In today’s hyper-connected world, platforms like X (formerly Twitter) and Threads provide investors with unparalleled access to a wealth of ideas, stock pitches, opinion, and discussions.

However, with this access comes a significant challenge:

distinguishing genuine investing expertise from superficial knowledge!

For newer investors, this can be particularly tricky—and potentially costly.

The Appeal of Superficial Authority

One common pitfall for inexperienced investors is the allure of accounts that seem authoritative at first glance.

These profiles often parrot popular investing mantras or regurgitate timeless aphorisms from legends like Warren Buffett.

While these soundbites too can be engaging and sometimes intellectually stimulating, they often lack the depth and rigor required for successful investing.

Buffett himself famously advocated for “criticizing by category and praising by name,” so while I won’t call out specific accounts, it’s worth noting that many of these “influencers” oversimplify complex concepts. This can then lead loyal followers to adopt flawed strategies or focus on the wrong priorities.

Spotting Red Flags: The Trap of First-Order Thinking

One telltale sign of superficial investing advice is a reliance on first-order thinking—addressing what is immediately apparent without considering deeper implications or trade-offs.

For example:

Focusing on Popular Trends: Accounts might highlight hot stocks or sectors without evaluating their long-term sustainability, risks, or doing proper valuation work (just glancing at valuation multiples has very little to do with actual valuation!).

Oversimplified Strategies: Principles like “buy and hold forever” or “be greedy when everyone is fearful“ are mantras that are often repeated without the necessary context. Owning stocks for multiple years without selling for instance only works for businesses with exceptional capital allocation and compounding potential—traits that require extensive qualitative analysis to identify.

I'd argue that dividend-focused accounts often fall into this category (and I acknowledge that I'm generalizing here!). While dividends can play a crucial role in some investment strategies and often contribute significantly to total shareholder returns, many accounts reduce their strategy to chasing high yields or emphasizing income at the expense of critical considerations like:

Valuation discipline

Reinvestment opportunities

Management effectiveness

For newcomers, this one-dimensional approach can become a trap, leading to portfolios built on shaky foundations.

What Sets True Expertise Apart?

The most valuable investing insights come from individuals who engage in second-order thinking. These investors consider not only the immediate implications of their decisions but also the broader, long-term trade-offs. Their advice often reflects years of experience, trial, and refinement, going far beyond textbook theories or catchy slogans.

“Knowledge comes from the combination of information, experience, and thoughtful reflection. Skip the final step, and you’re likely to repeat the same mistakes time and time again.” Arne Ulland

True experts:

Dive deep into valuation and capital allocation frameworks.

Challenge widely accepted norms, offering nuanced perspectives.

Blend lessons from the classics with their own hard-earned insights.

These profiles may not have the same mass appeal as the overly simplistic accounts, but they provide the tools and frameworks that enable durable, long-term investing success.

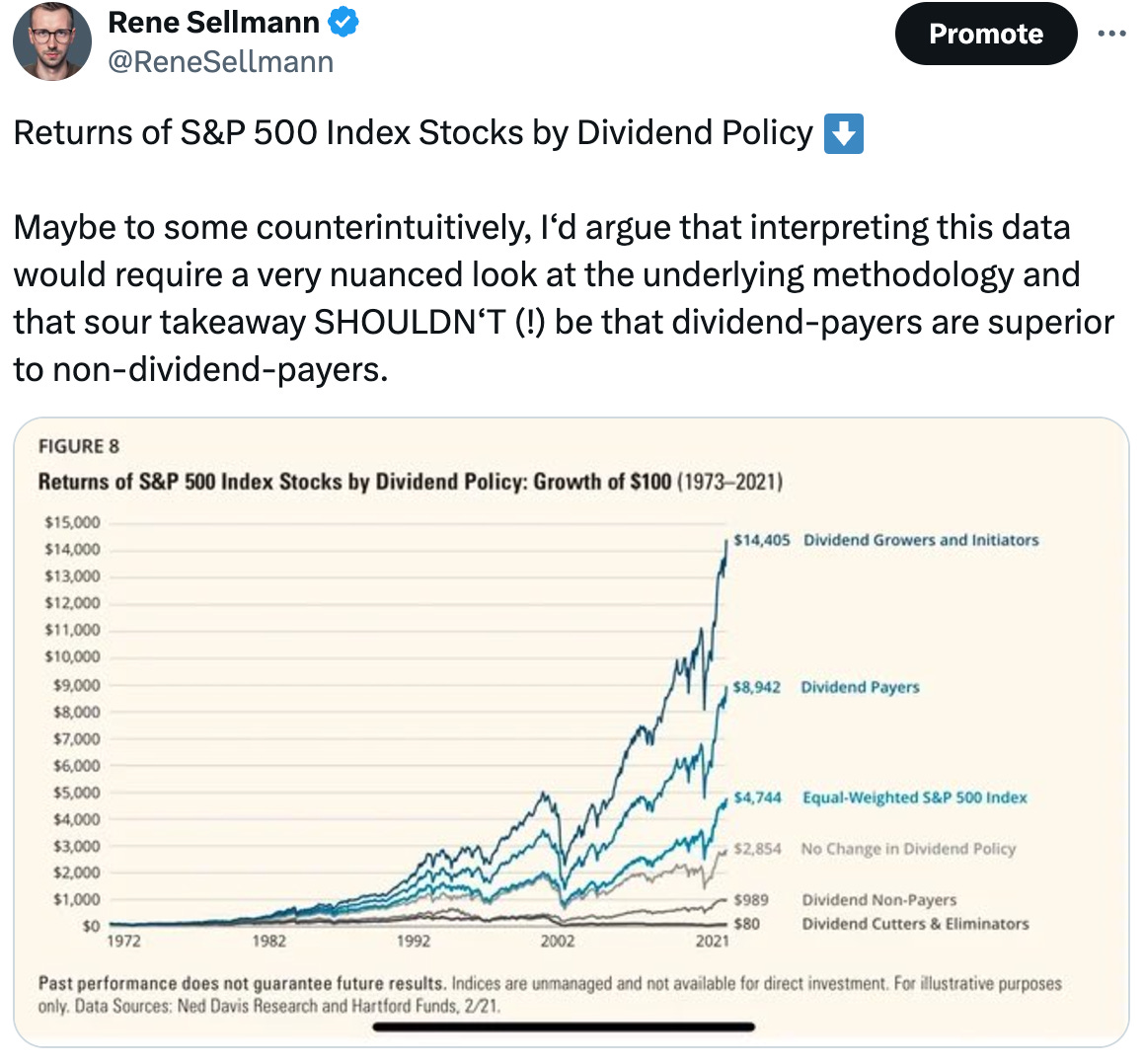

As I highlighted earlier, I like praising by name. So allow me to share one particular example of a post on X that is incredibly thought-provoking and nuanced (the post is pretty long, which is why I just linked it).

Advice for Newer Investors

If you’re a newer investor navigating social media’s crowded ecosystem, here are some key takeaways:

Be Skeptical of Simplistic Narratives: Ideas that sound too good to be true—or overly generalized—often are.

Be Selective in Who You Actively Follow: As a rule of thumb, you could try to keep the number of people you are following on X below 100.

Challenge What You Read: Ask yourself, “What are the deeper implications of this?”

Seek Second-Order Thinkers: Look for those who discuss not just “what” but also “why” and “how,” diving into the trade-offs and nuances of investment decisions.

Remember, true investing wisdom doesn’t just sound good—it holds up under scrutiny.

good post!