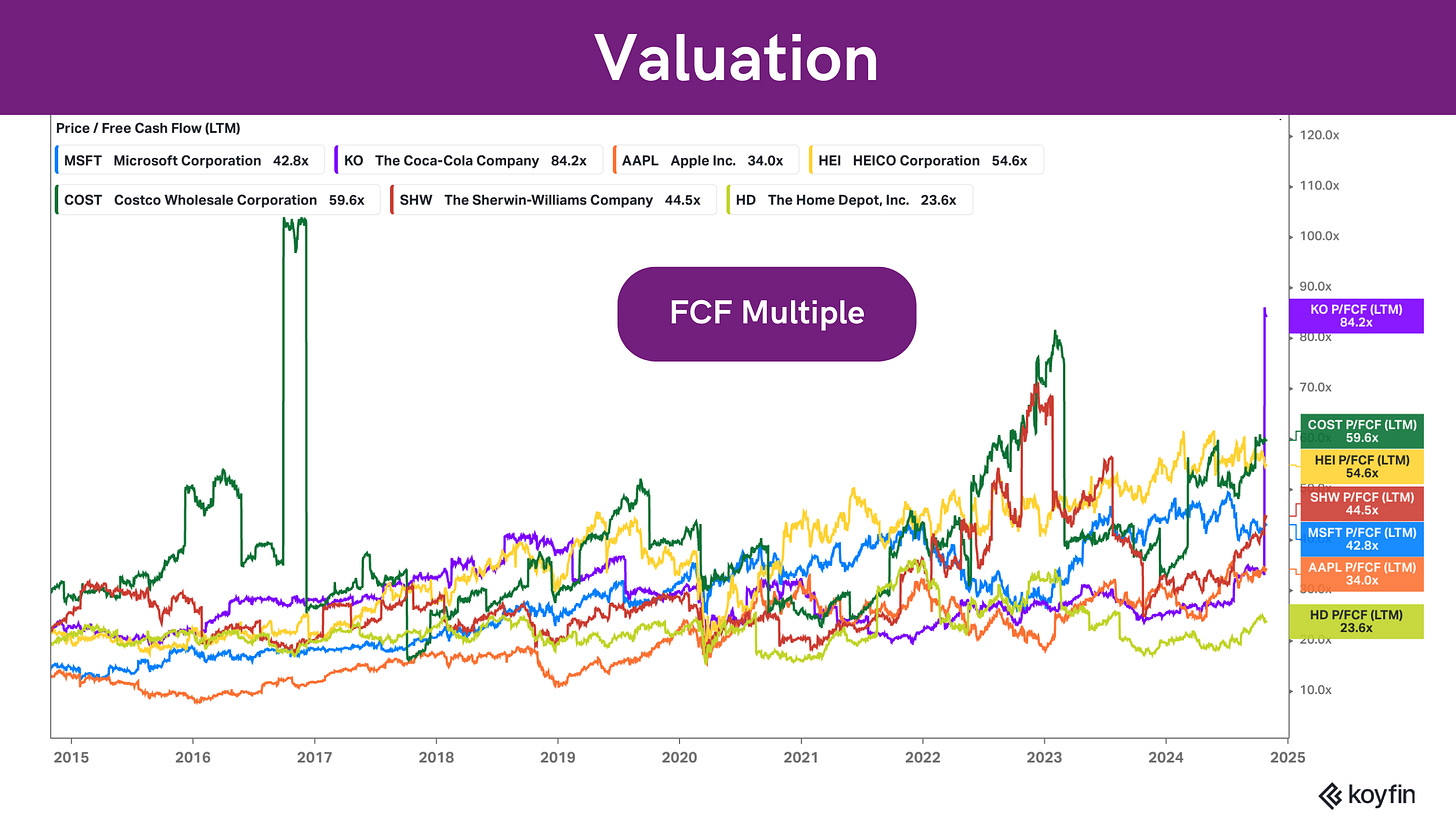

Price to Free Cash Flow (P/FCF)

The free cash flow (FCF) multiple is another crucial metric showing how much investors are paying per dollar of cash generated.

Many quality stocks are trading at historically high P/FCF ratios (do you see the upward trend in valuation multiples in both valuation charts?), meaning that even if these companies maintain high cash flow, the valuation may not be justified by future growth prospects.

DISCLAIMER: I took these screenshots last week; after Trump’s election victory, some of these names may already trade at higher multiples.

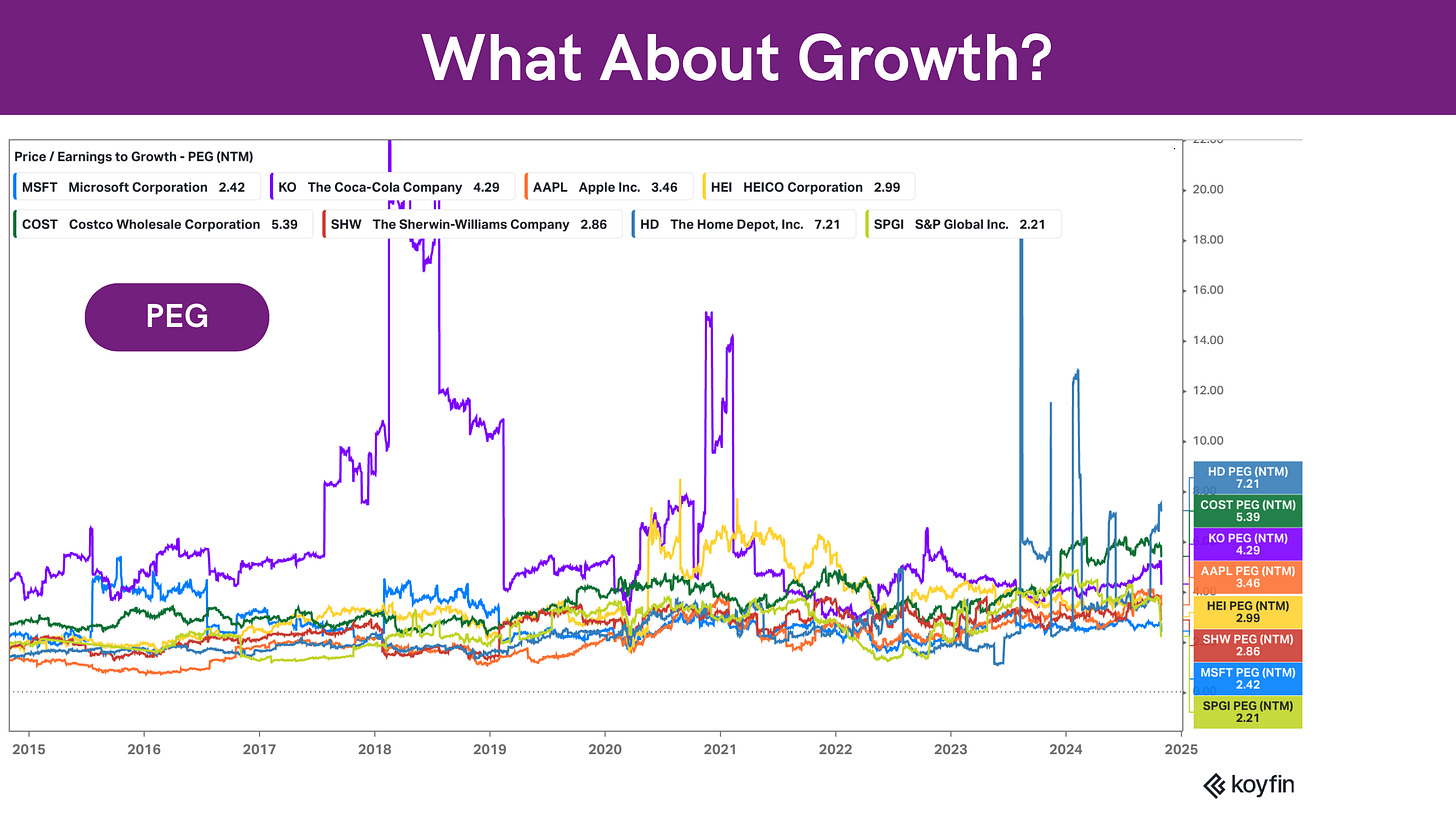

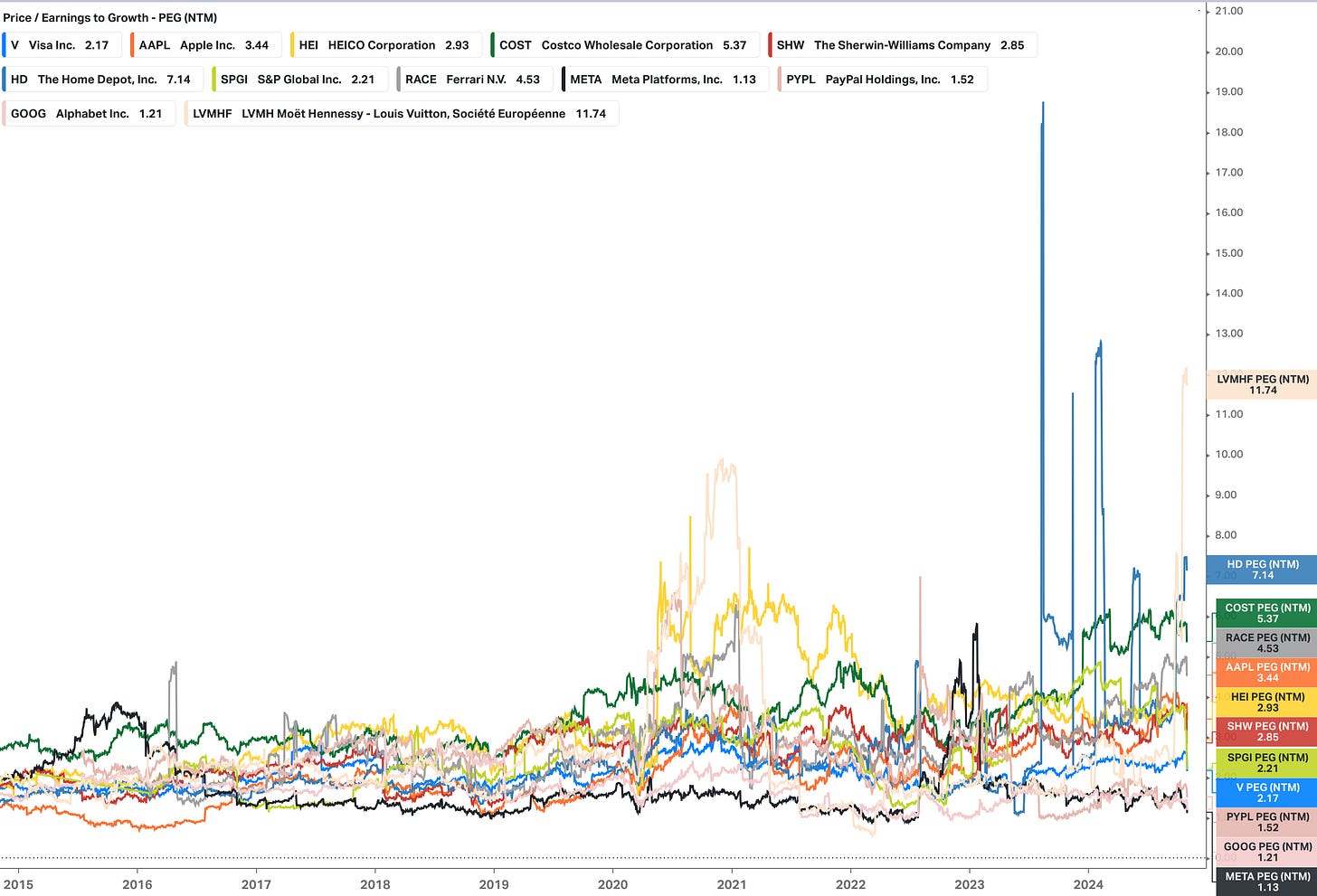

Price to Earnings to Growth (PEG) Ratio

I acknowledge that just looking at valuation multiples is not proper valuation work; true valuation work requires more in-depth, qualitative analysis of various factors (e.g. competitive landscape, growth runway, future expected ROIIC and much more).

But for the sake of this post, I’ll have to simplify things.

Arguably, the PEG ratio is a slightly better metric as it helps investors gauge whether a stock’s (high) P/E ratio is justified by its (high) growth. Stocks with PEG ratios above 2 are typically considered overvalued. Some quality stocks in this bubble have PEG ratios as high as 7 (such as Home Depot), indicating that investors may be overpaying for anticipated growth.

Overall, the elevated valuations across these metrics suggest that the premium for quality has reached historical highs, possibly reflecting a “bubble” in these traditionally stable stocks.

Quality Indices: Valuation Trends

The trend toward higher multiples is also visible in quality-focused indices, indicating that this is not isolated to a few high-profile stocks.

Quality Index Valuations

Here’s a breakdown of three popular quality indices:

MSCI US Quality Index:

The forward P/E ratio stands at 27x, nearly double the 14x it traded at in 2013.

In 2018, it ranged from 15-22x, making today’s premium almost 50% higher than recent historical “norms.”

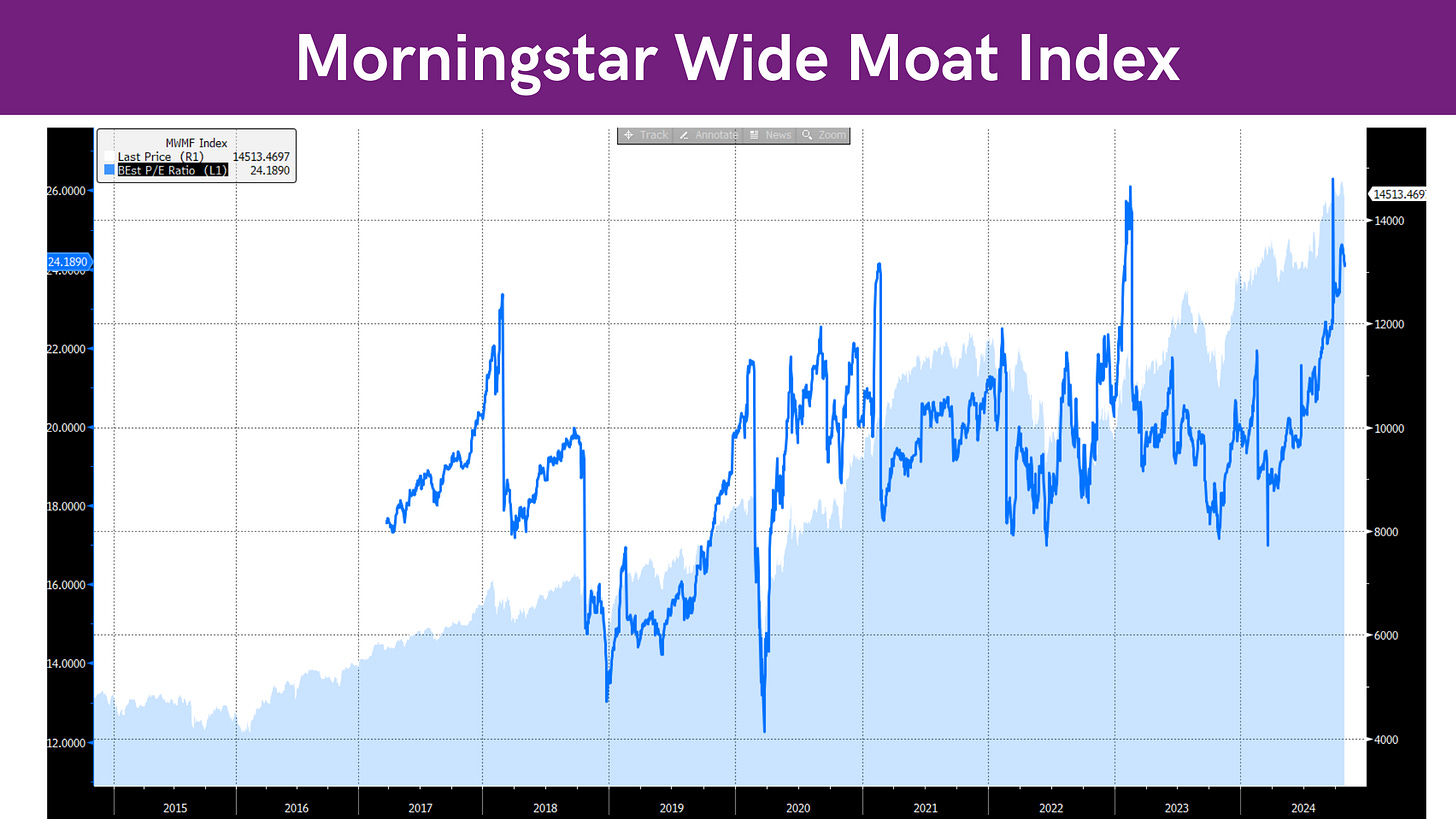

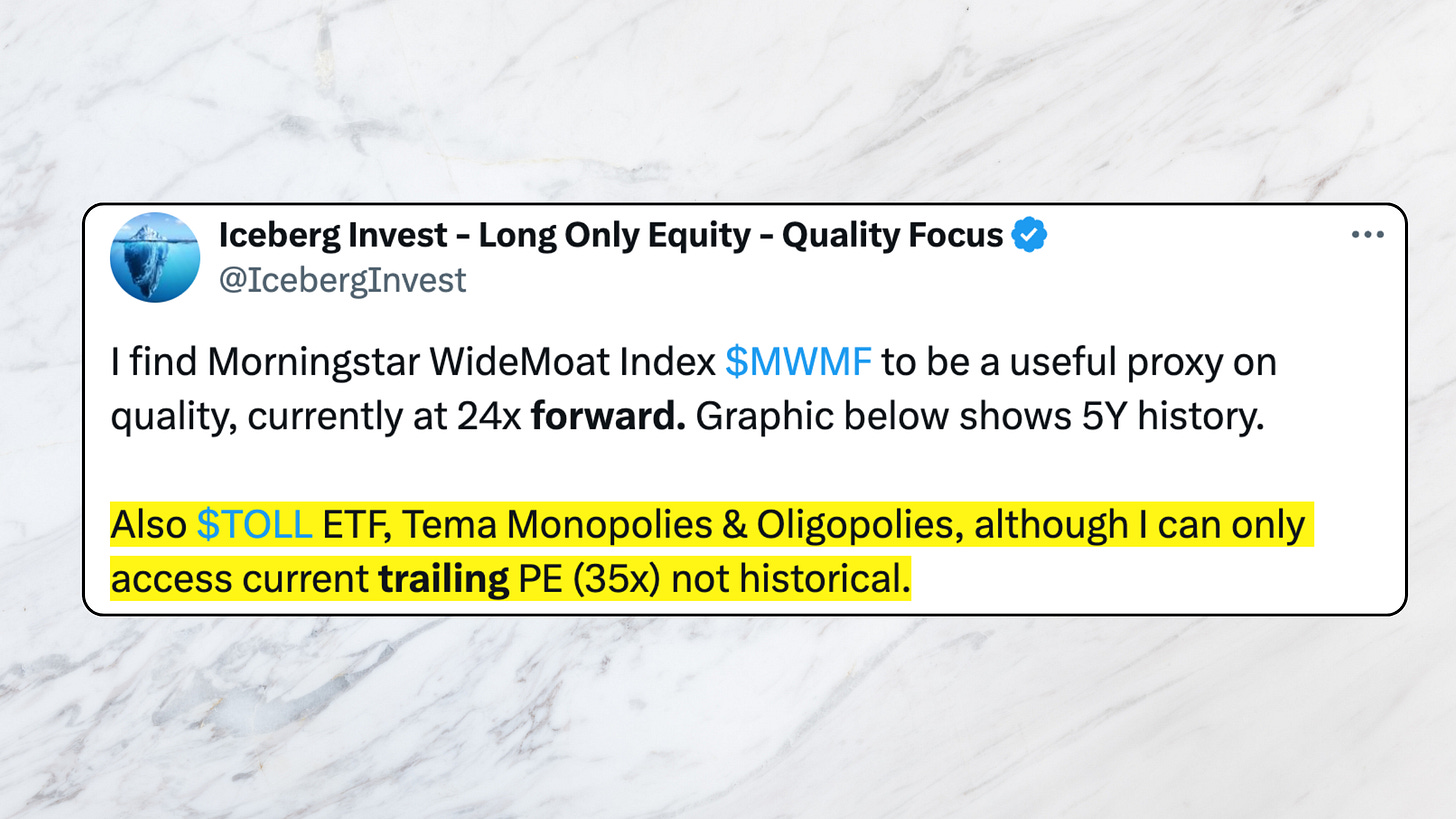

Morningstar Wide Moat Index:

This index is also showing elevated historical valuations, with a P/E significantly above the five-year average.

TEMA Monopolies and Oligopolies Index (TOLL):

Finally, this index focuses on monopolistic companies and is currently trading at a P/E of 35, a significant premium for perceived stability.

These elevated indices once again suggest that investor enthusiasm for quality has driven valuations to new highs, raising questions about the potential for mean reversion in the near future.

Are Future Returns at Risk?

Given these high valuations, we must ask: can these stocks sustain the same returns going forward?

If these multiples contract or revert to historical norms, future returns could fall short of past performance.

For instance, even if companies continue to grow revenue at 15%, the drag from valuation compression might limit total returns to single digits.

Let me just highlight the extent of various valuation compression drag scenarios:

If over the next 10 years, the valuation multiple declines by 20%, this will result in a headwind of -2.21% compounded annually.

If over the next 10 years, the valuation multiple declines by 30%, this will result in a headwind of -3.5% compounded annually.

If over the next 10 years, the valuation multiple declines by 40%, this will result in a headwind of almost -5% compounded annually.

If over the next 10 years, the valuation multiple declines by 50%, this will result in a headwind of -6.7% compounded annually.

Such headwinds may be hard to overcome simply via superior earnings growth.

In other words, the current valuations of some quality names could (!) – obviously, I have no crystal ball – serve as a drag on future returns, turning what once were stellar performers into lower-yielding, high-priced assets.

Is There Value to be Found in Quality Stocks?

Despite the challenges in finding undervalued quality stocks, a few names may still offer reasonable value relative to their peers. Here are some examples:

Visa, Google, and Meta Platforms: These companies often trade at lower multiples, sometimes even below a “market multiple,” and still offer quality growth profiles.

LVMH: While it’s not “optically cheap,” LVMH’s global brand and market position make it a reliable player at a reasonable premium.

PayPal: Previously trading around 10.5x free cash flow, PayPal arguably offered a more attractive valuation compared to its higher-priced high-quality peers.

While these stocks may not be true bargains, they provide an alternative to the pricier quality names, especially for patient investors willing to wait for favorable entry points.

A Patient Approach: Investing in Quality at a Reasonable Price

My investment philosophy centers on patience and disciplined valuation. I seek out quality stocks at reasonable prices—ideally below 15x free cash flow. While finding high-quality stocks at such multiples is challenging, maintaining discipline helps avoid overpaying, which can be a real drag on long-term returns.

When premiums are high across the market, waiting for short-term dislocations or industry-specific downturns can offer more attractive entry points for even the best companies. Patience is key, as paying 30-50x earnings or free cash flow, even for quality companies, introduces risks that can hinder returns.

Final Thoughts: Are We Overpaying for Quality?

While quality stocks offer undeniable advantages in terms of resilience and growth, current valuations could limit their future returns. Paying too much for even the best businesses reduces the potential for compounding returns, especially if there’s a reversion to more modest multiples.

For investors, now may be a time to reassess exposure to quality stocks trading at high premiums. The current market offers very few bargains in this category, but by remaining patient, we can position ourselves for stronger returns without the downside risk of overvaluation.

Do you agree? Are there other quality stocks you believe are overvalued or undervalued? Let’s discuss in the comments below.

Thank you for this great article!

I feel a sentiment shifting. Six months ago people were not open for this kind of articles, now I get positive comments when I warn for elevated prices.