Is Uber a Smart Investment in 2025? A Deep Dive into the Ride-Sharing Giant’s Future

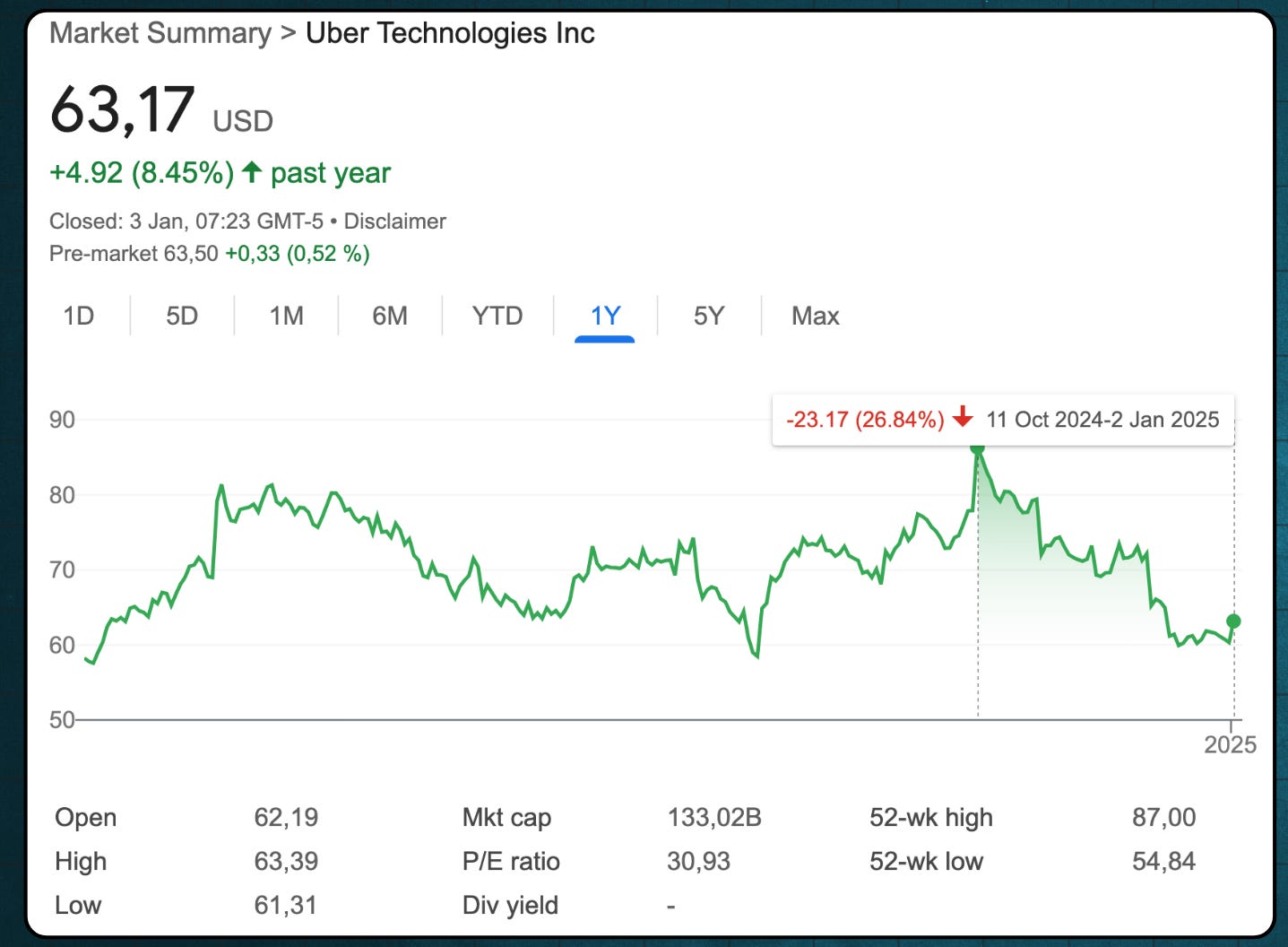

Uber Technologies has been under pressure recently, with its stock declining by roughly 26%, with concerns about autonomous vehicles (AVs) driving much of the pessimism.

Investors are debating whether this presents a long-term buying opportunity or signals deeper issues.

This detailed analysis will examine Uber’s business model, financials, competitive landscape, and valuation, while exploring the risks and opportunities presented by the transition to AVs. If you’re wondering whether Uber deserves a place in your portfolio, this is the comprehensive breakdown you need.

Uber's Business Model: Asset-Light and Scalable

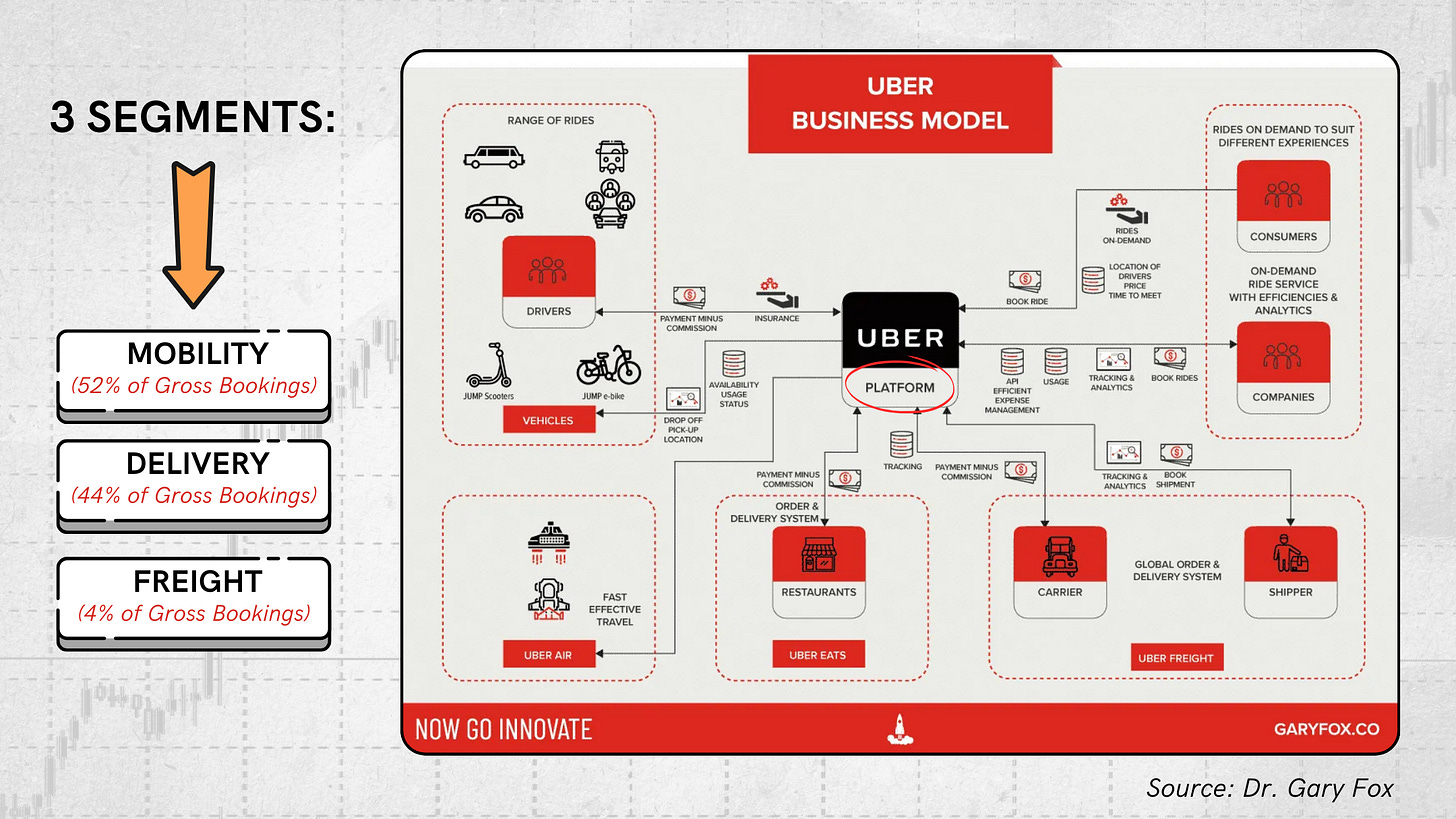

At its core, Uber is a technology platform that connects users with services across three segments: mobility, delivery, and freight.

Unlike traditional transportation companies, Uber does not own vehicles or employ drivers, allowing it to scale quickly with minimal capital requirements.

Here’s an overview of the relevance of each segment:

Mobility: Uber’s original ride-hailing service, contributing 50% of gross bookings.

Delivery: This includes Uber Eats and grocery delivery, representing 44% of gross bookings.

Freight: A smaller segment, comprising just 4% of gross bookings.

Clearly, the mobility and delivery segments drive Uber's core business, while freight, a smaller portion, arguably risks diluting management’s focus.

High-Margin Growth Areas

Two emerging segments stand out as potential game-changers for Uber:

Advertising: Uber’s advertising business grew 80% year-over-year, reaching a $1 billion run rate. With access to user location and behavioral data, Uber can deliver highly targeted ads, such as promoting nearby coffee shops during morning commutes.

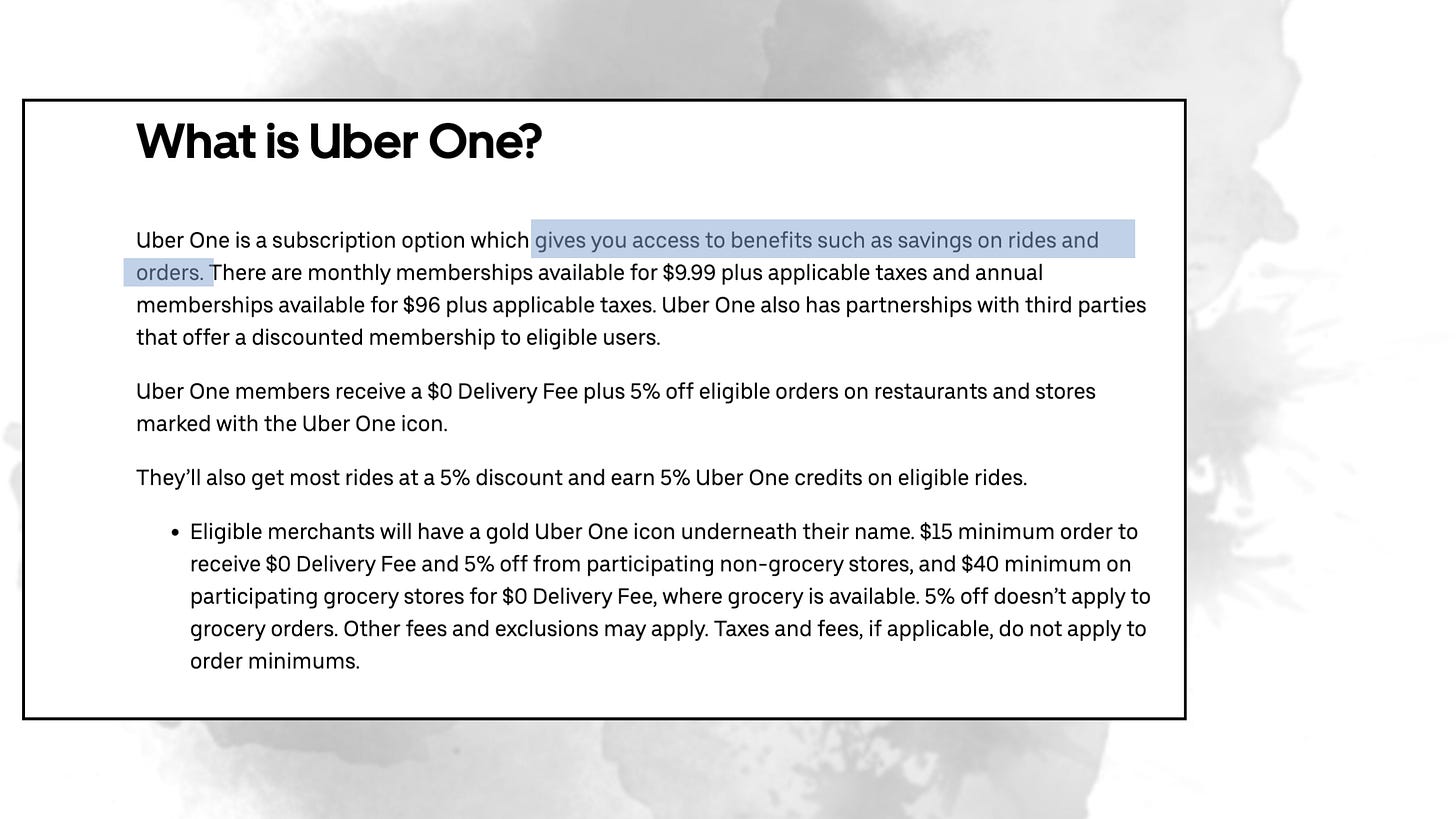

Subscriptions: With 25 million Uber One members, the subscription model drives loyalty and provides recurring revenue through perks like ride discounts and free deliveries.

What Gives Uber an Edge?

Uber’s rise to global prominence is no accident. The company has developed several competitive advantages that have propelled it to the forefront of the ride-sharing industry.

While not immune to challenges, these strengths underpin its dominance and help sustain its position in a highly competitive market. Let’s discuss each competitive advantage separately:

1. The Power of Network Effects

At the heart of Uber’s business is a two-sided network connecting riders and drivers. This dynamic network effect creates a self-reinforcing loop:

As more drivers join Uber, riders experience shorter wait times and better availability, increasing their satisfaction and likelihood of using the platform.

In turn, a growing base of riders attracts more drivers, who are drawn by the promise of consistent demand and income opportunities.

This network is especially powerful in new or underserved markets, where Uber’s ability to quickly scale creates a strong first-mover advantage. By facilitating an astonishing 31 million trips per day (Q3 2024), and boasting 161 million monthly active platform users and 7.8 million active drivers, Uber has reached a scale that competitors struggle to match.

However, the localized nature of Uber’s network effects (as discussed further down below) limits their global strength.

2. Brand Recognition and Cultural Pervasiveness

Few companies achieve the level of brand ubiquity that Uber enjoys. The name "Uber" has transcended its corporate identity to become a verb synonymous with ride-hailing itself.

Phrases like "I’ll Uber there" illustrate how deeply embedded the company is in modern culture.

This brand recognition offers significant competitive advantages:

Top-of-Mind Awareness: When customers think of ride-hailing, Uber is often their first choice, giving it a head start over competitors and lowering customer acquisition costs.

Global Consistency: Uber’s branding and app experience are remarkably consistent worldwide. Travelers arriving in new cities often default to Uber because of its familiarity and ease of use.

Trust: For many users, Uber represents reliability and safety, built over years of consistent service delivery.

Brand strength is particularly valuable in commoditized industries like ride-sharing, where services are often indistinguishable. By fostering strong brand recognition, Uber gains an edge in acquiring and retaining customers despite the price sensitivity of the market.

3. Scale and the Volume of Trips Facilitated

Uber’s sheer scale is another formidable advantage. As of Q3 2024, the platform facilitated 2.9 billion trips per quarter, or over 31 million trips per day. This immense volume not only demonstrates Uber’s dominance but also creates operational efficiencies and valuable data advantages:

Operational Efficiency: With such high volumes, Uber can optimize its algorithms to reduce wait times, improve driver routing, and manage peak demand effectively. The scale also allows Uber to experiment with new features and services (e.g., advertising) with minimal risk.

Barrier to Entry: Competing at Uber’s scale requires immense capital investment and operational expertise. For example, smaller competitors often struggle to provide the level of reliability and availability that Uber can deliver simply due to its existing infrastructure. One of the reasons UBER burned billion of dollars over its business history was that UBER was providing incentives to both riders and drivers to get the network started all across the globe.

4. Access to Data: The New Oil

Uber’s access to vast amounts of mobility and consumer data is a key competitive advantage in today’s data-driven economy. Few companies, aside from Google (and the Google Maps app), possess this level of insight into how people move within cities. Uber’s data includes information on:

Rider and driver preferences.

Traffic flow and patterns across multiple geographies.

Demand dynamics during peak and off-peak hours.

This data is incredibly valuable for optimizing operations, developing new services, and enhancing profitability. It also enables Uber to enter adjacent high-margin industries, such as advertising and partnerships with tech leaders.

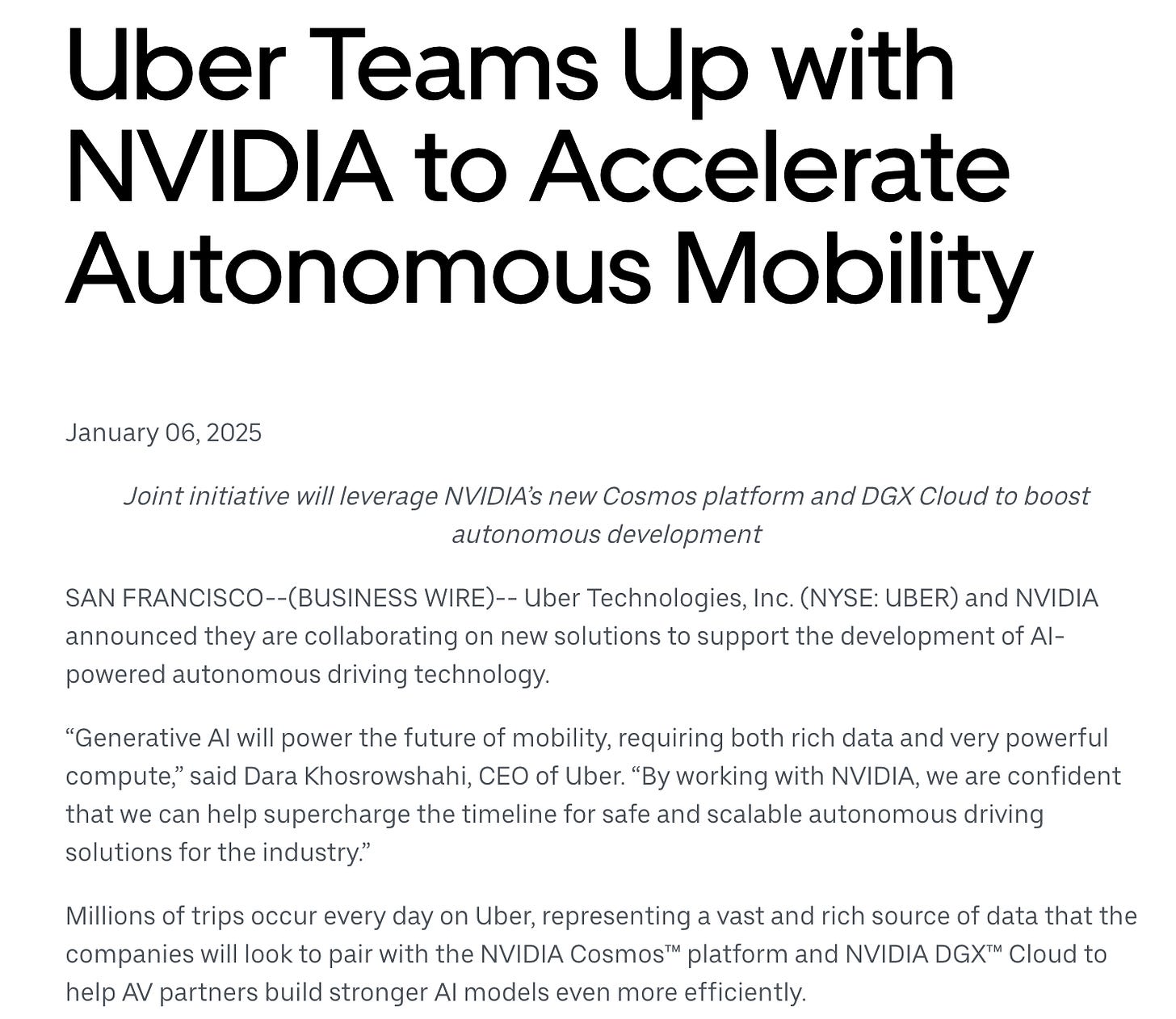

The Nvidia Partnership

Uber’s recent deal with Nvidia underscores the strategic importance of its data. Nvidia’s advanced AI and GPU technology will integrate with Uber’s data troves to accelerate autonomous vehicle development and other AI-powered innovations. By leveraging Nvidia’s capabilities, Uber aims to help carmakers refine driverless technologies and optimize its own platform further, positioning itself for leadership in a future dominated by autonomous mobility.

In an era where "data is the new oil," Uber’s unparalleled access to mobility insights not only strengthens its current business but also opens doors to transformative opportunities.

The Sum of Its Parts: A Formidable Business Model

Uber’s competitive advantages work in tandem to create a business that is difficult to replicate. The network effects provide a foundation of reliability and scale, while the brand recognition ensures that Uber remains the default choice for millions of riders worldwide. Meanwhile, the immense number of trips facilitated daily bolsters its data capabilities and operational efficiency, reinforcing its dominance.

However, these advantages are not unassailable. The localized nature of its network effects and the commoditized nature of the service leave Uber vulnerable to disruption. Let’s discuss these challenges:

Localized Network Effects: A Limiting Factor for Uber

Network effects are a powerful driver of competitive advantage in many technology companies. A typical network effect occurs when the value of a service increases as more users join the platform. Think of social media platforms like Instagram: each new user makes the network more valuable for existing users by increasing connectivity and engagement opportunities. However, Uber’s network effects are localized, which limits their strength and scalability.

In Uber’s case, network effects operate city by city. Let’s break this down:

Driver Side (Supply):

When a city has a small number of drivers, adding more improves the service significantly by reducing wait times for riders and increasing coverage.

However, once wait times drop to a tolerable level, the benefit of adding more drivers diminishes sharply. A rider doesn’t gain any additional value from having 1,000 available drivers compared to 800 if their wait time is already minimal.

Rider Side (Demand):

On the demand side, once Uber attracts enough customers in a city to ensure steady income opportunities for drivers, adding more riders does little to improve the attractiveness of the network for drivers.

This is because drivers are already being matched quickly with rides. Adding more riders in this scenario only marginally impacts the driver’s ability to earn income.

Commoditization of Ride-Sharing Services

Uber’s localized network effects are further weakened by the commoditized nature of ride-sharing services. In a commoditized market, services are largely interchangeable, and customers choose providers based on price or availability rather than loyalty. Let’s explore how this applies to Uber:

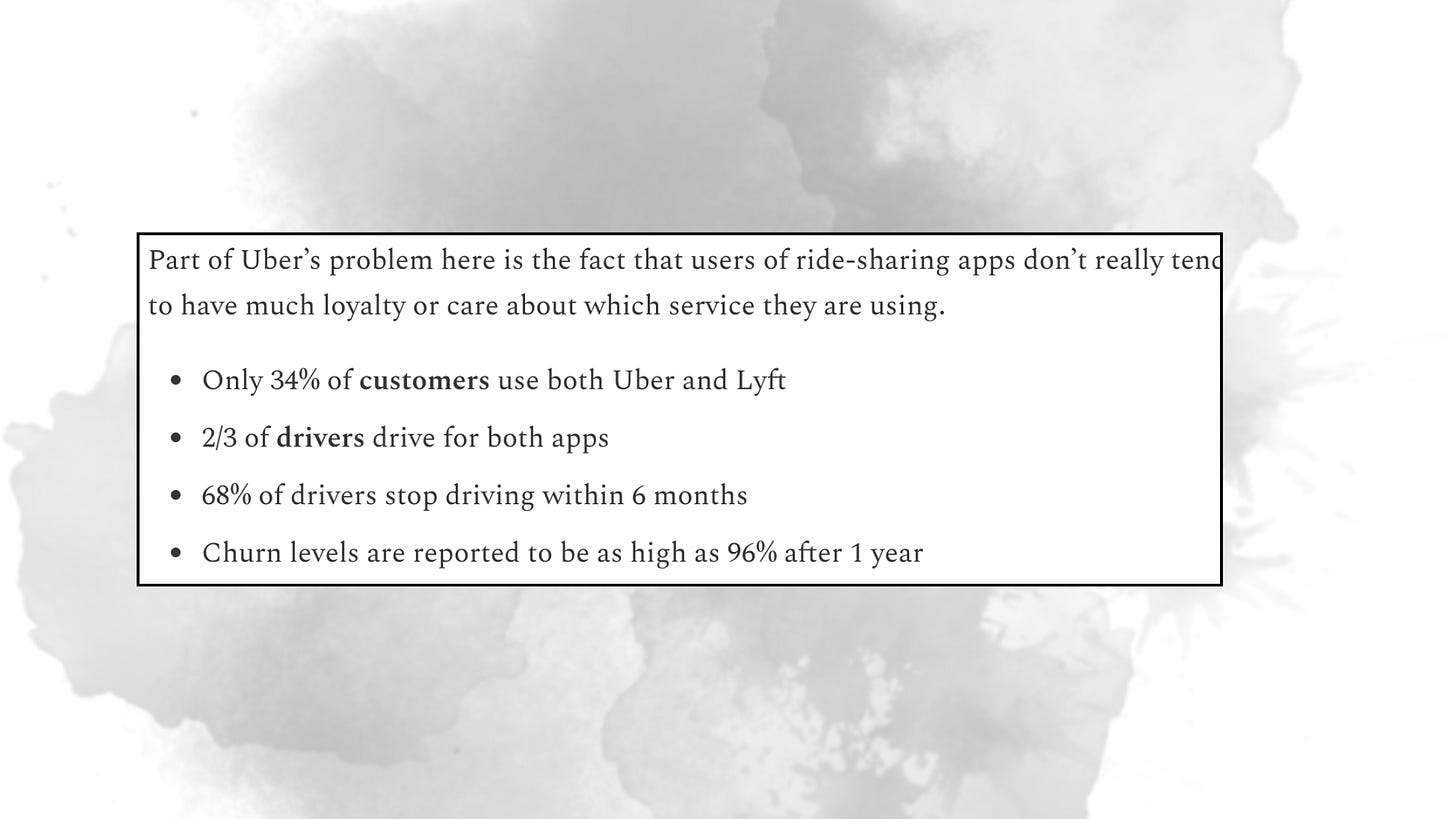

1. Low Consumer Loyalty: A substantial portion of Uber’s customers also use competing services like Lyft. Studies indicate that a large percentage of ride-sharing customers use both platforms, switching based on factors such as wait times, cost, and promotions. This lack of stickiness undermines the traditional advantages of network effects, as riders aren’t locked into Uber’s ecosystem.

Source: Innovestor Substack “Uber Deep-Dive” (2021)

2. High Driver Churn: Similarly, Uber drivers often work for multiple platforms. Approximately two-thirds of drivers are active on both Uber and Lyft, and 96% of Uber drivers used to churn within six months. This dynamic is further evidence of commoditization, as drivers choose platforms based on earnings potential rather than loyalty to a specific service.

3. Price Sensitivity and Lack of Differentiation: Most riders view Uber, Lyft, and other ride-sharing services as interchangeable. When choosing a platform, customers prioritize:

Price: Dynamic pricing ensures users gravitate toward the lowest cost option.

Availability: Riders select the platform with the shortest wait times.

Convenience: Switching between platforms is seamless due to minimal switching costs.

These factors contributed to Uber being unprofitable for the most part of its history. The commoditization of ride-sharing also puts pressure on Uber’s margins:

Price Wars: To retain customers, Uber must continuously compete on price, eroding profitability.

Marketing Spend: Significant spending on promotions and incentives is necessary to retain riders and attract drivers, increasing customer acquisition costs.

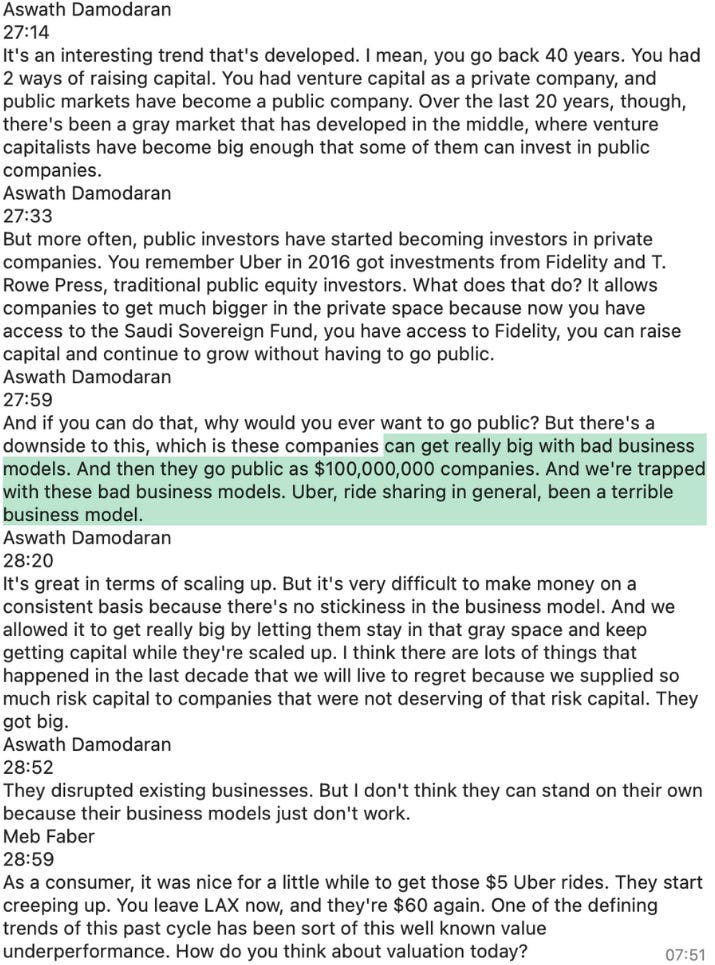

Aswath Damodaran hence called UBER a “bad business model.”

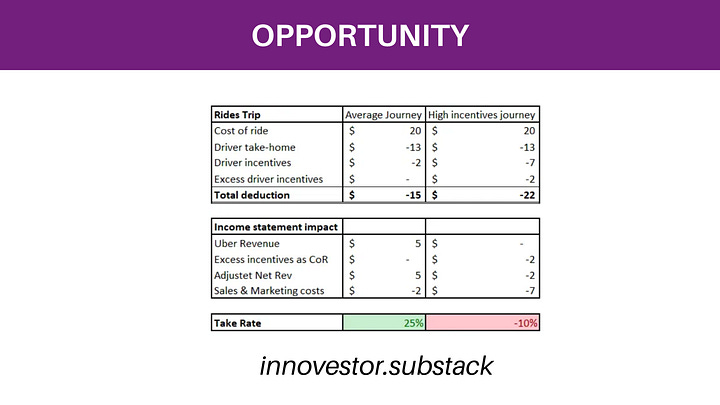

Allow me to share two unit economics breakdowns I came across when research Uber:

Implications for Uber’s Competitive Position: Vulnerability to Disruption

Uber’s localized network effects and commoditization leave it vulnerable to competitors:

Localized Competitors: Smaller, regional ride-sharing apps can achieve sufficient scale in specific cities, particularly where regulatory barriers or customer loyalty to local brands exist.

Autonomous Vehicle Providers: AV companies like Waymo and Tesla could bypass Uber’s platform entirely by offering direct-to-consumer services.

Opportunities for Differentiation

Despite these challenges, Uber has opportunities to mitigate the effects of commoditization:

High-Margin Growth Areas: Expanding its advertising and subscription businesses can create stickier customer relationships and reduce dependence on price-sensitive riders.

Partnerships: Collaborating with AV providers allows Uber to remain relevant in a world where drivers are no longer necessary, leveraging its demand aggregation capabilities.

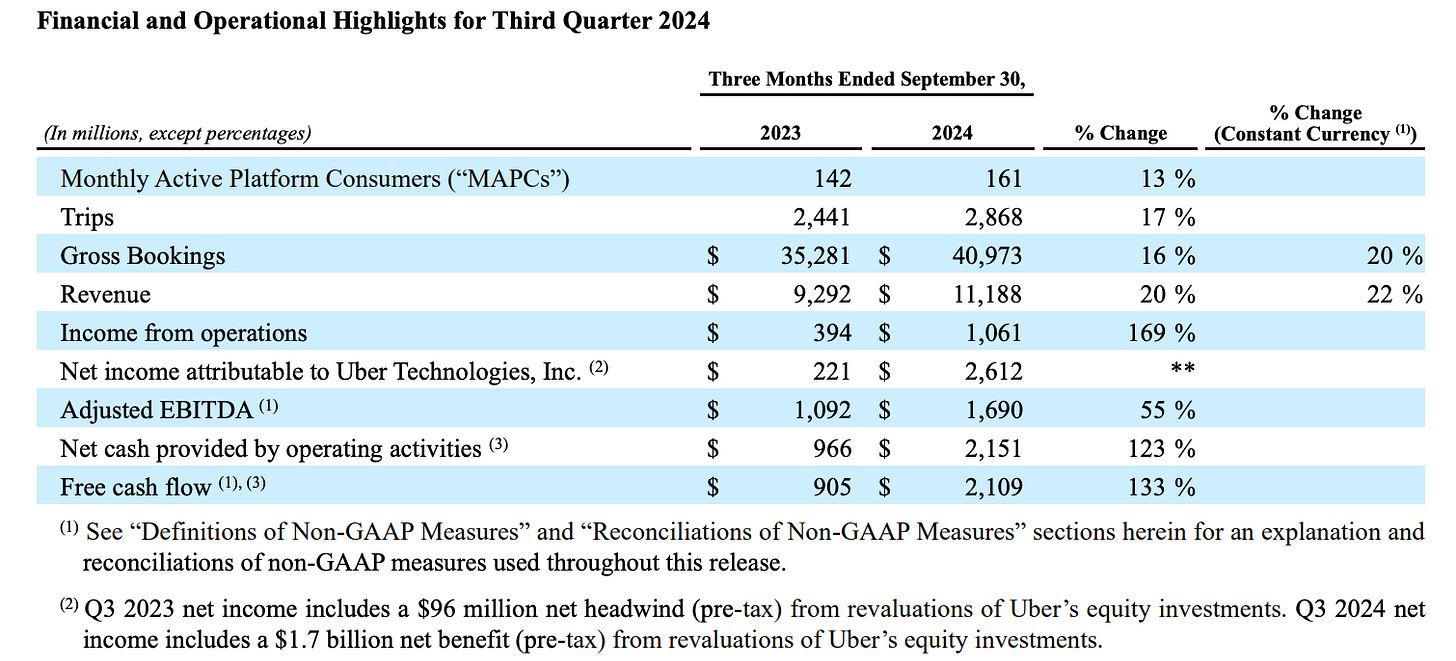

Financial Performance: From Cash Burn to Profitability

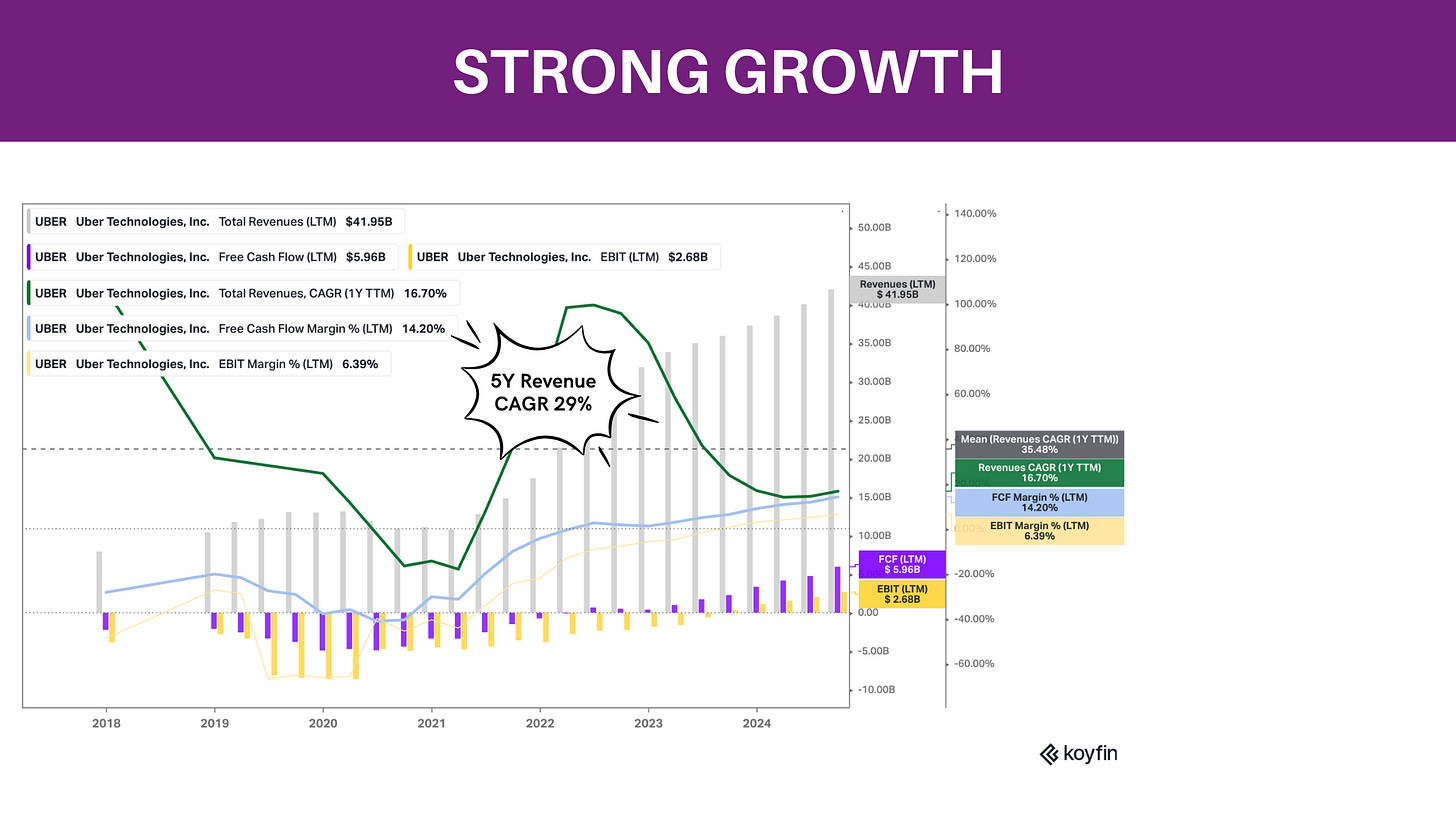

Uber has made significant strides in improving its financial health. Historically known for burning cash, the company now generates substantial free cash flow and operating income.

Revenue Growth: Compounded at 29% annually over the past five years.

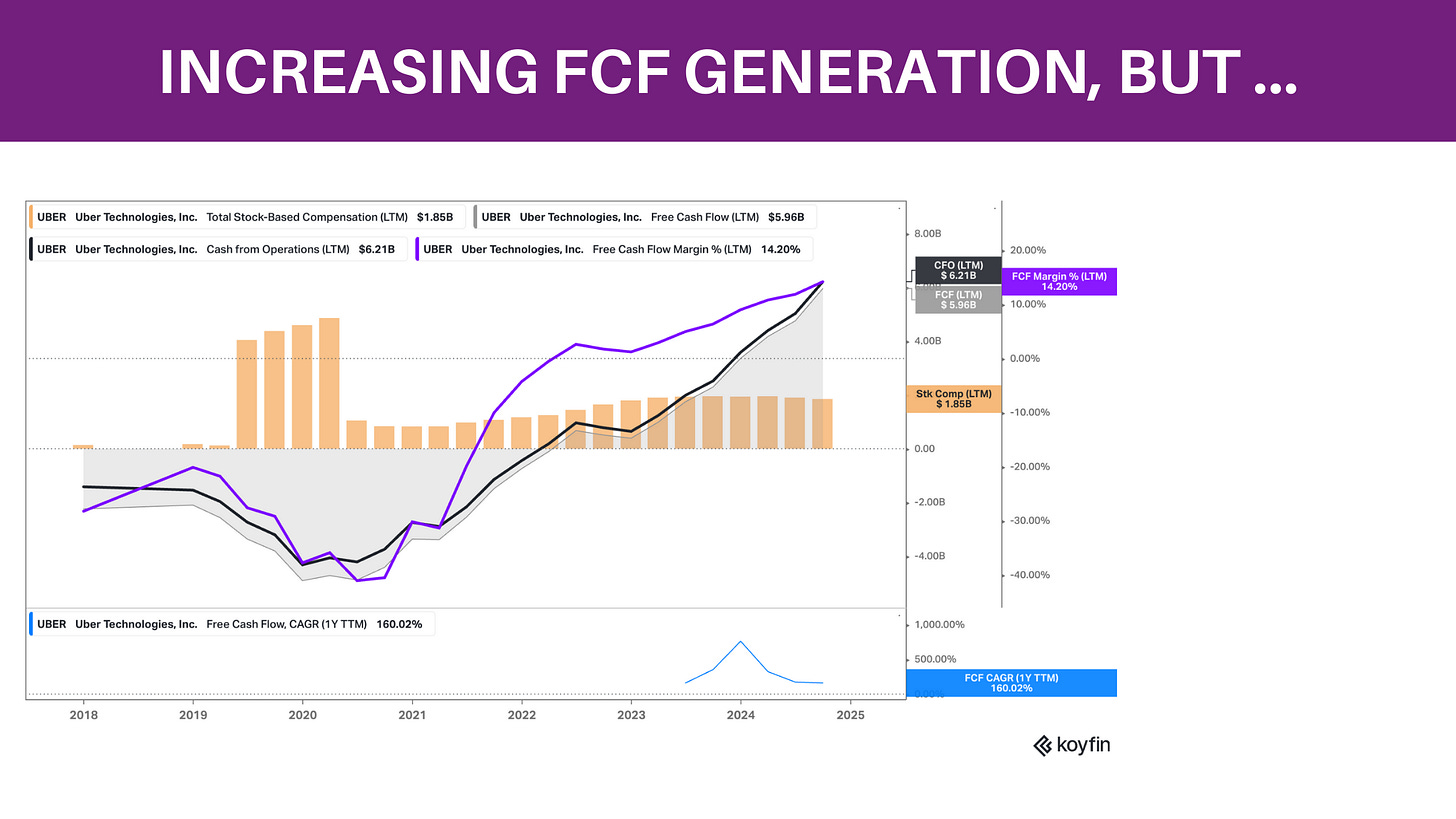

Free Cash Flow (FCF): $6 billion generated in the past 12 months, though stock-based compensation reduces “true FCF” to ~$4 billion.

Margins: Operating income reached $2.7 billion, with margins trending upward.

Capital Allocation

Uber’s management has announced aggressive share buybacks, reflecting confidence in its long-term trajectory. With its asset-light model requiring minimal reinvestment, Uber – now being profitable – has flexibility to reward shareholders or pursue strategic initiatives.

The Autonomous Vehicle Debate

The transition to autonomous vehicles (AVs) represents both a threat and an opportunity for Uber. Let’s examine both perspectives.

Threats

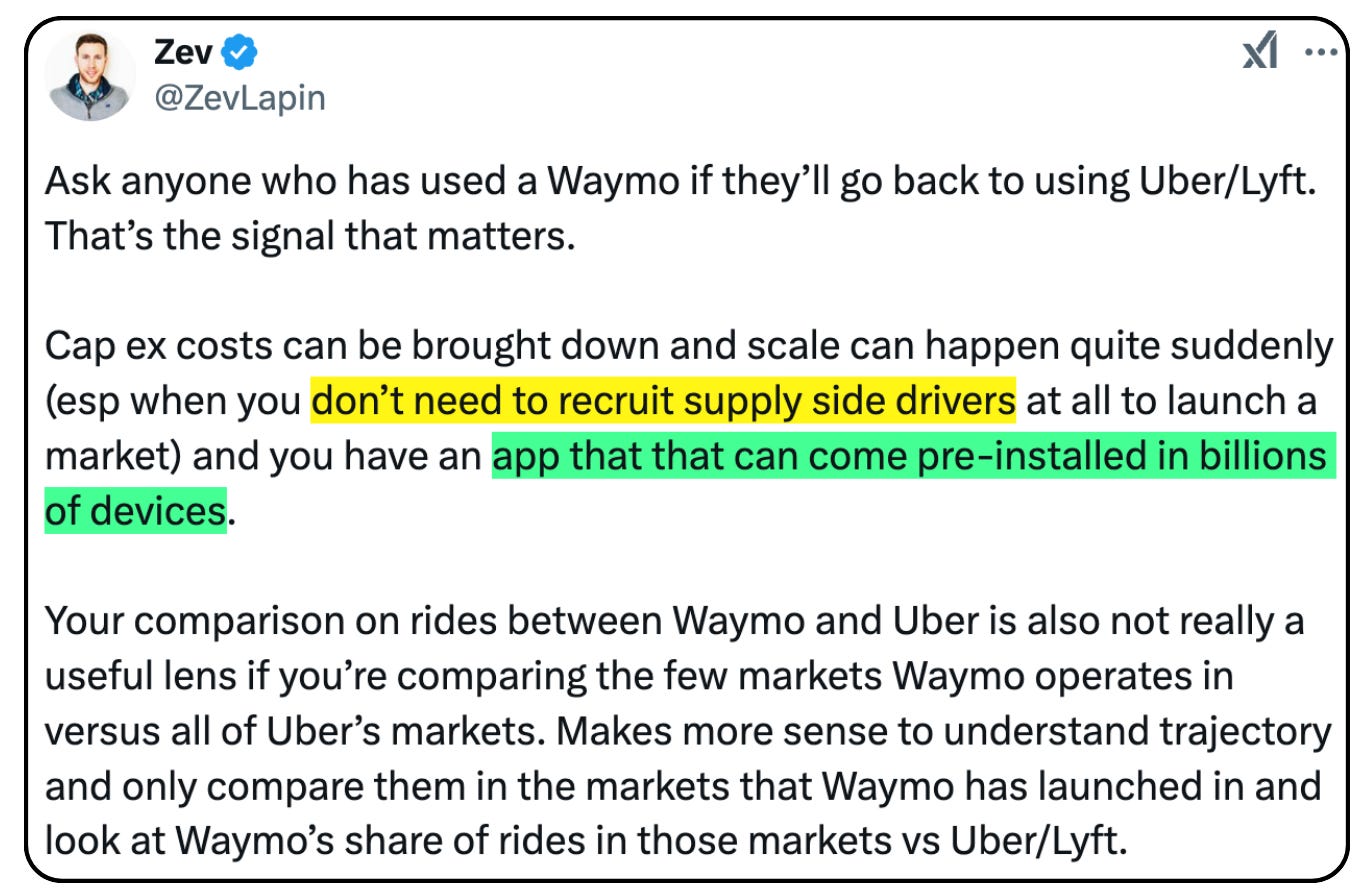

Disruption of Uber’s Driver Network: Uber’s competitive advantage lies in its two-sided network, connecting drivers with riders. AVs could eliminate the need for human drivers, allowing competitors like Waymo (Google) and Tesla to bypass Uber and offer direct services.

Localized Network Effects: While Uber enjoys scale in individual cities, AV providers could replicate this model locally, undermining Uber’s global advantage.

Increased Competition: Companies like Waymo are already providing AV rides in cities like Austin and Miami without the help of Uber, testing the feasibility of bypassing Uber entirely.

Opportunities

Partnerships with AV Providers: Uber has partnered with 14 AV companies, including Waymo in select cities, leveraging its massive user base as a demand aggregator.

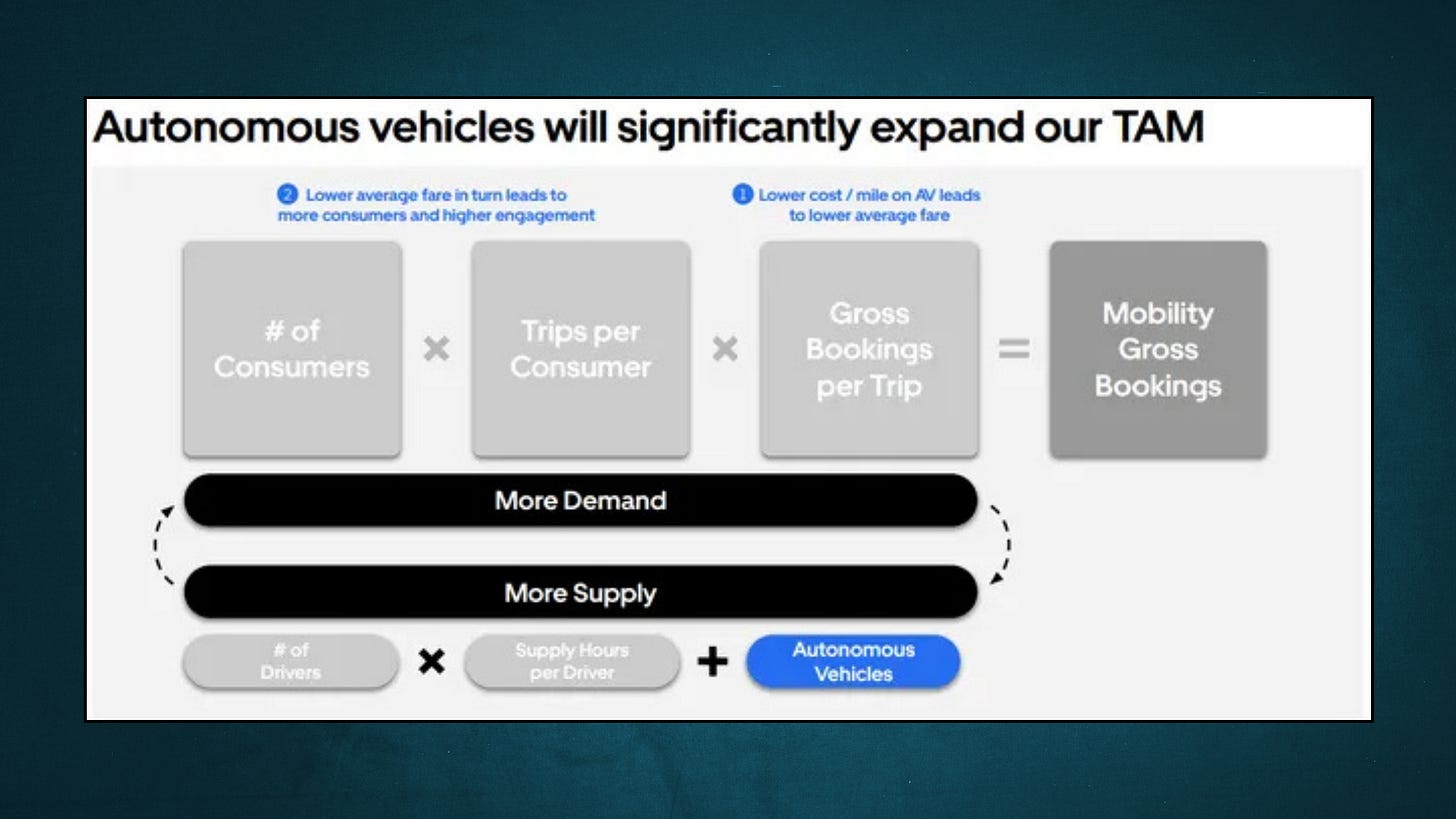

Expanded Market: AVs are expected to increase trip frequency, and expand Uber’s total addressable market (TAM). Uber projects significant growth in gross bookings as AV adoption scales.

Data-Driven Insights: Uber’s vast troves of user data could be invaluable in optimizing AV routes and operations.

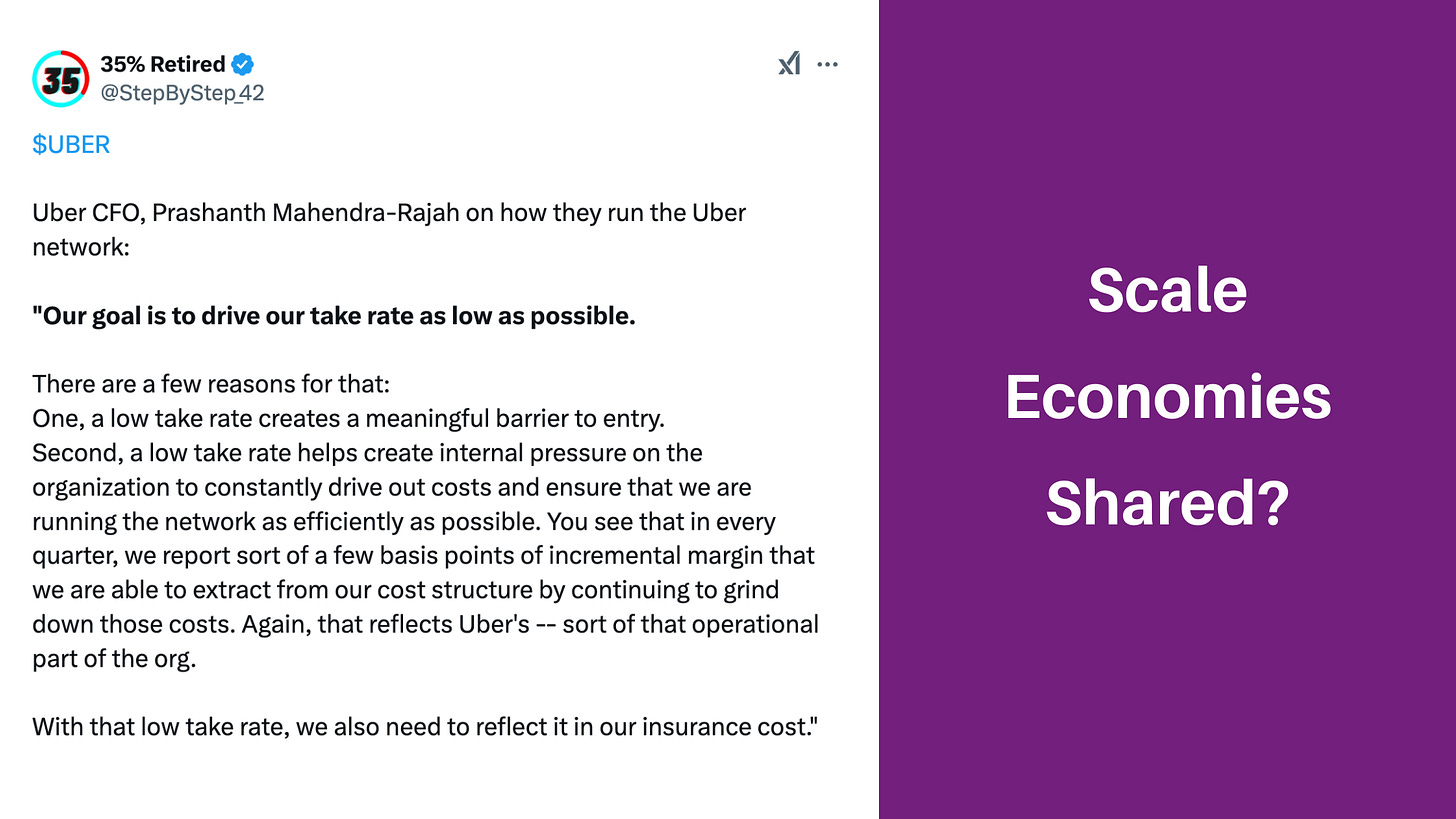

Better Unit Economics? What would global-scale autonomous driving do to Uber’s unit economics? Will rides simply get way cheaper over time (no labor costs) or will the margins of the AV distribution platform (possibly UBER?) just skyrocket? Management gave hints that the business might in fact pursue the scale economies shared playbook (although I’m not buying into this narrative as Uber has significantly increased prices in many localized networks after driving out local competition).

Timing of the AV Transition

While AV technology is advancing rapidly, widespread adoption remains – in my view – at least 10 years away. Building and scaling a global AV fleet is capital-intensive and time-consuming. For example, Waymo currently provides only 175,000 rides per week, compared to Uber’s 31 million daily trips. This suggests Uber has a significant runway to adapt.

Valuation: Can Uber Deliver Enough Growth?

To evaluate Uber’s investment potential, I conducted a reverse discounted cash flow (DCF) analysis:

Base/Bull Case Assumptions

Free Cash Flow: $4 billion (adjusted for stock-based compensation).

Growth: 25% for the next five years, 15% for the following five years, with a terminal growth rate of 3%.

Discount Rate: 10%.

Under these assumptions, Uber’s intrinsic value is ~$99 per share, suggesting upside from current levels. However, a more conservative valuation requiring a 50% margin of safety implies Uber would need to grow FCF at 35% annually for the next five years—an ambitious target given competitive and regulatory uncertainties.

Key Questions for You to Assess Correctly:

Role in an AV World: Can Uber maintain its central role in mobility as AVs scale, or will competitors disintermediate its platform?

Unit Economics: Will AVs lower costs enough to boost/maintain profitability, or will competition force ride prices down?

Cash Flow Deployment: How will Uber use its growing cash flow? Smart capital allocation will be critical to creating long-term shareholder value.

Final Thoughts: A Promising but Risky Bet

Uber’s transformation into a profitable, free cash flow-generating business is impressive. However, the challenges posed by the AV transition, competition, and regulatory risks cannot be ignored.

For long-term investors, Uber offers significant upside IF it can navigate these challenges and solidify its role in the AV ecosystem. At current valuations, it’s not a “no-brainer” investment in my view though but a company worth monitoring closely.

What’s your take on Uber’s future? Will it dominate the AV era, or are its challenges too great? Share your thoughts in the comments!