Investing in Alcoholic Beverages? A Sector Analysis & A Value Investor's Perspective!

The alcoholic beverages industry has a storied history, spanning centuries and reaching across the globe.

In recent years, however, the sector’s stock performance has been lackluster, leading some investors to question whether it might hold hidden value.

In this deep dive into the industry, I examine the challenges and opportunities in the industry, including the influence of consumer trends, the unique dynamics of different alcoholic categories—spirits, beer, wine, and the emerging “Beyond Beer” category—, and current valuations.

By considering the business models, growth opportunities, and associated risks, I’ll determine whether this sector deserves investors’ attention right now.

1. Current Market Landscape: Why Alcohol Stocks are Struggling

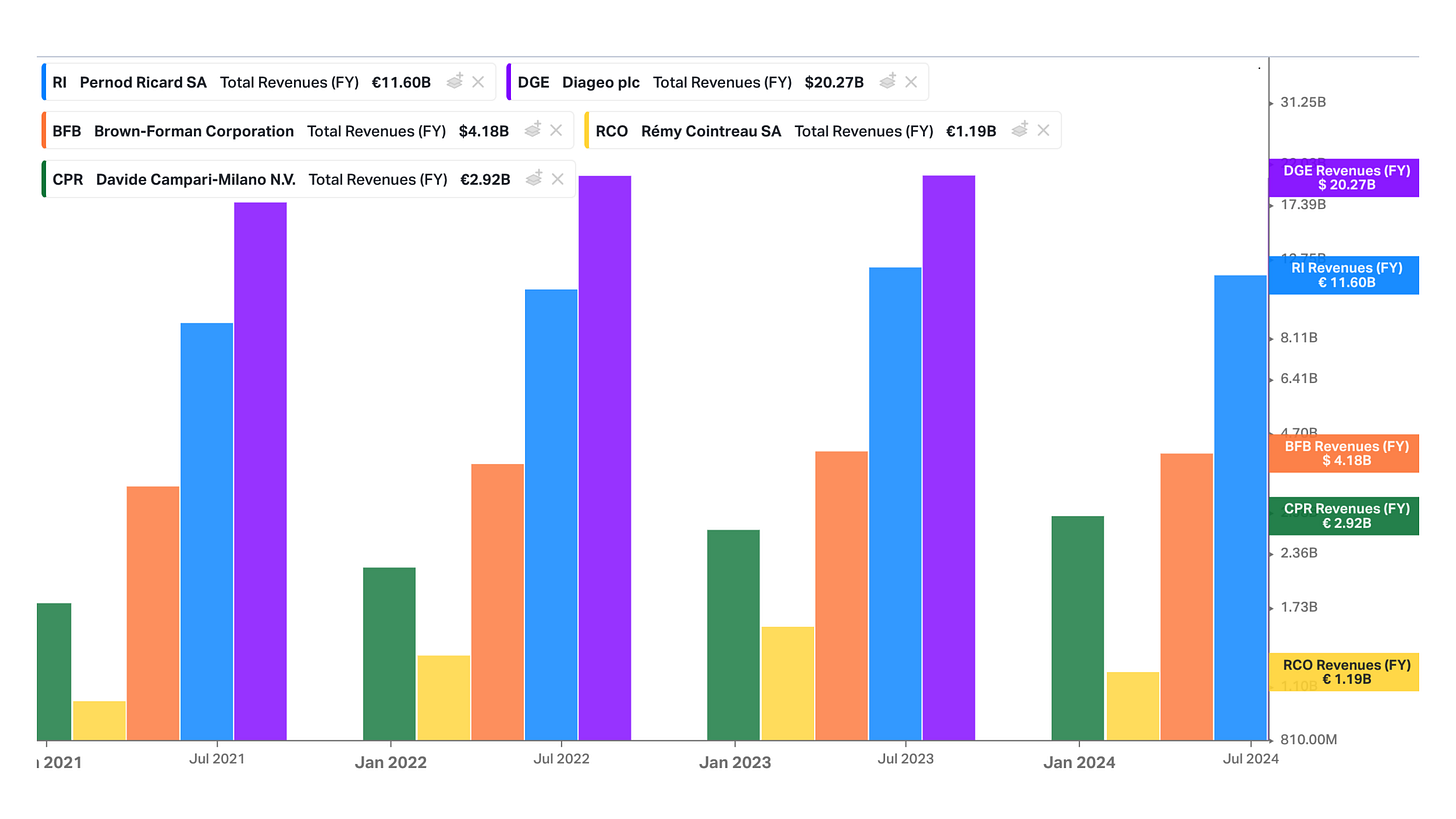

The alcoholic beverage industry has experienced significant headwinds, with stock performance lagging behind broader market indices.

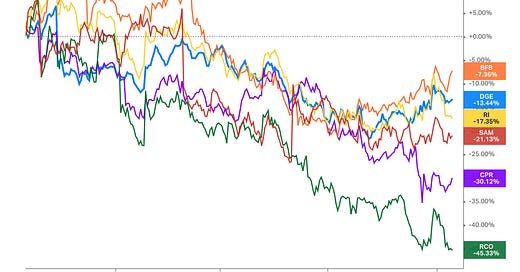

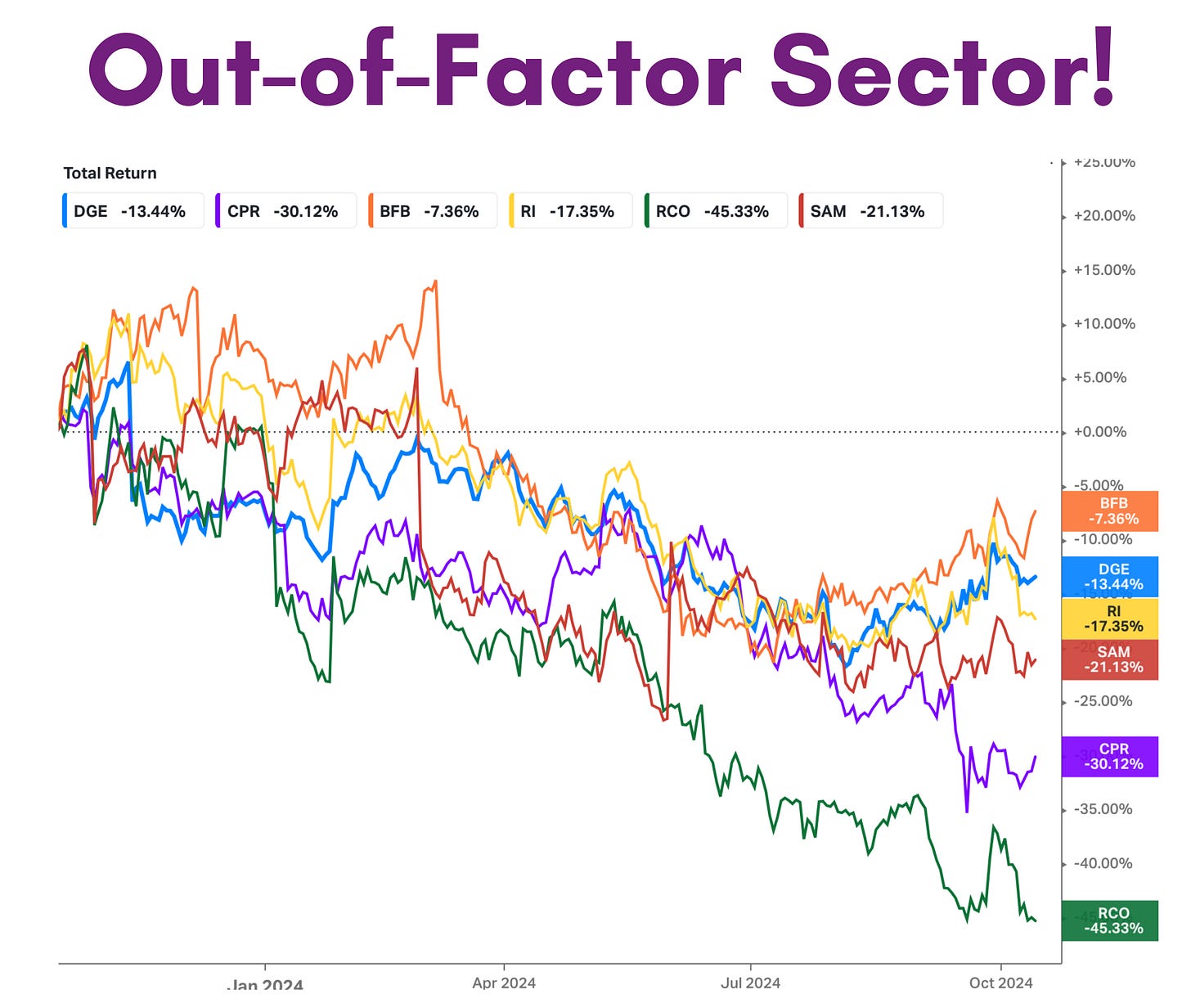

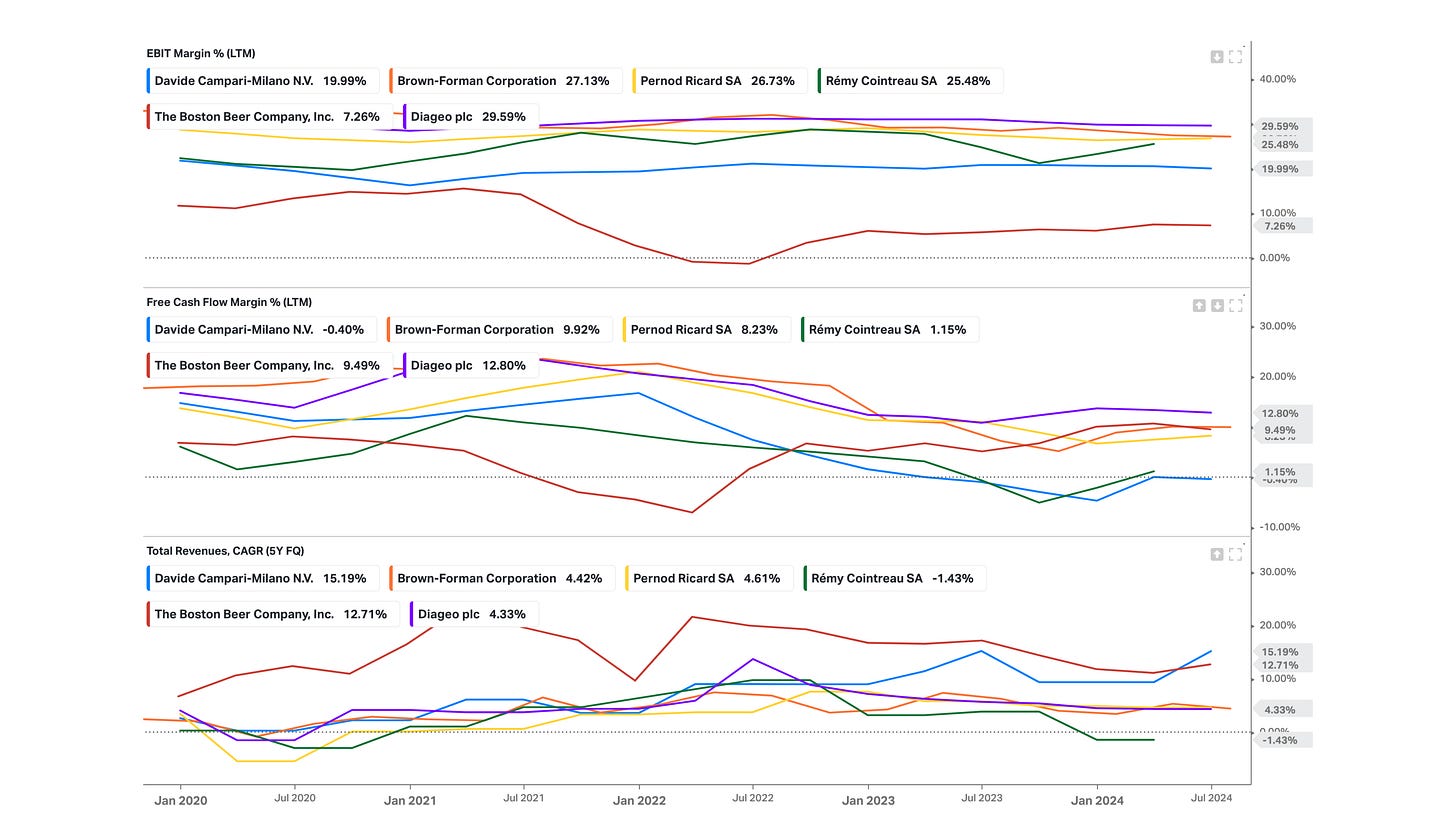

Major players like Diageo, Pernod Ricard, Campari, Anheuser-Busch, Boston Beer, and others have seen flat or declining returns (even on a “total return” basis) not only over the last 12 months (see chart above) but also over the last five years! (see chart below)

Across the board, spirits companies have struggled to keep pace with the S&P 500. For instance:

Diageo: Down nearly 10% over the last five years

Pernod Ricard: Declined by 17.6% over the same period

Campari: losing 8%

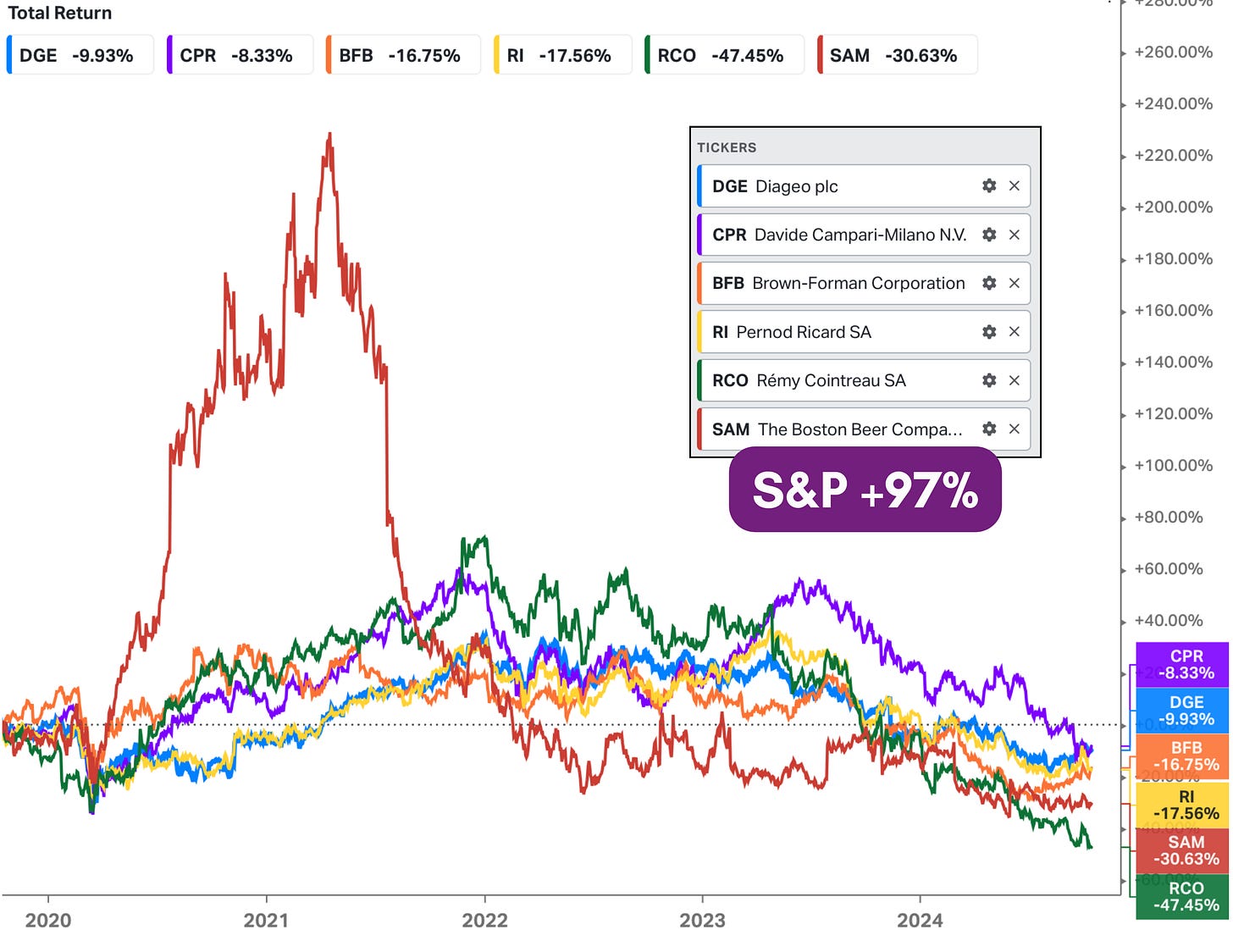

While most of the names in the charts above are global giants in the spirits market (with Boston Beer being an exception), we can observe a similar trend in the beer category:

Anheuser-Busch InBev, Molson Coors, Constellation Brands, and Boston Beer are among the largest beer companies, and their stock performance reflects both a sluggish market for traditional beer products and headwinds unique to each company.

Here’s a look at their one-year performance:

Anheuser-Busch InBev: Losing 29% as the company grapples with shifting consumer preferences and the fallout from recent marketing controversies (Read “Behind the Backlash Against Bud Light” by the NYT).

Molson Coors: Also flat over five years, with possibly limited pricing power and stagnant volumes impacting its bottom line.

Boston Beer: Among the worst performers, down by around 26% over five years

In many cases, these underwhelming results mirror broader challenges within the sector, such as slowing growth, sometimes declining volumes, and maybe most importantly, shifting consumer preferences.

2. Decline in Valuation Multiples for Spirits

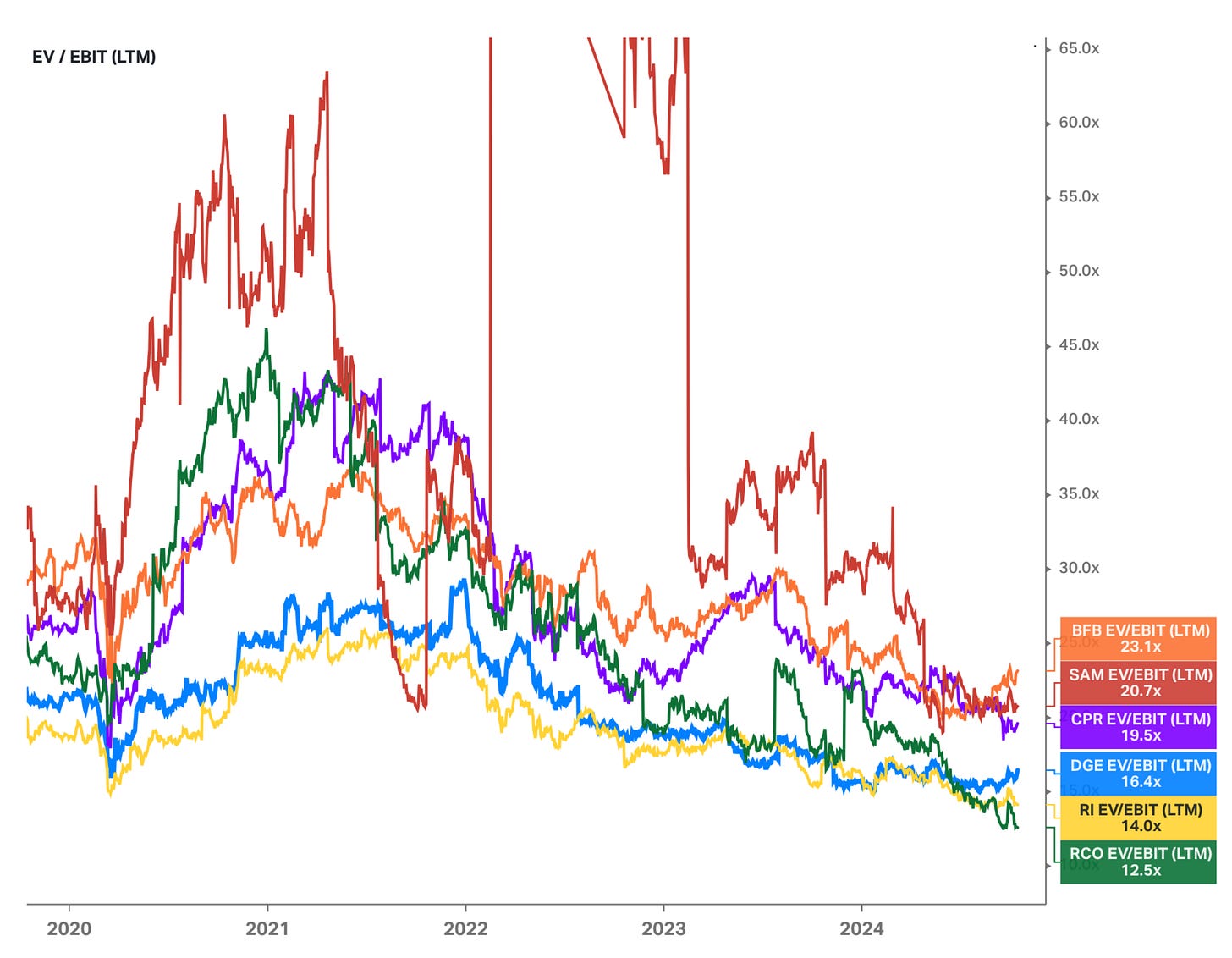

For spirits companies, the average EV/EBIT multiple has historically ranged between (around) 20x and 30x, reflecting the perceived stability and consistent cash flows associated with established brands.

However, over the past year, these multiples have compressed, with most spirits stocks now trading between 14x and 23x EV/EBIT, as investor sentiment turns more cautious and macroeconomic pressures weigh on the industry.

This compression in valuation multiples reflects investors’ more conservative expectations for growth and profitability within the sector and significantly contributed to the poor performance of the stocks over the more recent past.

Put differently, the decline in multiples across spirits and beer companies suggests that the sector’s poor stock performance is not solely attributable to deteriorating fundamentals; rather, it indicates a sector-wide re-rating based on lower future growth expectations and possible structural headwinds.

For value investors, this multiple contraction might present opportunities, as long as the intrinsic value of these stocks is significantly larger than the price they trade at (which, as shown, has come down for many stocks).

However, the poor stock performance (partly driven by multiple compression) may also emphasize the need for careful analysis, as multiple contraction can signal long-term secular challenges in a sector, particularly if growth rates and margins do not improve; or even further decline. Value investors often refer to these types of situations as “value traps;” an optically cheap multiple that is nonetheless, and somewhat counterintuitively, not signaling that the stock is actually cheap.

In summary, the alcoholic beverage sector’s stock performance over recent years, highlighted by the underperformance of both beer and spirits companies, appears driven by both challenged fundamentals (more on this later) and a reset of valuation multiples. As investors recalibrate their expectations for growth in the sector, the compression in EV/EBIT ratios underscores a more cautious outlook.

But as explained, the stagnation in stock prices underscores a potential dislocation between current valuations and the actual underlying value within these companies. The discrepancy between alcohol stocks and the S&P 500, which has risen nearly 100% in the past five years, has prompted me to take a second look, wondering if these businesses might be undervalued in a world where cyclically underperforming sectors can yield bargains.

3. Understanding the Business Model of Alcohol Stocks

The business model in the alcoholic beverages industry is relatively straightforward, centering around three core elements: production, marketing, and distribution.

This model enables large alcohol companies to maintain a steady flow of cash and ensures their resilience across market cycles. By focusing on building strong brands, expanding distribution networks, sometimes acquiring companies to leverage the distribution network, and adapting products to align with consumer tastes, companies like Diageo exemplify how the industry captures value from brand equity and consumer loyalty.

Here’s a closer look at each component of the business model, with Diageo as a prime example:

1. Production

The production side of the business encompasses everything from sourcing ingredients to manufacturing a wide range of products across various alcoholic categories—spirits, beer, wine, and beyond. Alcohol companies typically produce iconic beverages that are woven into the cultural fabric of their markets, leading to strong brand loyalty. Diageo, as one of the world’s largest alcohol companies, operates in over 180 countries and owns more than 200 brands, giving it a diverse and highly recognized product portfolio. This global scale and production diversity help mitigate risks and allow Diageo to capture value across different consumer demographics and regions.

2. Marketing and Brand Equity

Building and sustaining brand equity is central to the business model, as iconic brands in the alcohol industry can create lifetime loyalty among consumers. Through strategic marketing and advertising campaigns, companies like Diageo establish strong connections with their target audiences and consistently reinforce their brands’ identities.

Diageo also adapts its branding to align with local markets, leveraging data-driven insights to tailor marketing campaigns. This strategic approach to brand building ensures that products remain relevant across different demographics, boosting both visibility and market share globally.

3. Distribution and Market Reach

Distribution is a significant part of the competitive edge for alcohol companies, as access to diverse and global distribution networks is essential for scaling operations and maintaining market share.

Diageo’s extensive distribution network spans retail stores, bars, restaurants, and e-commerce channels. The company’s products reach consumers across various environments, whether they’re purchasing directly online, ordering cocktails at a bar, or buying a bottle at a local store.

The sheer scale and reach of Diageo’s distribution network create a moat, as smaller competitors often find it challenging to match the breadth of channels and logistical capabilities required for global distribution. This distribution advantage enables Diageo to launch new products effectively, maintain stock across its key markets, and access new consumer segments as they arise.

4. The Four Major Categories of Alcohol: Growth and Risks

Understanding the industry’s main categories provides insight into potential growth opportunities and the risks of each sub-sector.

The four main categories are spirits, wine, beer, and Beyond Beer.

1. Spirits

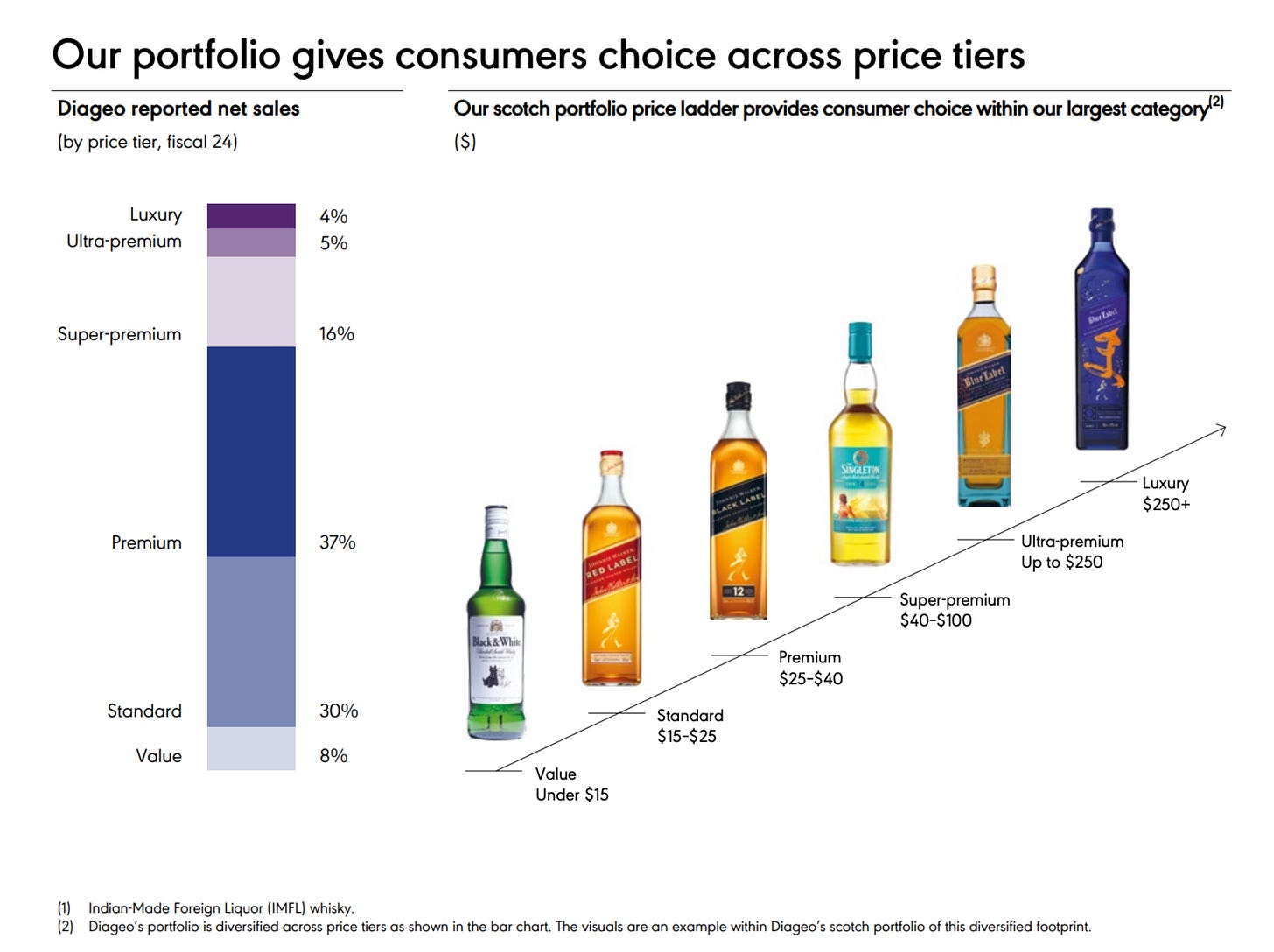

Spirits, including whiskey, vodka, rum, and tequila, represent some of the highest-margin products within the industry. As a category, spirits offer higher profit margins than beer and wine due to strong pricing power and premiumization. Spirit companies have successfully elevated certain brands to luxury status, appealing to a market willing to pay more for high-quality or rare beverages.

Advantages of this category include:

Premium Pricing: Many spirits brands have leveraged “premiumization,” positioning themselves as high-quality products worthy of higher price points.

Less Structural Decline: Compared to beer, spirits face fewer headwinds, as they are not as dependent on large volume sales to sustain profitability.

Flexibility Across Categories: Spirits brands are able to enter new subcategories like ready-to-drink cocktails, enabling them to tap into the growth seen in the Beyond Beer category.

2. Wine

Wine’s appeal has traditionally been strong, but it has struggled to adapt to changing consumer preferences, especially among younger generations. Although wine brands may benefit from dedicated consumer bases, they lack scalability due to their often “niche status” and the complex requirements for growing grapes and regional limitations.

3. Beer

Beer has faced significant challenges, with consumption declining in many markets. While craft beer temporarily reinvigorated the category, volumes are largely stagnant or in decline. Beer companies like Anheuser-Busch and Molson Coors have attempted to offset this by expanding into the Beyond Beer category, but their core products remain under pressure.

Challenges of this category:

Declining Volumes: Beer’s long-term decline in demand has been partially offset by price increases, but volumes are not growing.

Single Product Focus: Unlike spirits, which can be used in various formats, beer generally serves one purpose, limiting its adaptability.

4. Beyond Beer

The "Beyond Beer" category has emerged in response to consumer interest in variety and healthier alternatives, especially among younger demographics who favor lighter, often more refreshing drinks, leading to innovations like low-calorie or gluten-free options.

Hard Seltzers: Carbonated water with alcohol and flavorings.

Flavored Malt Beverages: Drinks like hard lemonade or hard iced tea.

Ready-to-Drink Cocktails (RTDs): Pre-mixed cocktails available in cans or bottles.

Cider and Perry: Fermented apple (cider) or pear (perry) beverages.

Hard Kombucha: Fermented tea with alcohol content.

Mead: An alcoholic drink made from fermented honey.

Alcoholic Ginger Beer and Root Beer

For example, Boston Beer’s Twisted Tea has become a significant growth driver for the company, making up a substantial portion of the company’s revenue.

(Source: Brauwelt.com)

Growth Prospects in Beyond Beer:

Consumer-Driven Growth: Beyond Beer is seeing growth rates well above the industry average, attracting both major companies and new entrants.

Innovation-Friendly: This category allows for innovation, with new products and flavors emerging regularly, such as Boston Beer’s hard cider and hard seltzer lines.

5. Why the Alcohol Industry is Resilient and Attractive to Value Investors

Let’s start with a fun fact that might surprise you:

One of the best-performing stocks of all time has returned a mind-boggling 265 million percent over a 98-year period. Yes, you read that right. An initial investment of just $1 in 1925 would have grown to $2.65 million by today. That equates to an annual compounded return of 16.8% over nearly a century.

Curious which stock we’re talking about? Here’s a hint: it’s in an industry that has some surprising similarities to the alcoholic beverages sector.

Any guesses?

…

The stock is Altria, formerly Philip Morris—a major player in the tobacco industry.

What’s so special about these "sin stocks" that enables them to generate steady and substantial returns over the long term?

I’d argue that both tobacco and alcohol have unique qualities that not only make them resilient but also appealing to investors. Below are some of the key traits that make the alcohol industry a compelling sector for long-term, value-focused investments.

5.1. Strong Brand Recognition and Loyalty

One of the defining strengths of both the tobacco and alcohol industries is their robust brand recognition and consumer loyalty. Many consumers of tobacco products and alcoholic drinks remain fiercely loyal to their preferred brands. This effect is probably even stronger in the tobacco industry.

Once a consumer finds a brand they like, they often stick with it for years, or even decades, fostering consistent demand and providing companies with stable revenue streams.

(Some of Pernod Ricard’s 240 brands)

Developing this level of loyalty requires both time and consistency. Consider the heritage brands in Diageo’s portfolio, which took generations to build and are now widely associated with quality and tradition:

Guinness: First brewed in 1759, this iconic stout has grown from a small brewery in Ireland to an internationally recognized brand synonymous with authenticity and craftsmanship.

Johnnie Walker: Founded in 1820, Johnnie Walker remains one of the world’s most recognizable Scotch whiskies, conveying both prestige and trust.

Smirnoff: Launched in 1898, Smirnoff has become a staple vodka for many consumers, blending quality with approachability.

Baileys: Introduced in 1971, Baileys rapidly gained popularity and has maintained its status as the leading Irish cream liqueur.

This longevity in branding strengthens a company’s competitive position and builds a reputation that resonates across generations. As with tobacco brands like Marlboro, which has been trusted for generations, alcohol brands convey a sense of heritage and reliability that is difficult for new entrants to replicate.

5.2. Inelastic Demand: Resilience in Economic Downturns

Another key similarity between the alcohol and tobacco industries is the inelastic demand for their products. Despite fluctuations in the economy, people continue to purchase alcoholic beverages and tobacco products due to a mix of habitual, addictive, and social drivers.

Whether for celebration, relaxation, or socializing, alcohol consumption is woven into various facets of daily life, making it a stable source of revenue even during recessions.

The addictive nature of tobacco and the social importance of alcohol further bolster their demand resilience. Unlike many discretionary products, alcohol and tobacco do not see significant drops in consumption during economic downturns. In fact, some studies indicate that alcohol sales may even increase slightly during recessions, as people turn to affordable “comforts” when faced with economic stress.

This steady demand provides alcohol companies with a relatively stable revenue base, insulating them from the extreme cyclicality faced by other industries.

5.3. Pricing Power and Profitability

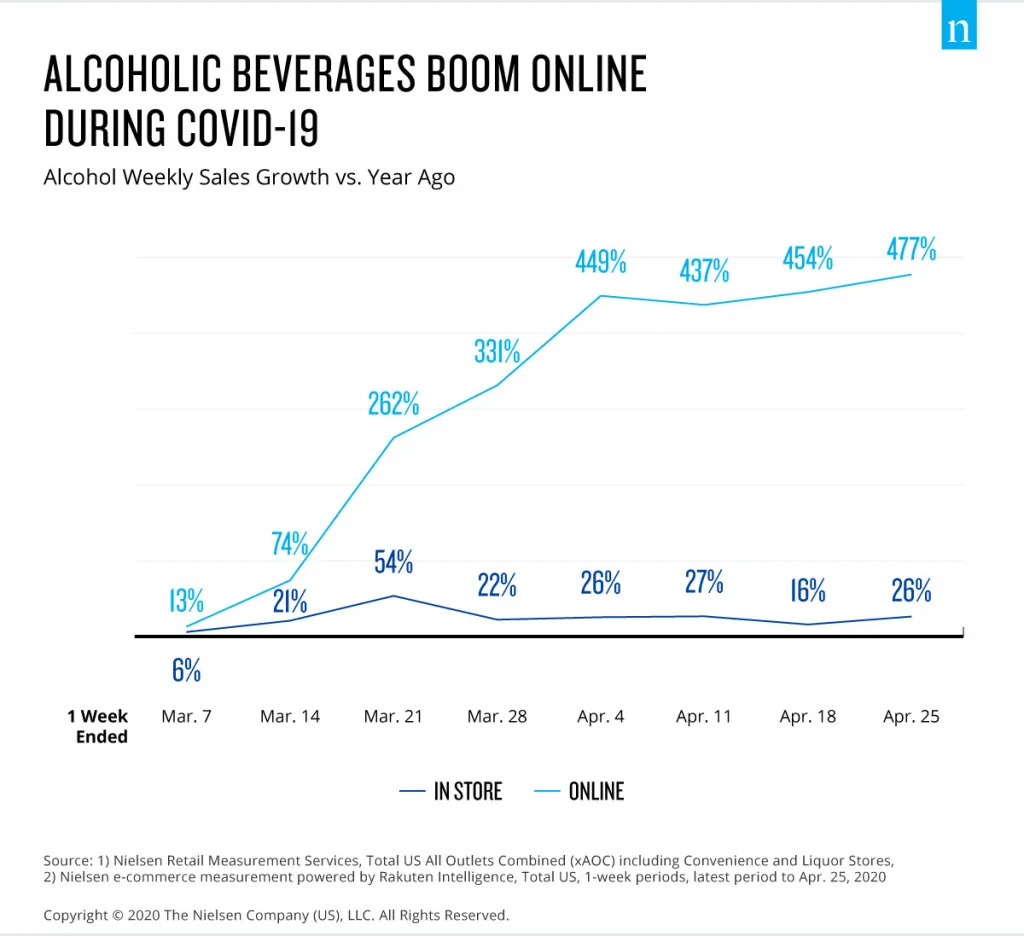

Due to their addictive qualities and cultural importance, both tobacco and alcohol companies benefit from substantial pricing power. Consumers of these products are generally willing to absorb gradual price increases, allowing companies to enhance profit margins and sustain healthy cash flows.

(Source: Statista)

For spirits in particular, the trend of premiumization—where brands offer high-quality, often limited-edition products at premium prices—further amplifies this effect. Consumers often perceive these premium brands as a symbol of quality or status, which enables companies to maintain higher price points.

Diageo’s Johnnie Walker Blue Label is an excellent example of a premium product with pricing power.

Positioned as a luxury Scotch, it commands a significantly higher price point than standard options, contributing to Diageo’s robust margin profile.

Even in more mainstream products, slight annual price adjustments generally don’t deter consumers from purchasing their preferred brands.

However, while this pricing power is a core advantage, it’s worth noting that alcohol companies still face certain cost pressures. Rising marketing expenses and CapEx related to production and distribution can (temporarily) squeeze margins, particularly for companies seeking to expand into new markets or product lines. Nonetheless, the inherent pricing power of alcohol brands often offsets these costs, allowing companies to remain profitable.

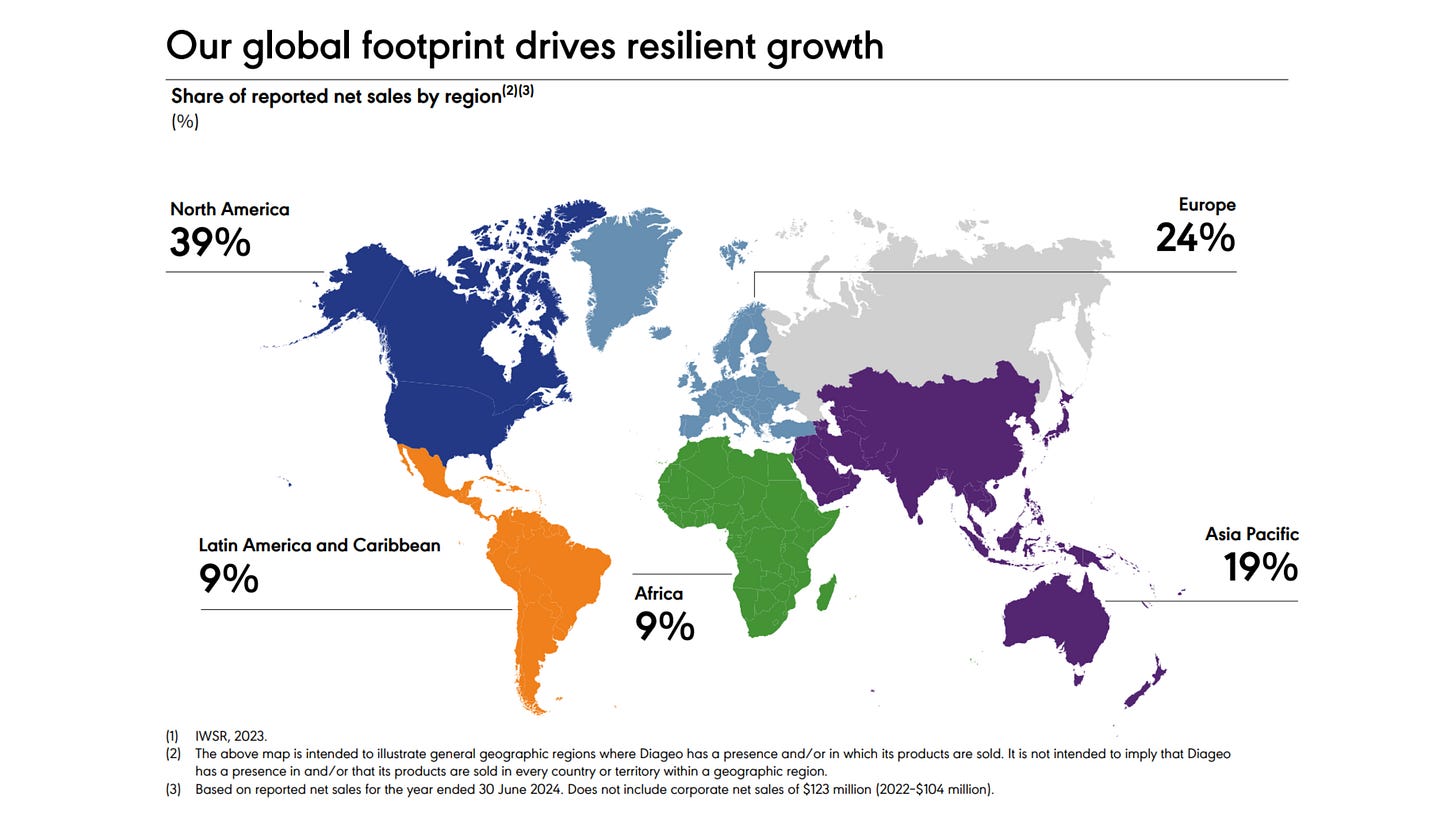

5.4. Global Reach and Emerging Market Growth

Both tobacco and alcohol companies have expanded their presence worldwide, benefiting from access to diverse and often rapidly growing markets. In emerging economies, increasing disposable income and evolving consumer preferences have created new opportunities for these companies to expand. As consumers in countries like China, India, and Brazil become wealthier, they often adopt more premium lifestyles, including the purchase of international alcohol brands.

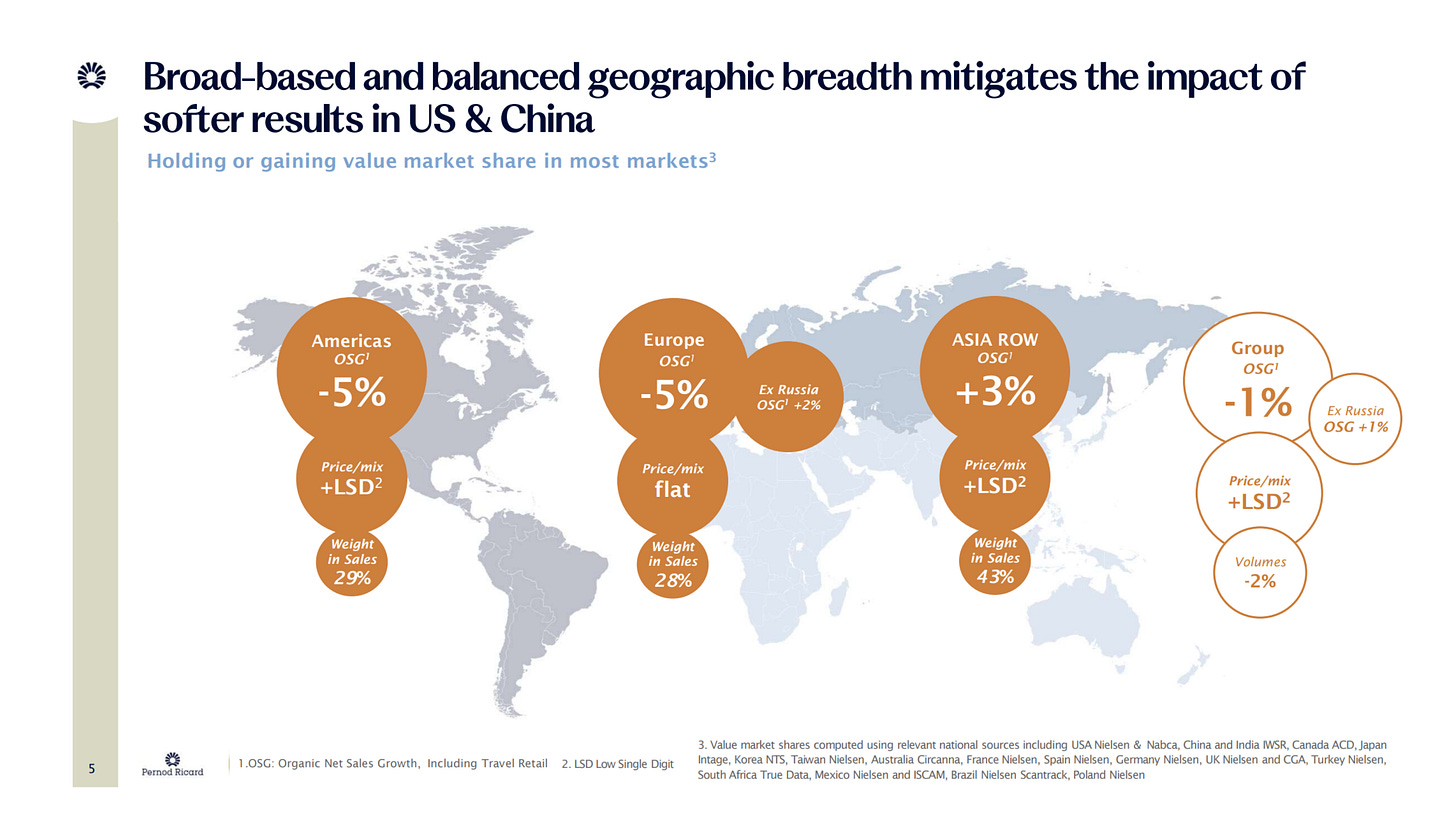

(Source: Pernod Ricard)

Diageo, for example, has strategically expanded its distribution in emerging markets, where it targets consumers eager to trade up to more prestigious international brands. Additionally, as mentioned before, Diageo’s localized approach in certain markets allows it to tailor products to regional tastes, increasing the chances of brand loyalty in new demographics.

Emerging markets remain a key driver of growth for the alcohol industry, offering potentially higher returns due to lower saturation and rising demand for premium brands.

5.5. Regulatory Constraints: Barriers to Entry for New Players

The strict regulations governing both the alcohol and tobacco industries serve as barriers to entry that protect existing players. Regulations vary significantly by country but generally cover advertising, distribution, and sales.

For instance, alcohol sales are often limited to specific channels and require licenses, which restricts market access and can be prohibitively expensive for new entrants.

The requirement for licenses and the restrictions on where and how alcohol can be marketed and distributed reduce competitive pressures from smaller players. In many countries, advertisements for alcohol and tobacco products are restricted, creating additional obstacles for new companies trying to establish brand recognition.

For Diageo and other established players, these regulations provide a built-in advantage by safeguarding market share and preventing an influx of competitors.

While regulations limit how these products are marketed and sold, they also confer a “moat” that helps to protect incumbents. Despite occasionally adding operational costs, these regulatory barriers help stabilize the market dynamics and maintain a concentrated competitive landscape.

5.6. Market Consolidation and Scale Advantages

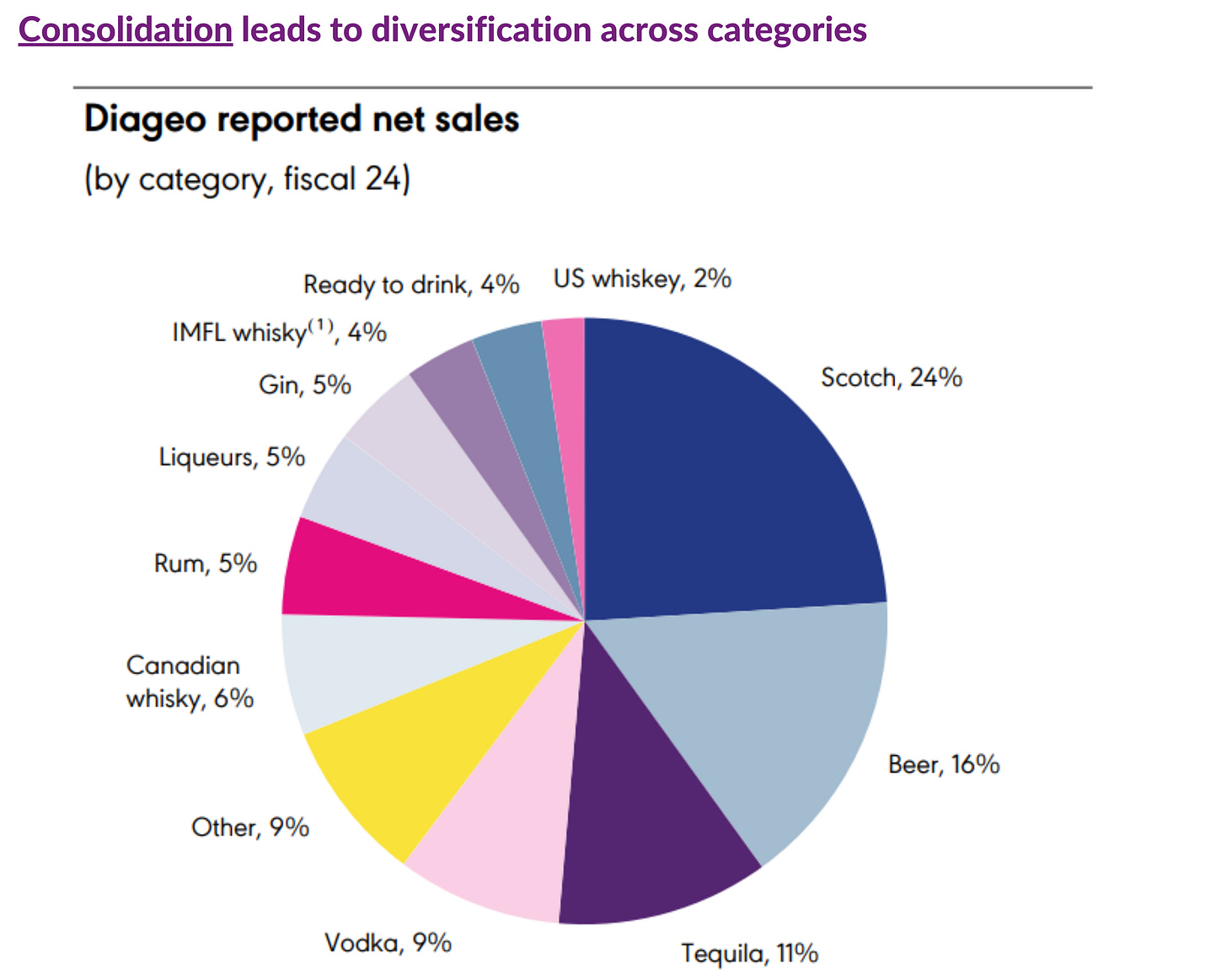

Over time, both the tobacco and alcohol industries have experienced significant consolidation, with a few large players now dominating global markets. This consolidation trend benefits large companies like Diageo, Pernod Ricard, and Anheuser-Busch, which can leverage their scale for operational efficiencies and distribution advantages.

By operating at a large scale, these companies have created diversified portfolios that span various alcoholic categories, enabling them to cater to different consumer preferences.

Consolidation also brings about strategic advantages when it comes to acquisitions. Large alcohol companies, with their established distribution networks, can pay a premium for acquisitions of smaller brands that have demonstrated growth potential. Once acquired, these brands are integrated into the parent company’s distribution channels, allowing them to achieve growth and profitability goals more rapidly than if they remained independent. For example, Diageo’s acquisition of Don Julio, a luxury tequila brand, allowed it to capitalize on the booming demand for premium tequila by leveraging Diageo’s distribution network and marketing prowess.

The result of this consolidation is an oligopoly-like market structure where a few large players dominate, reinforcing barriers to entry and reducing competition. This structure provides added stability for investors—which in turn makes the art of valuing these businesses easier—as these major players can control significant portions of the market and invest in long-term growth strategies with reduced risk.

Why These Traits Are Appealing to Value Investors

The combination of strong brands, inelastic demand, pricing power, global reach, regulatory protection, and market consolidation makes the alcohol industry an attractive sector for value investors. Just as Altria and other tobacco giants have provided consistent returns over the years, large alcohol companies benefit from similar protective factors that make them reliable, often income-generating investments, that are easier to value than companies operating in more dynamic sectors.

While these “sin stocks” may not deliver explosive growth, they offer stability, strong cash flows, and high barriers to entry. For investors focused on long-term, steady returns, the alcohol sector’s resilience and profitability make it worth considering, especially at times when valuations offer attractive entry points.

6. Two More Things to Be Aware Of!

While the alcohol industry offers resilience and profitability, there are some trends investors should closely monitor.

Leading companies in the sector are making strategic moves to focus on “premiumization,” shifting their product portfolios to emphasize high-end brands. Additionally, with the sector currently out of favor, many companies are prioritizing shareholder yield through share buybacks and dividends. Let’s briefly discuss these two trends.

6. 1. Premiumization: Focusing on High-End Brands

A major trend reshaping the alcohol industry is premiumization, where companies shift their focus to high-end products that offer greater profit margins. As consumers increasingly gravitate toward premium brands, especially in spirits, companies are restructuring their portfolios to align with these preferences. This trend is especially visible in acquisitions of premium brands and divestitures of lower-end brands or local labels that don’t fit the luxury profile.

Recent Premiumization Moves

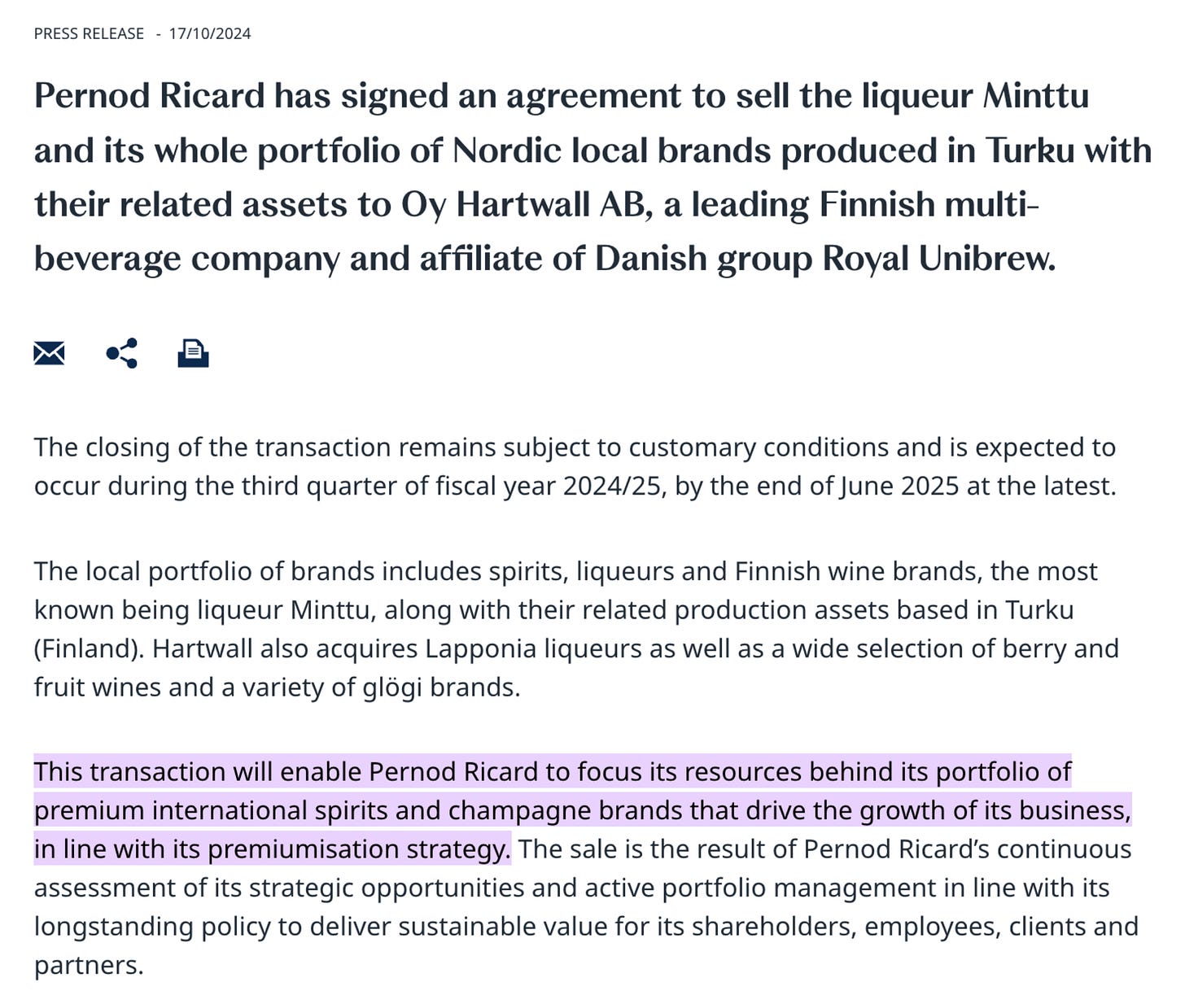

Pernod Ricard is a prime example of this trend. The company recently signed an agreement to divest several Nordic local brands, including the liqueur Minttu, along with related assets in Turku, Finland.

These assets will be sold to Oy Hartwall AB, part of Denmark’s Royal Unibrew. This divestiture allows Pernod Ricard to focus its resources on premium international spirits and champagne brands that are key to its premiumization strategy.

Other industry players are following similar strategies:

Diageo: Over the past decade, Diageo has actively reshaped its portfolio, acquiring high-end brands like Don Julio (tequila) and Casamigos (tequila), co-founded by actor George Clooney. Both acquisitions tapped into the growing consumer interest in premium tequila, particularly in North America. At the same time, Diageo has divested some lower-end brands and less profitable assets, including Seagram’s VO Canadian whisky, Goldschläger cinnamon schnapps, and Myers's Rum. These brands, while historically popular, did not align with Diageo’s premiumization goals.

Ivan Menezes, Chief Executive of Diageo: “Diageo has a clear strategy to deliver consistent efficient growth and value creation for our shareholders. This includes a disciplined approach to allocating resources and capital to ensure we maximise returns over time. Today’s announcement is another example of this strategy in action. The disposal of these brands enables us to have even greater focus on the faster growing premium and above brands in the US spirits portfolio.”

Campari Group: Campari has made several moves to reinforce its portfolio of high-end offerings, including the acquisition of Grand Marnier, a premium French liqueur. The acquisition allowed Campari to diversify into the luxury liqueur category, while continuing to streamline its portfolio by selling off non-core assets. In 2024, Campari also completed the billion-dollar Courvoisier deal.

These examples reflect the industry leaders’ strategic focus on premium products, which typically boast higher margins and align with consumer trends toward quality and exclusivity. As companies continue to divest less-premium brands and acquire luxury names, the industry may see more specialization and higher profit margins over time. However, this focus on premiumization may also introduce risks, as it narrows the market segment and may increase reliance on affluent consumer demand.

6.2. Shareholder Yield: The Power of Buybacks and Dividends

As the alcohol sector remains out of favor, some investors may worry that market sentiment could remain low for an extended period.

However, even when the market fails to re-rate alcohol stocks, companies in this sector can generate great returns for shareholders through disciplined capital allocation. Companies like Altria in the tobacco sector have demonstrated how shareholder yield can drive long-term returns, even when the underlying industry faces challenges. In the alcohol sector, companies with savvy management teams that optimize capital allocation by repurchasing undervalued shares can provide attractive returns.

As hinted at above, the best example of high shareholder yield can be seen with Altria in the tobacco industry. Altria has consistently returned significant capital to shareholders through dividends and share buybacks.

In the alcohol sector, companies can similarly reward shareholders through buybacks, especially if valuations are low. Here’s why buybacks at low valuations are powerful:

Share Count Reduction: When shares are repurchased at low prices, the company reduces its share count at a discount, amplifying each remaining shareholder’s stake.

Higher Per-Share Earnings: With fewer shares outstanding, earnings per share (EPS) increase, which can make the stock more attractive over time.

Compounding Effect: If companies maintain buybacks over an extended period, this can compound shareholder value, similar to reinvesting dividends.

7. Risks and Challenges Facing the Alcohol Sector

While the alcohol industry is a compelling place to go hunting for value investors due to its resilience, brand loyalty, and pricing power, there are several emerging risks that could impact its long-term growth and profitability.

Here are four key risks investors should consider:

1. Secular Headwinds: Declining Alcohol Consumption

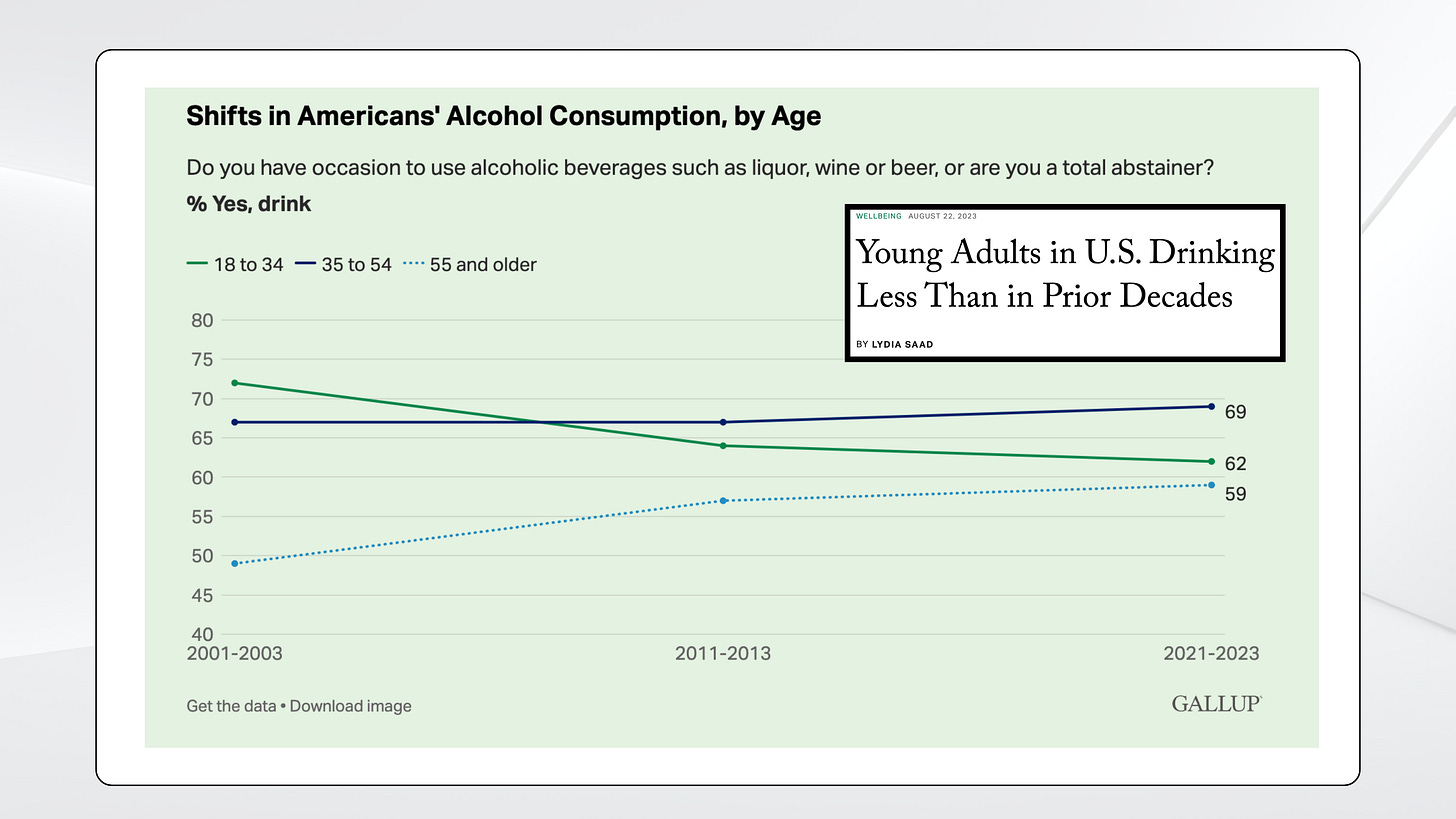

One of the most prominent risks facing the alcohol industry is the steady decline in alcohol consumption, particularly in Western countries and among younger generations.

Changing attitudes toward health and wellness are driving younger consumers to either reduce their alcohol intake or avoid it altogether. Gen Z and millennials, in particular, are leading this shift, as seen in recent surveys that indicate a reduced inclination to drink compared to older generations.

A Bloomberg report highlighted this trend, noting that even in wine-loving nations like Italy, younger drinkers are turning away from traditional red wine in favor of lower-alcohol options, or avoiding alcohol entirely.

“[…] great viniculture nations like Italy are having to adapt to the waning popularity of red wine, as younger drinkers opt for trendy craft beers and fizzy whites — or swear off alcohol entirely.”

Many are opting for lighter, trendier choices like craft beers or low-alcohol beverages. In response, major alcohol companies have started to embrace alcohol-free or low-alcohol alternatives. For instance:

Diageo has launched several low-alcohol or alcohol-free products, such as the alcohol-free version of its iconic Guinness stout, Guinness 0.0.

Heineken has expanded its offerings with Heineken 0.0, which has performed well, particularly among health-conscious consumers looking for a “social drink” without the alcohol.

While these offerings can help offset some of the demand loss, they may not fully counterbalance the impact of declining alcohol consumption on the industry’s growth trajectory. For investors, the key question is whether these non-alcoholic alternatives can truly generate comparable margins and long-term brand loyalty.

2. Emerging Markets as a Double-Edged Sword

Emerging markets, such as China, India, and Brazil, are often cited as potential growth engines for the alcohol industry. Rising disposable incomes, urbanization, and changing consumer habits in these regions create new opportunities for global alcohol brands. For instance, as consumers in China and India gain wealth, many are more inclined to purchase international brands that carry a certain level of prestige.

However, there are counterpoints to this growth narrative. Many emerging markets already have established, culturally integrated local alcohol products. In India, for example, local whisky brands dominate the market, with Indiabecoming one of the largest whisky producers in the world.

“In fact, seven of the top 10 global whisky brands across the globe are Indian, says Sangram Sinha, general manager and head of international business at Pernod Ricard India, which owns Seagram’s whiskies.“ - Tracey Furniss (scmp.com)

Consumers in these regions may prefer local brands, which can be more affordable and better suited to local tastes. This trend limits the growth potential for international brands, especially premium products, as local competitors often have stronger brand loyalty and lower production costs.

The evolving economic landscape in emerging markets also presents unique challenges. Currency volatility, shifts in local regulations, and economic fluctuations can impact visibility and profitability. While these markets may hold potential, the path to sustained growth may require localized strategies, partnerships with or acquisitions of regional producers, which come with their own sets of challenges.

3. The Rise of Private Labels and Influencer Brands

Another emerging risk is the growth of private-label and influencer-endorsed alcohol brands, which are quickly capturing market share (check out this list of 63 celebrity liquors and spirits).

Private-label brands produced by large retailers, such as Costco’s Kirkland Signature alcohol line, are gaining popularity among price-sensitive consumers. These private labels often come at a lower price point while maintaining reasonable quality, making them attractive alternatives to traditional brands.

Influencer brands are also shaking up the industry. With the reach of social media, celebrities and influencers can quickly popularize a new brand, often targeting younger audiences who value the trendiness and novelty of these products. A notable example is Casamigos tequila, co-founded by actor George Clooney, which gained rapid success before being acquired by Diageo.(

(do you know the guy on the left? ;-))

While the long-term staying power of some of these influencer brands remains questionable, the trend toward private labels and influencer-backed products poses a challenge to established players. These brands can dilute market share and force legacy companies to increase marketing expenditures to retain relevance with younger consumers.

4. Slowing Growth in a Mature Market

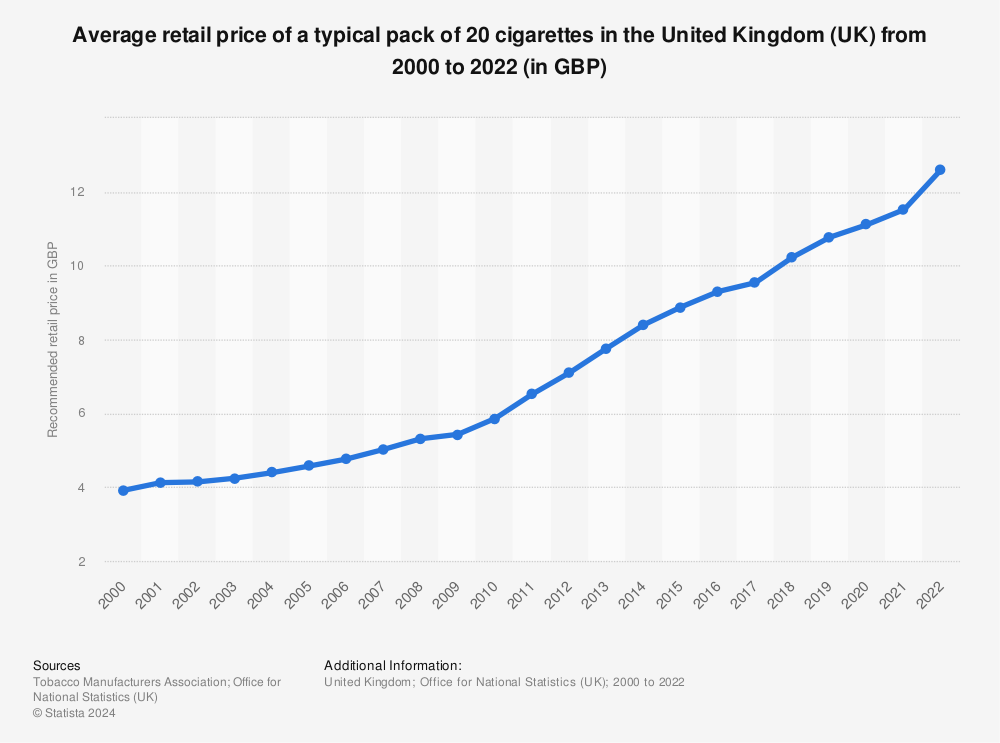

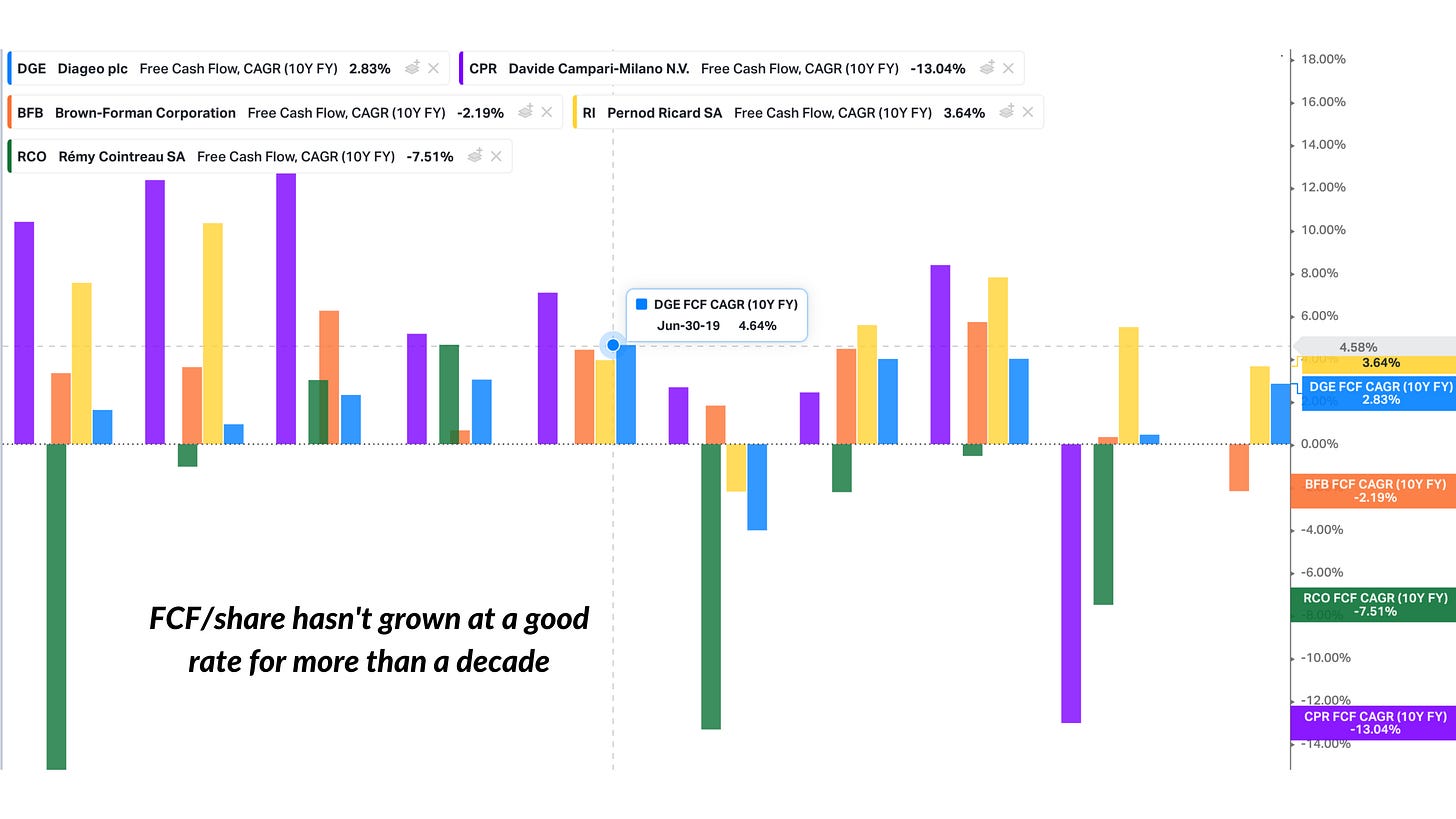

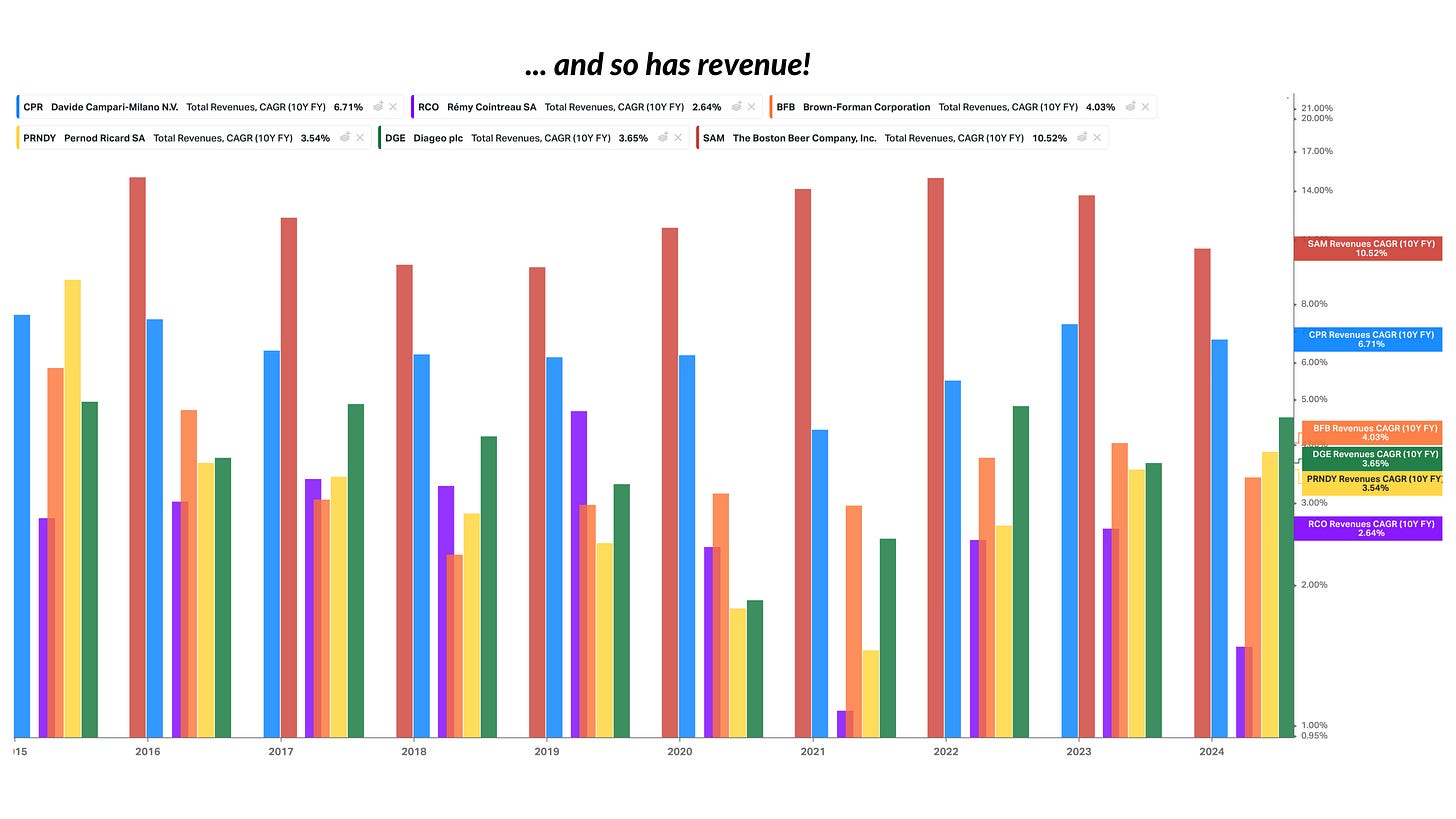

While the alcohol industry has historically demonstrated steady growth, the last ten years indicate that the sector may already have reached maturity.

In Western countries, growth rates for many alcoholic categories, including beer and spirits, have slowed or even stagnated, as seen in the shared charts reflecting compounded FCF and revenue growth over the past decade.

As revenue growth is one of the key long-term drivers of shareholder value creation, this slowing growth could limit the sector’s ability to deliver satisfying long-term capital appreciation, especially for companies that are already trading at relatively high valuations.

For value-focused investors, the question of sustainable growth becomes paramount in assessing whether the sector can continue to deliver returns that justify current valuations.

My Take: Evaluate Companies on an Individual Basis! (or: Micro Beats Macro!)

Given the risks outlined above, it’s essential to evaluate alcohol companies on an individual basis rather than approaching the sector as a monolithic entity.

Not all companies are equally positioned to navigate these challenges. Some, like Diageo and Pernod Ricard, have been proactive in expanding their portfolios with premium products and alcohol-free options, others like Boston Beer may benefit from the shift to the Beyond Beer category, while still others may struggle to adapt to shifting consumer preferences and competitive dynamics.

Moreover, not all alcohol stocks are equally priced which can also lead to opportunities if the sector as a whole gets punished by the market.

8. Final Thoughts: Is the Alcohol Sector a Worthwhile Investment?

The alcoholic beverages sector offers a compelling mix of stability, strong cash flow, and brand loyalty. However, investors must consider the current valuation multiples, which remain elevated despite slow growth.

For those who prioritize dividends and low-risk returns, alcohol stocks may offer a "bond-like" investment. However, for growth-focused investors, the sector may lack the high compounding potential seen in more dynamic industries.

So in conclusion, for intelligent value investors, the alcohol sector could be attractive, but only at the right price. When valuations are low, the sector’s resilient cash flows and predictable revenue streams can offer a margin of safety. In particular, companies with strong balance sheets, growth in Beyond Beer, and effective capital allocation strategies may offer potential upside. However, patience is key—until these stocks reach more attractive valuation levels, they may not represent compelling buys.