Getting Started the Right Way: 5 Timeless Lessons from a 10-Year-Old Ian Cassel Blog Post

Investing in stocks is one of the best ways to build wealth, but getting started the right way is crucial.

In this post, I’ll share some timeless investing principles and lessons from Ian Cassel, founder of the MicroCap Club, inspired by his 10-year-old blog post, Getting Started.

Some insights expressed in that blog post remain just as relevant today, offering guidance for those beginning their investment journey today! I’ll of course also share my take on some of Ian’s points to help you start off strong.

Lesson #1: Dream Big and Overcome Fear!

Ian begins his post with a powerful statement:

I believe God has created us with the ability to achieve our dreams. It is up to us to dream big. Everyone is born with a spirit of courage but as we age slowly develops into a spirit of fear. The quickest path to a mediocre life is to give in to your fear of failure.

He highlights how many people start life with a spirit of courage, but over time, this courage turns into fear—fear of failure, of taking risks, or of stepping out of their comfort zone.

As investors, it’s vital to dream big, but more importantly, we must surround ourselves with the right people—those who push us forward, not hold us back.

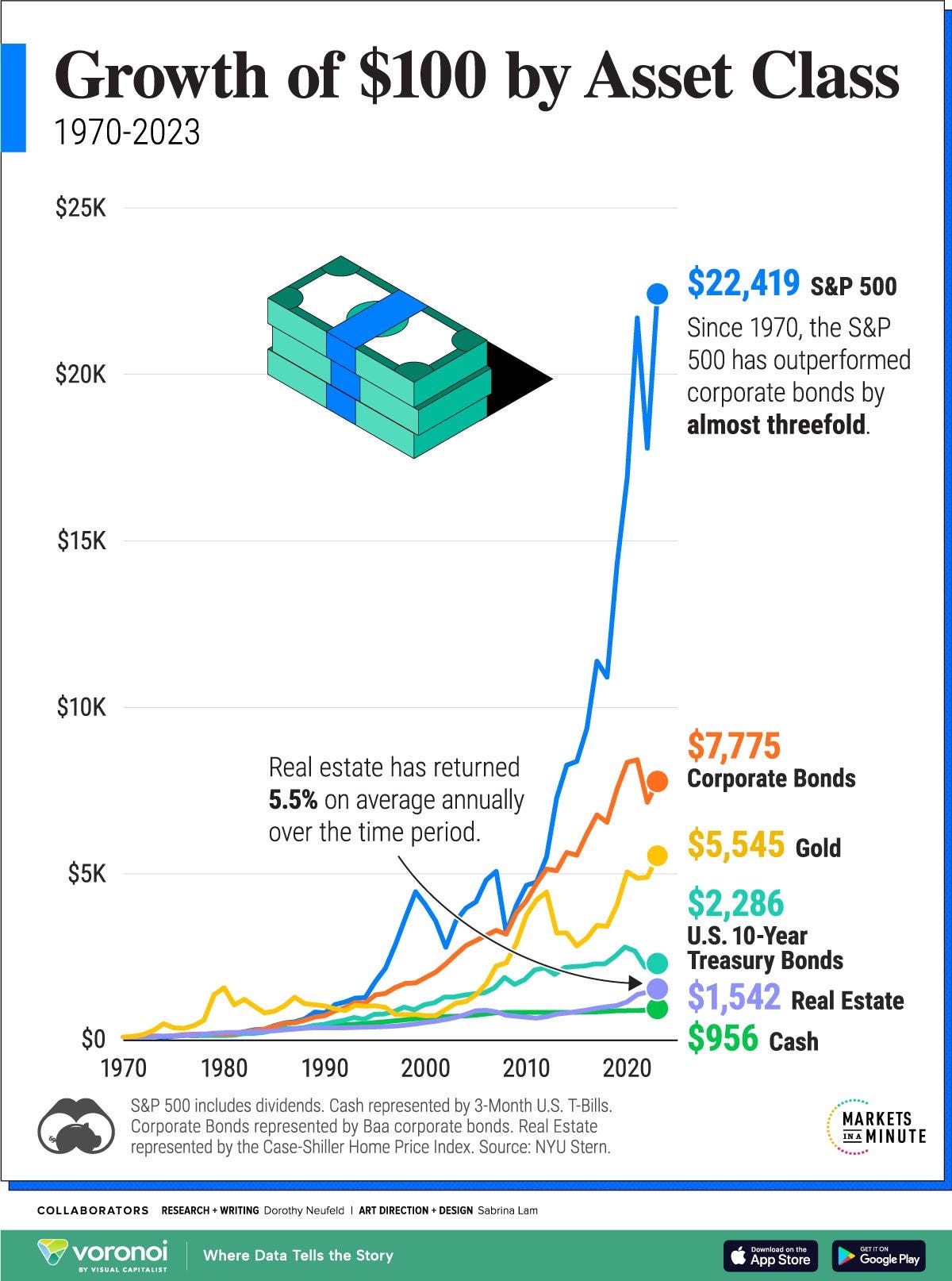

Whether your dream is to build financial freedom, travel the world, or give back to your community, investing is a proven way to help you achieve your goals. Investing in stocks in particular has consistently been one of the top-performing asset classes, offering long-term growth and wealth-building potential.

(Source: Visual Capitalist)

And of course, investing in high-quality stocks has been a particularly successful investment strategy.

Lesson #2: Immerse Yourself in the World of Investing

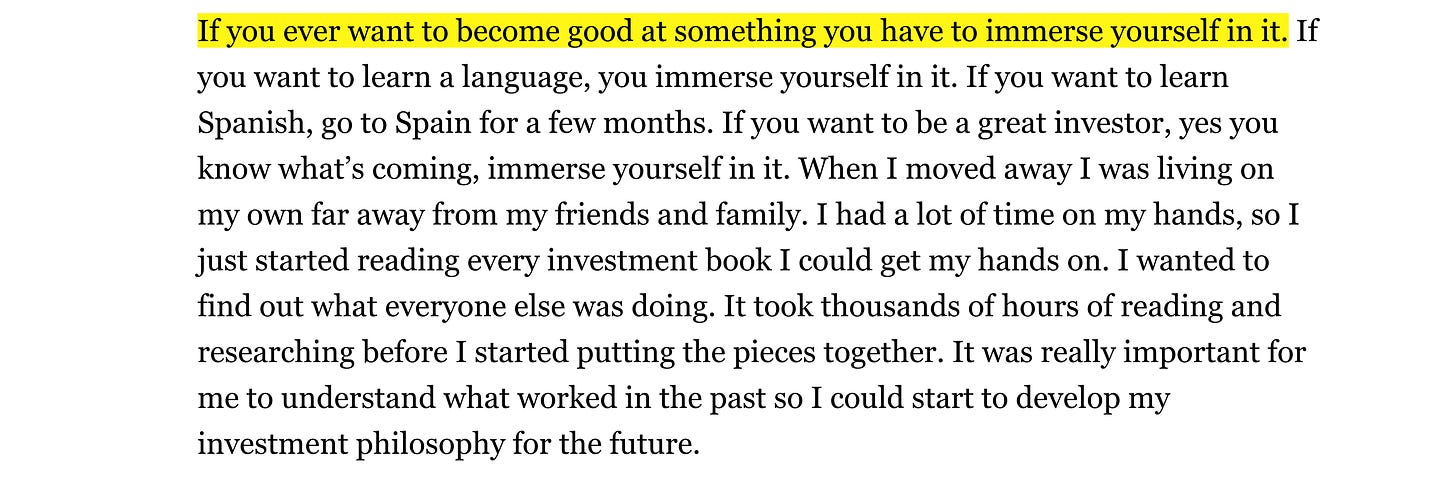

One of Ian’s most important lessons is that to become good at something, you have to immerse yourself in it.

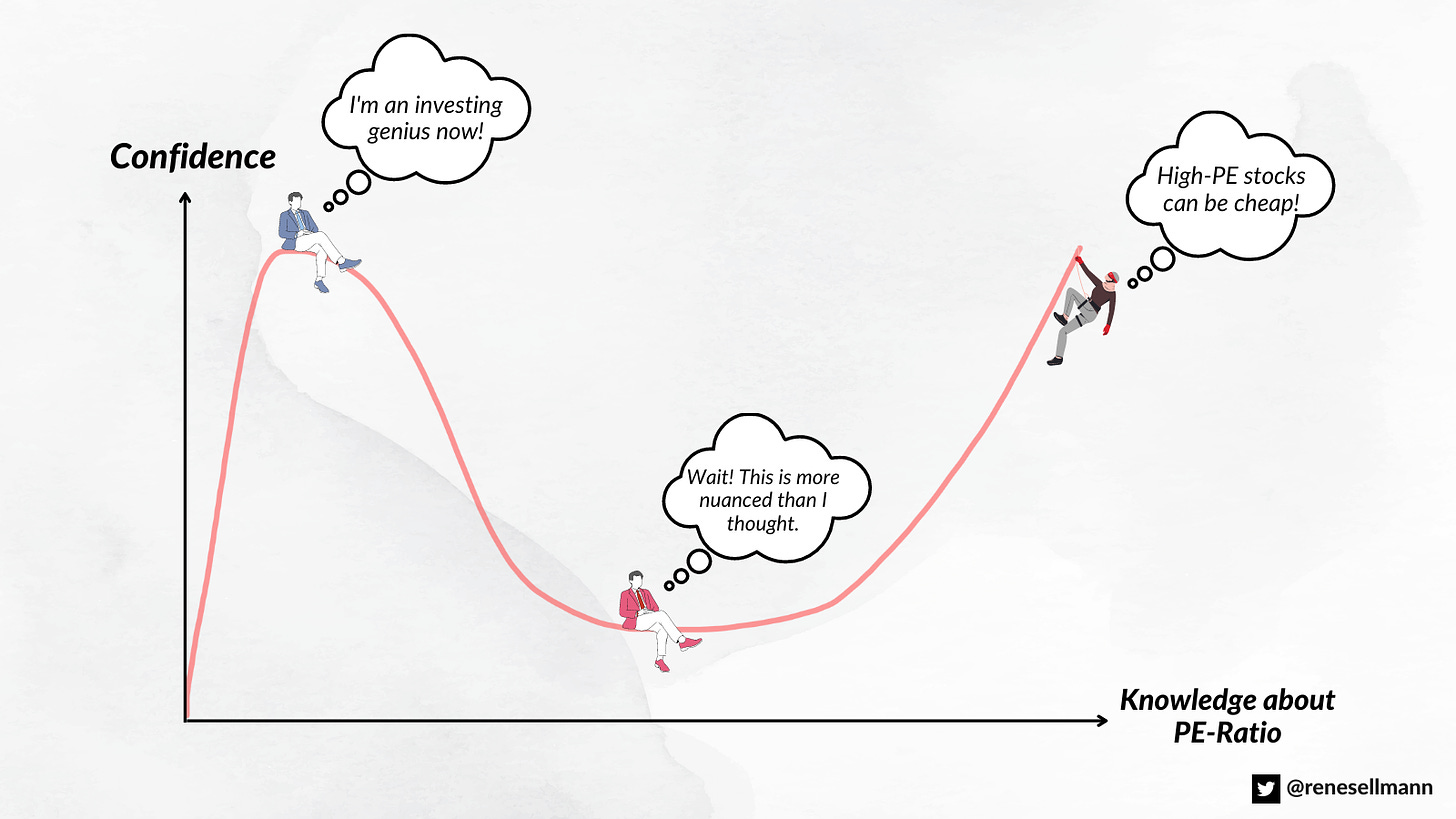

This is particularly true when it comes to investing. Many beginners believe that after reading a few books or following financial influencers, they’ve mastered the discipline. But nothing could be further from the truth.

Early on, you may feel overconfident in your investing skills—a phenomenon known as the Dunning-Kruger effect.

However, as you progress, you’ll likely realize how little you knew in the beginning.

That’s why it's essential to take the time to truly learn the fundamentals. Spend the first few years of your journey building a solid investment framework grounded in proven, timeless principles.

This approach will ensure you can compound your wealth steadily over the long term, instead of experiencing boom and bust cycles from poor decision-making.

"Striving for sustained, uninterrupted compounding over long periods of time is smart investing, and that’s precisely our goal. Many people think of us as a ‘value investor’ and others ask whether we are a value or a growth investor. We’ve started to say, we’re neither, we are a compounding investor." Chuck Akre

Lesson #3: The First $100,000 is the Hardest

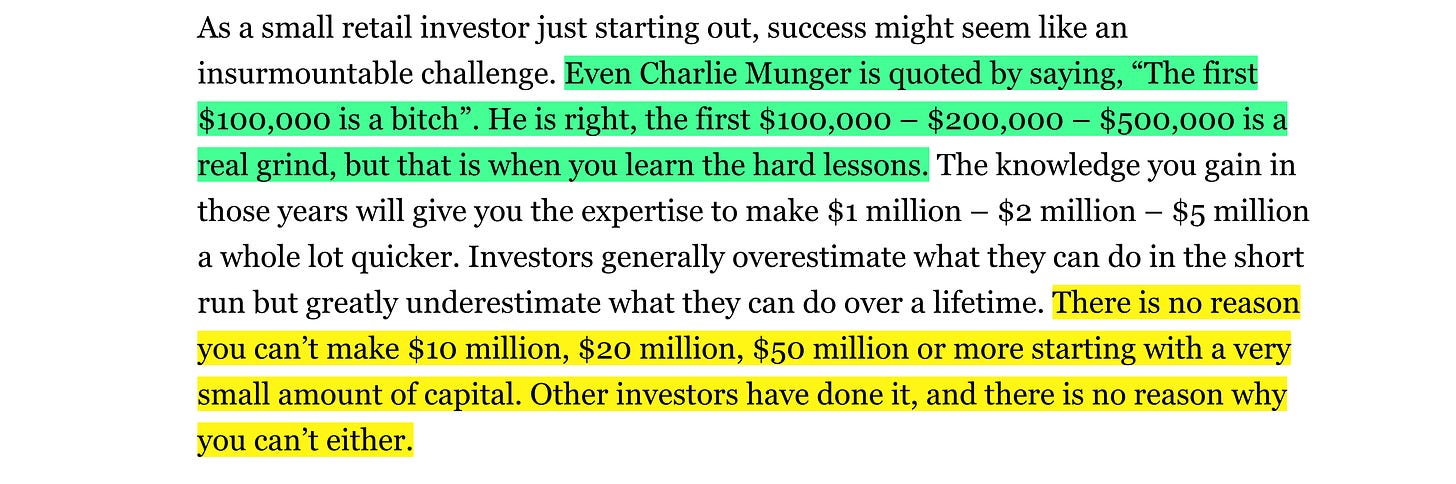

Even Charlie Munger is quoted saying, “The first $100,000 is a b****.” Ian emphasizes that those early years are when you learn the hardest lessons, and while progress may feel slow at first, it’s vital to push through.

For example, if you’re starting with $30,000, a 10% return may only yield $3,000—hardly life-changing. But over time, as your capital grows, the absolute dollar gains will become more and more significant and will at some point—if you keep at it— surpass your annual income from your job (certainly during some years).

Consistency and perseverance are key. As your investments compound over 20 or 30 years, there’s no reason you can’t build substantial wealth. As highlighted in yellow above, Ian reminds us that others have turned small amounts of capital into millions, and there’s no reason you can’t do the same—if you start early and stick with it.

Lesson #4: Stop Making Excuses and Get Started

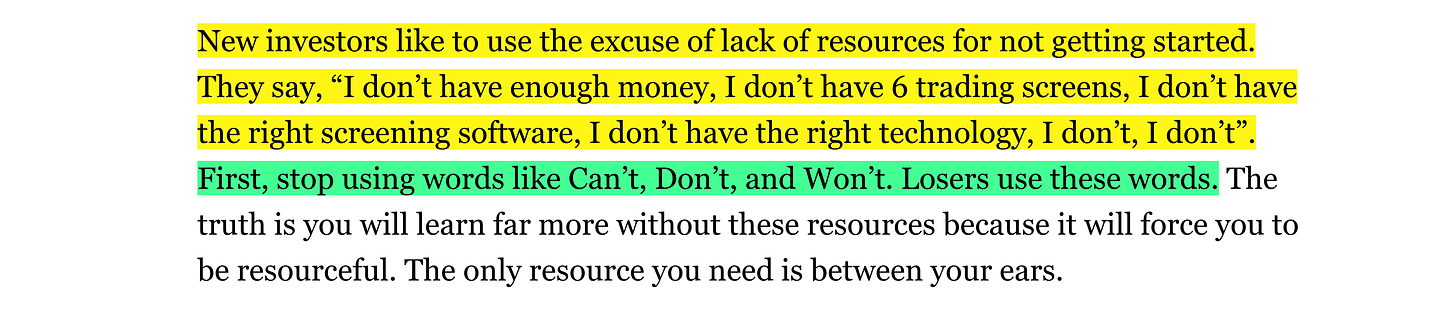

Many new investors use excuses like "I don’t have enough money," “I don’t have the time“ or "I don’t have the right tools" to delay getting started. Ian’s message is clear: stop using words like "can’t" and "won’t."

Lack of capital, time, or resources is just that—an excuse.

The key is to get started, no matter how small your initial investment. The power of compounding means that even modest amounts can grow into significant sums over time.

Lesson #5: The Value of Mentorship

A recurring theme in Ian’s blog post is the importance of mentors. As he quotes Mike Murdoch, “There are two ways to receive wisdom: mistakes and mentors.”

While making mistakes can teach valuable lessons, a mentor can accelerate your learning and help you avoid costly errors early on.

Mentors have already walked the path you’re on, and they can provide critical advice, even if it’s sometimes harsh. In my mentorship program, for instance, I push my mentees to immerse themselves in the world of investing and put in the necessary work upfront. Early on, the absolute returns may seem small, but the knowledge and foundation you build will pay dividends over the long run.

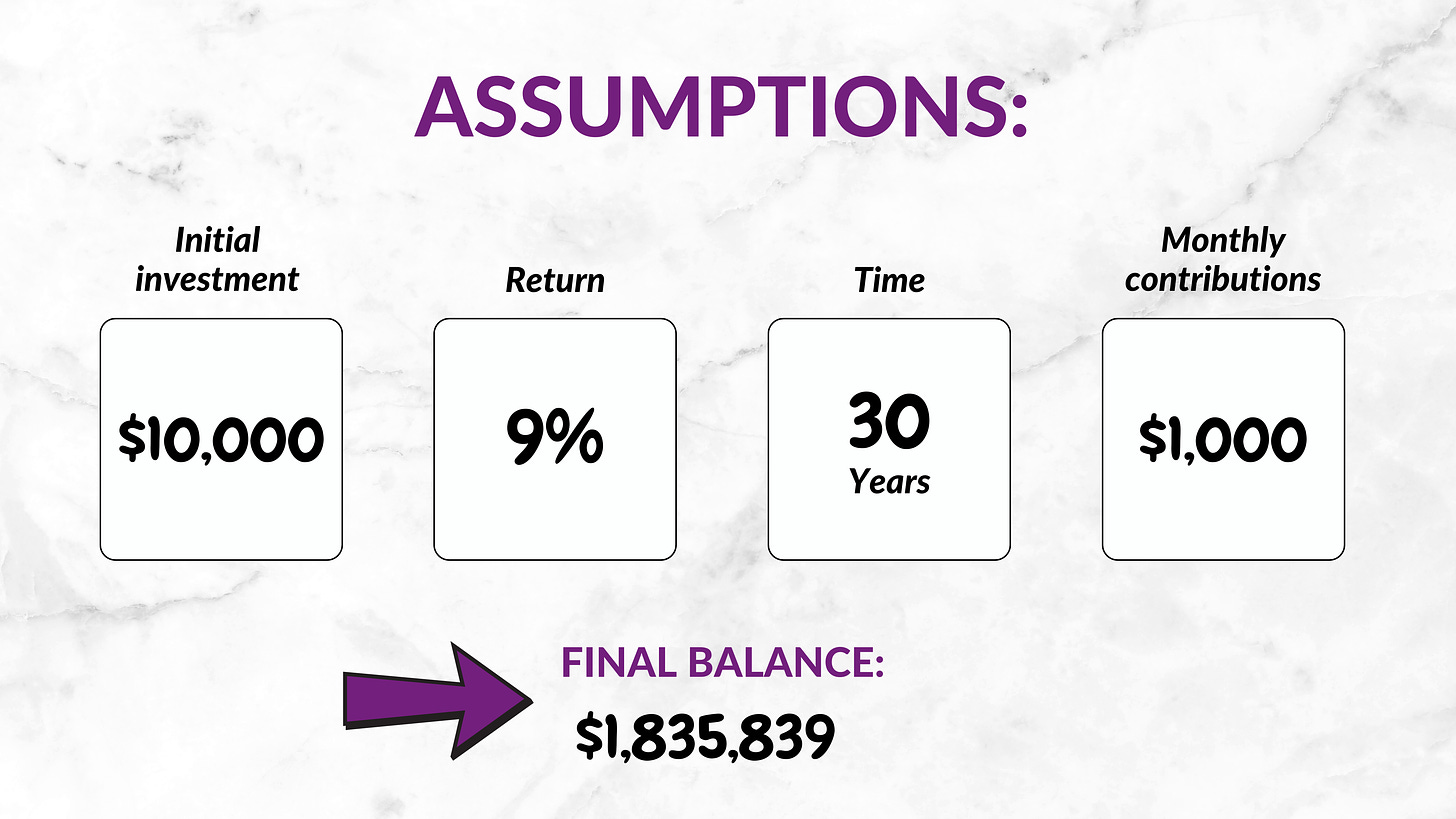

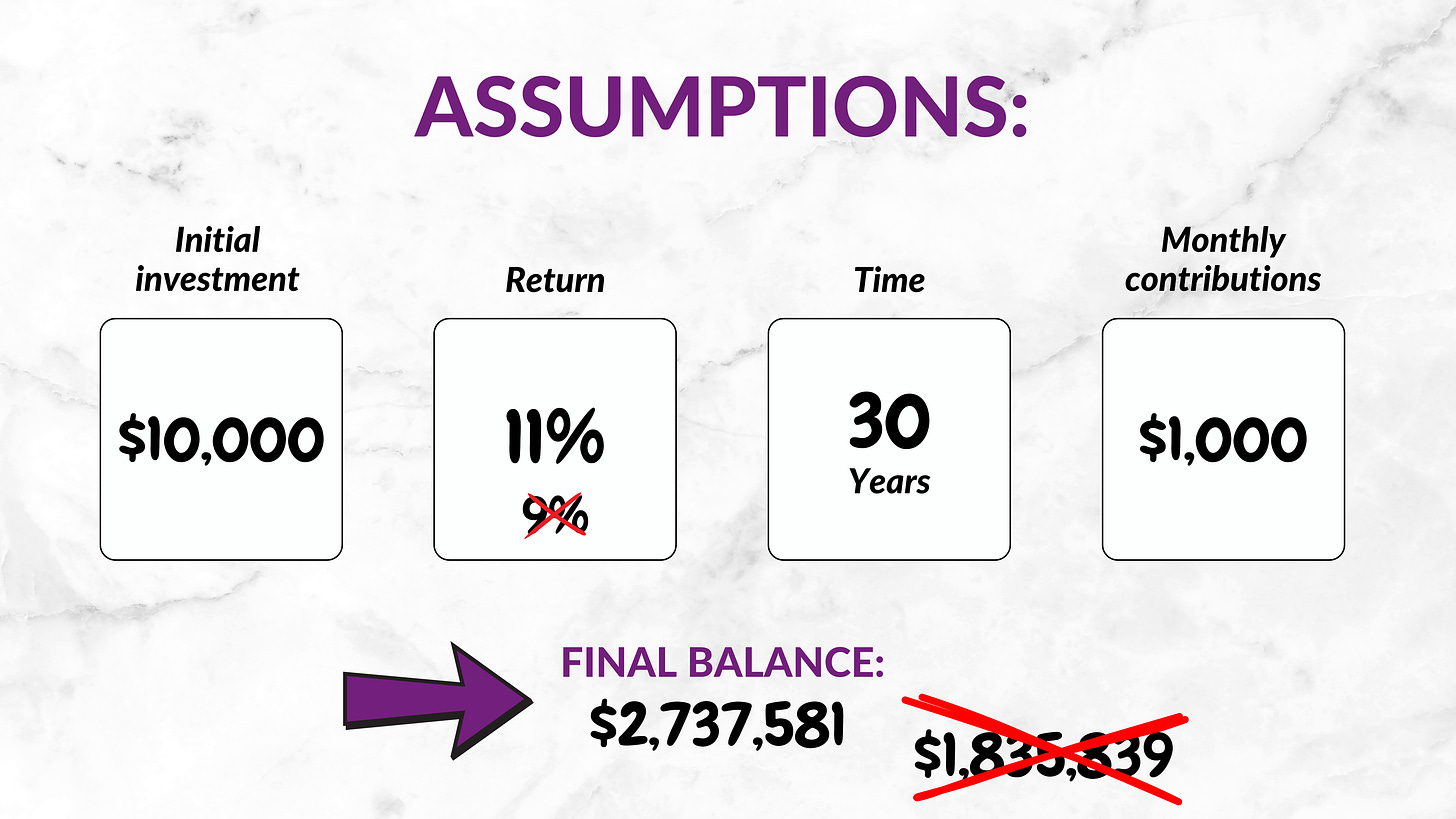

Let’s look at an example. Suppose you start with $10,000, earn a 9% annual return, and contribute $1,000 monthly over 30 years. After three decades, you’d accumulate around $1.8 million.

Now, if you could improve your return with the help of a mentor just slightly—say to 9.5%—you’d end up with $2 million. Improve your CAGR to 11% and the difference becomes pretty mind-blowing:

This small difference shows the power of improving your knowledge and skills as an investor.

Whether it's improving your skills, learning from mentors, or continuously refining your investment process, the returns on this type of investment can be life-changing.

Take the time to develop a robust investment philosophy and framework. By doing so, you not only increase your potential returns, but you also set yourself up for long-term success. Remember, the goal is to compound your wealth over decades, and that requires patience, discipline, and a commitment to continuous improvement.

Both Ian Cassel and Warren Buffett emphasize this as well and argue that one of the best investments you can make is in yourself.

I recently shared the following tweet on the idea that you should consider your “skills” as an asset class:

Conclusion

The journey to becoming a successful investor starts with small steps. Dream big, immerse yourself in the discipline, stop making excuses, and get started as soon as you can. Remember, the first $100,000 is the hardest, but by building a strong knowledge foundation, finding mentors, and investing in your own education, you can turn small sums into substantial wealth over time.