Deep Dive into Yeti Holdings, Inc.: Analyzing the Opportunity in this Underfollowed Stock

In a recent edition of the Ticker Talk format on my YouTube channel, I sat down with Andrew, a fellow investor, to discuss a stock that he owns: Yeti Holdings, Inc. YETI 0.00%↑.

Yeti, a premium lifestyle brand specializing in outdoor and leisure products, has made a name for itself through its high-quality offerings and aspirational appeal. While its products are expensive, they resonate deeply with their core audience, a factor that has played a significant role in the brand’s rise.

Our conversation covered everything from the company’s business model and growth prospects to the risks and valuation, providing a comprehensive look at Yeti as an investment idea. If you’re an investor or simply curious about how a consumer brand can turn niche products into big business, read on.

(Andrew’s Yeti collection – does not include all of the Christmas gifts he bought for friends and family this year)

Understanding Yeti’s Business Model

Founded in 2006 by Roy and Ryan Seiders, Yeti Holdings initially focused on high-performance coolers designed for outdoor enthusiasts.

(Learn a little more about Yeti’s history here)

Over time, the company diversified into other categories, such as drinkware, backpacks, and barware, solidifying its position as a go-to brand for high-quality, durable outdoor gear.

“When Yeti was founded in 2006, many people scoffed at the idea of a $300 cooler. Sure, the company was promising a product that could last a lifetime, but you could snag an ice bucket from Coleman for a fraction of the price. That gripe didn’t last: in the first nine months of 2023, Yeti made over $1 billion in sales.“ – Alex Lauer

Personally, I only associate Yeti only with their tumblers. But their portfolio consists of much more than I’d imagined. Hence, to develop a better understanding of the company, I’d encourage you to head to Yeti’s website and check out their product range.

Andrew described Yeti as a company that thrives on its ability to combine functionality with status:

“Yeti isn’t just a product—it’s an experience. Owning a Yeti product signals quality and durability, but it also taps into a sense of identity for its customers.”

Yeti’s customers, predominantly middle- to upper-middle-class individuals, appreciate products that are built to last.

Whether it’s a $300 cooler for a camping trip or a $40 tumbler for coffee on the go, Yeti’s offerings cater to people who are serious about their hobbies and willing to pay a premium for reliability and branding.

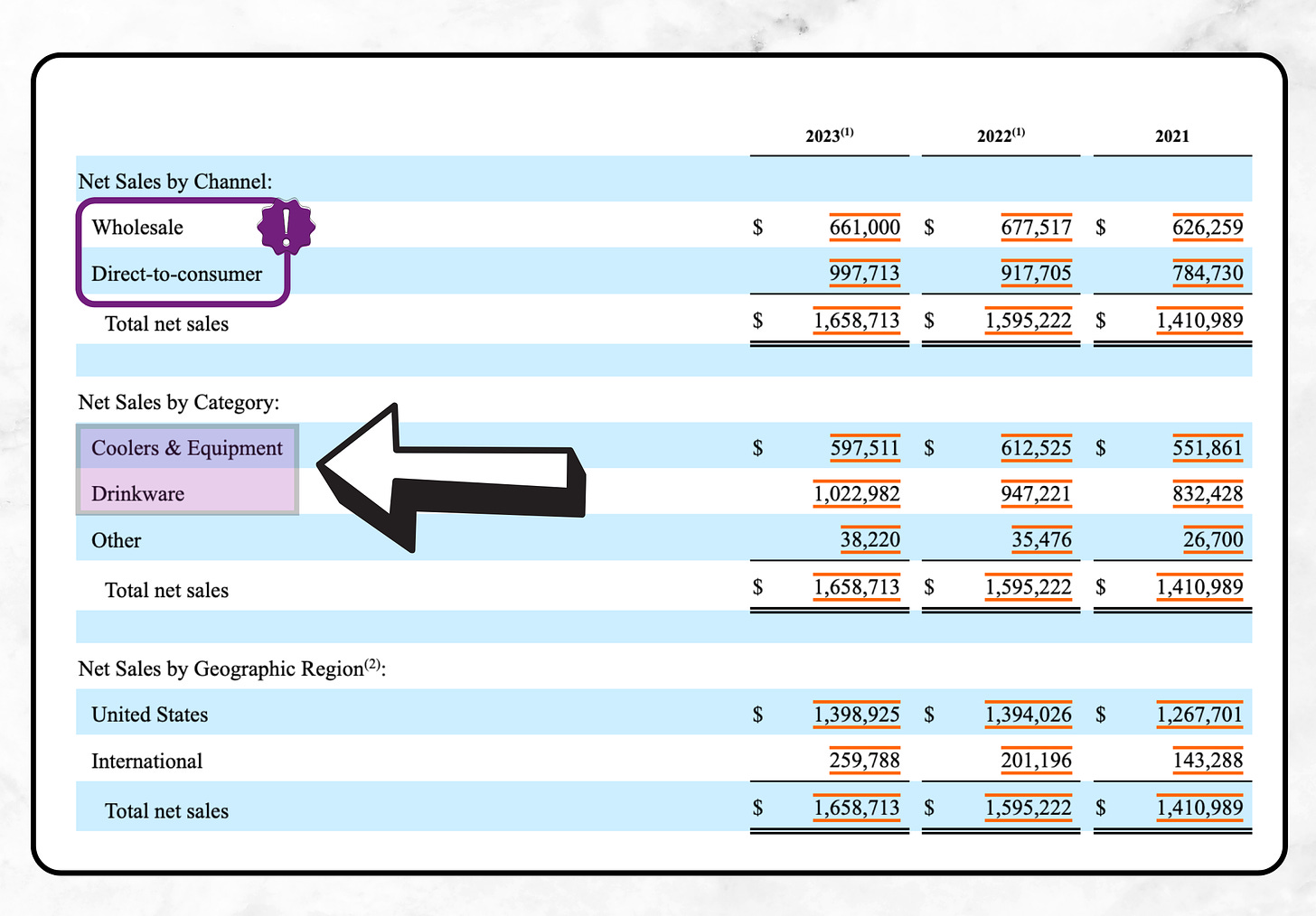

Another defining aspect of Yeti’s business is its direct-to-consumer (DTC) strategy, which now accounts for more than half of the company’s total revenue. By selling through its own website and retail stores, Yeti can maintain tight control over its brand image and enjoy higher margins compared to wholesale channels.

The Appeal of Yeti’s Products

Yeti products have carved out a niche in the outdoor market by emphasizing durability and premium design. Andrew, a longtime customer, shared his experience owning over 20 Yeti items (see image above), including coolers, drinkware, and backpacks. These products are more than functional tools; they are part of a lifestyle.

What sets Yeti apart is its focus on building a reliable and aspirational brand. Products like their hard coolers are designed to last a decade or more, and their drinkware boasts insulation technology that keeps beverages at the desired temperature for hours. Customers often view their purchases as investments, further reinforcing loyalty to the brand.

Andrew explained:

“When you buy a Yeti cooler or tumbler, you’re not just buying something to use; you’re buying peace of mind. You know it will perform well, and it’s not something you’ll need to replace anytime soon.”

While this quality is great for building a good reputation among customers and contributes to Yeti’s pricing power, as investors, we typically prefer businesses with recurring revenue streams, as they provide more predictable and stable income compared to one-time equipment sales, where products are purchased and used for years before being replaced.

However, in the case of Yeti, there is a compelling argument to be made that the company is effectively building an ecosystem. For instance, the company has expanded its product range to cater to various use cases, from French presses for coffee lovers to cast-iron cookware for outdoor chefs. This diversification helps Yeti maintain its relevance and attract repeat customers.

By offering a diverse range of complementary products – and let’s not forget about the various colors for the hardcore Yeti collector –, Yeti encourages customers to make additional purchases over time, fostering repeat business and customer loyalty despite the non-recurring nature of its core product lines.

Financial Performance: Solid Numbers Backing the Brand

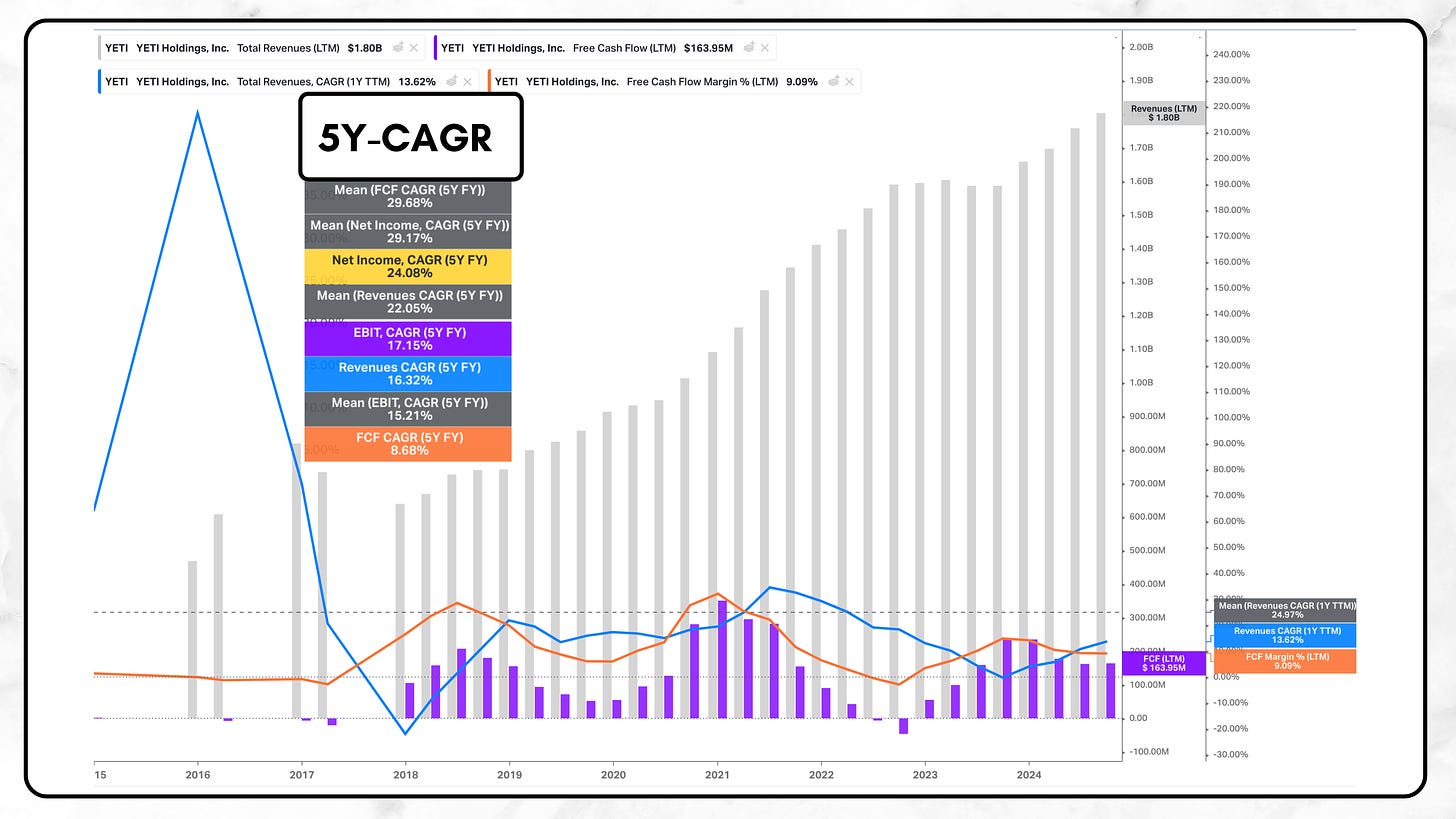

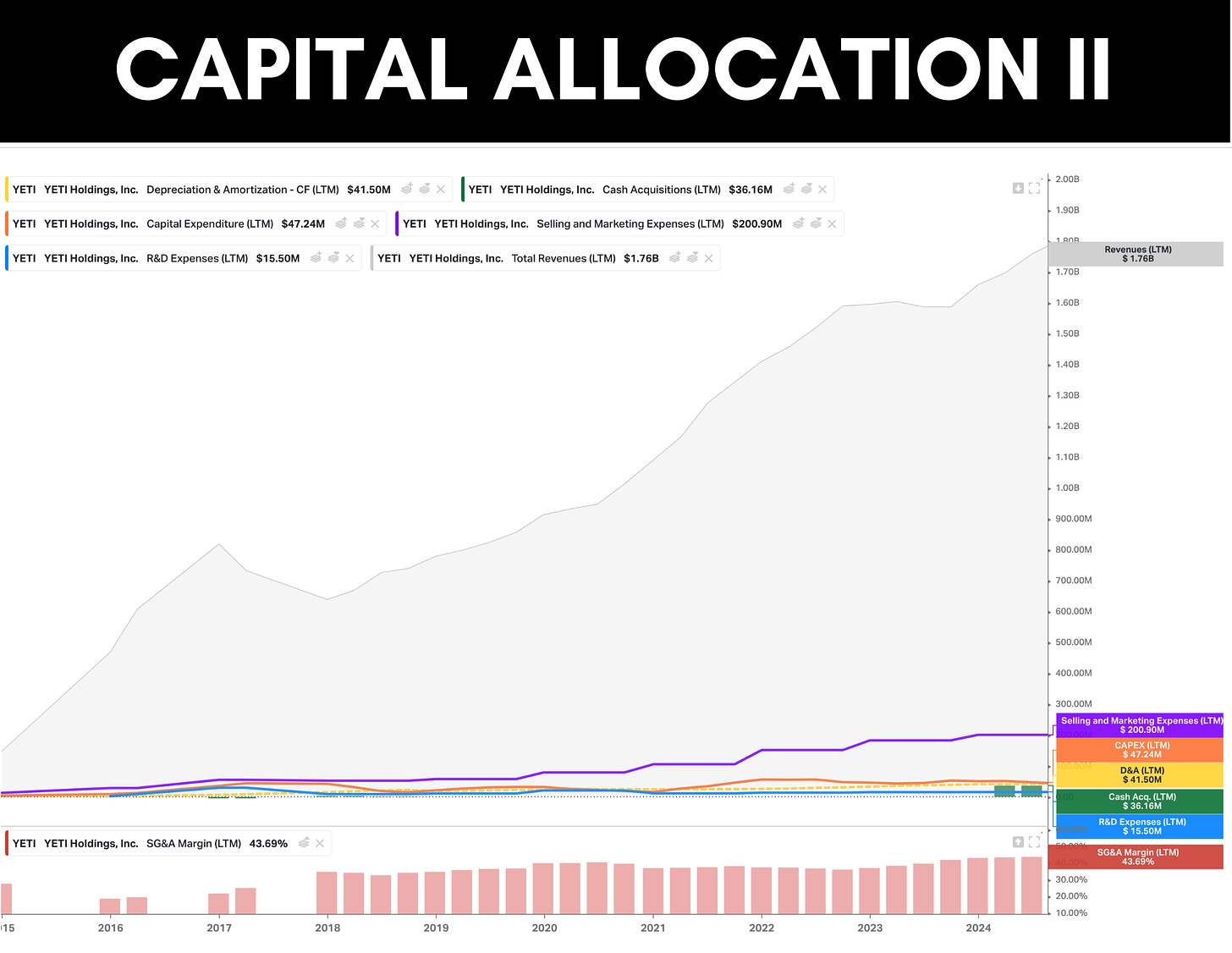

Yeti’s financials reflect its ability to maintain growth while preserving healthy margins. Since 2016, revenue has tripled, growing from approximately $600 million to over $1.8 billion today.

This growth has been driven by a combination of new product launches, expansion into international markets, and the increasing strength of its DTC channels.

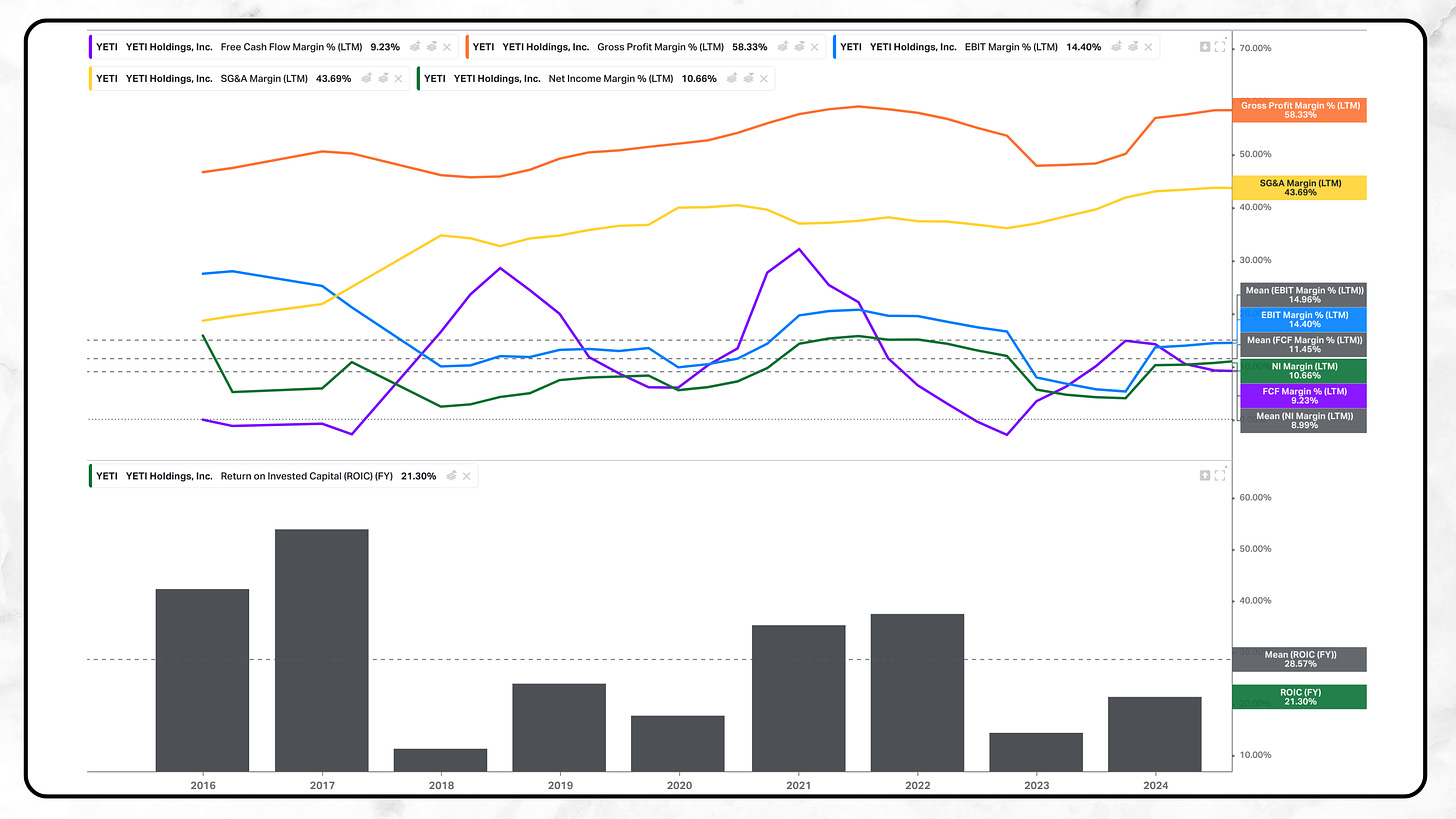

One standout metric is Yeti’s gross margin, which has consistently exceeded 50%. This high margin demonstrates the pricing power of the brand and its ability to charge a premium for quality. Management is targeting further improvements, with an aim to surpass 60% gross margins within the next five years.

In terms of free cash flow, the company generated $160 million over the last twelve months, equating to a 9% margin. While this margin appears lower than operating profitability, it reflects investments in supply chain optimization and future growth initiatives, such as international expansion.

Andrew highlighted the company’s return on invested capital (ROIC), which has averaged 28.5% over the last decade:

“This is a strong ROIC for a company selling physical goods. It shows that management has been effective in deploying capital to drive growth without compromising profitability.”

Growth Drivers: How Yeti Plans to Scale

Yeti’s growth prospects are rooted in three key areas: international expansion, product innovation, and acquisitions.

These pillars provide a roadmap for the company to build on its domestic success and capture new opportunities.

International Expansion

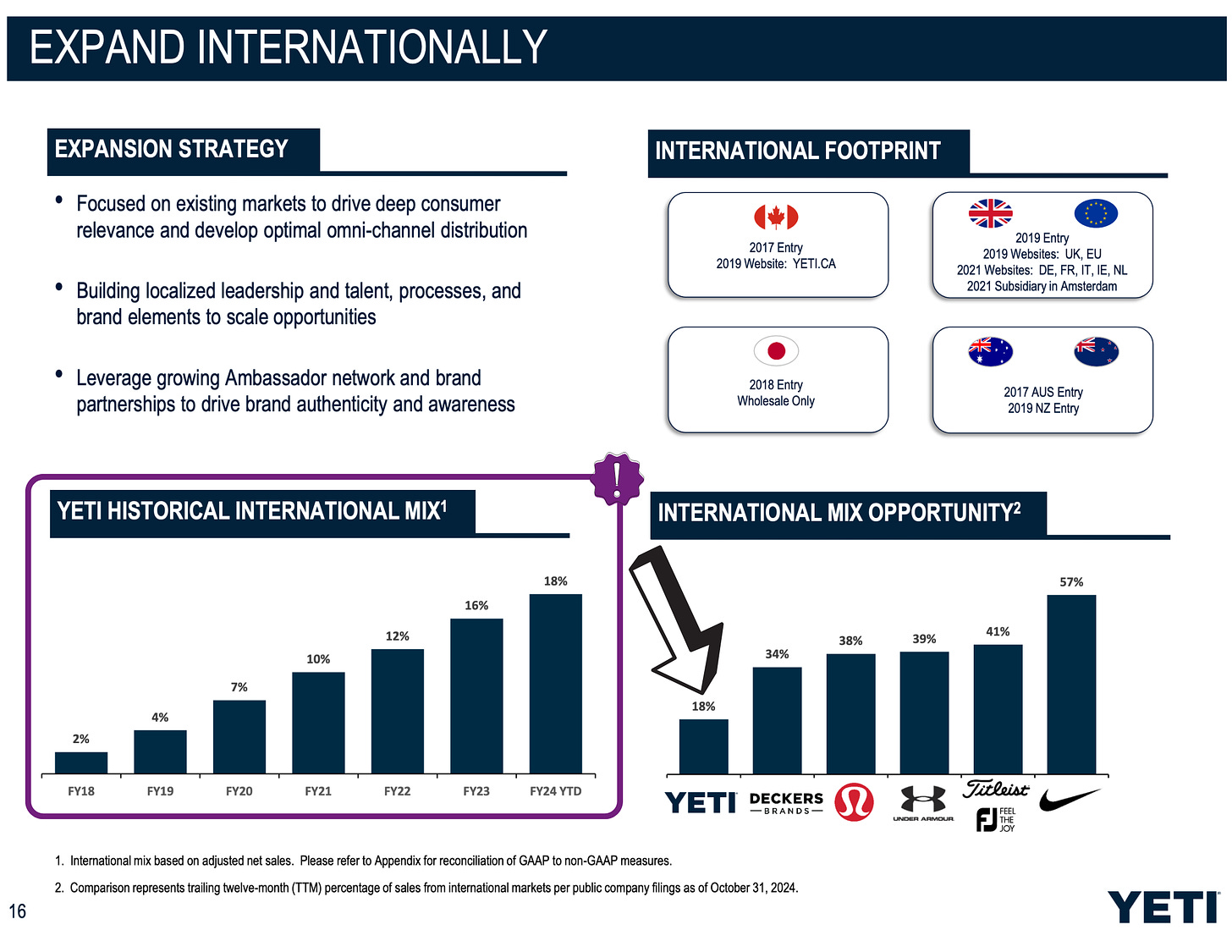

Today, only 18% of Yeti’s revenue comes from outside the U.S. This leaves significant room for growth, particularly in regions like Europe and Asia, where similar premium brands have found success (see chart below).

Andrew compared Yeti’s international potential to that of Titleist, a golf brand with a similar demographic profile, where international sales account for 41% of revenue.

“If Yeti can even reach 30% international sales, it would double its revenue outside the U.S. That’s a huge opportunity.”

To support this growth, Yeti is establishing partnerships with local distributors and expanding its e-commerce presence abroad.

Product Innovation

As already highlighted, Yeti continues to introduce new products that align with its brand ethos. Recent launches include backpacks and specialty coffee gear, which help the company tap into new customer segments.

By focusing on high-margin categories, Yeti ensures that new products not only expand its offering but also improve profitability.

Andrew pointed out that innovation is central to maintaining customer loyalty:

“Yeti’s ability to consistently deliver high-quality, thoughtful products is what keeps customers coming back. It’s not just about the coolers anymore.”

Acquisitions

In addition to organic growth, Yeti has pursued acquisitions to accelerate its entry into new categories.

The most recent example is Mystery Ranch, a premium backpack brand known for its rugged designs and durability. While Yeti plans to integrate some of Mystery Ranch’s products into its own lineup, it will retain the original brand for certain niche markets, such as firefighting and military gear.

Another notable acquisition is Butter Pat, a leader in cast-iron cookware. This move aligns with Yeti’s goal of becoming a one-stop shop for premium outdoor and lifestyle gear.

Yeti CFO Mike McMullen shared, “Regarding our acquisitions of Mystery Ranch and Butter Pat Industries, both transactions were completed in Q1 of this year, utilizing cash on hand for a combined consideration of $48.5 million.”

“This week, Yeti announced the acquisition of Butter Pat Industries, a company founded in 2013 that produces cast-iron pots and pans in a way that seeks to replicate the cookware of historic brands like Griswold. Like Yeti, their products elicit sticker shock from first-time buyers, but upon actual use, people seem to come around (I certainly did).“ Alex Lauer

“We’ll be making new products and scaling to reach new audiences and cooks. Butter Pat Industries will focus exclusively on manufacturing with YETI, and together we’ll help people discover how easy it is to use and love the greatest cast iron on earth in their homes, offices, or out in the wild.” Yeti statement“

Risks to Consider

No investment is without risks, and Yeti is no exception. Here are some of the key challenges the company faces:

Competition: Rival brands like Stanley have gained popularity, particularly among younger consumers. However, Yeti’s core customer base remains loyal, driven by the brand’s strong reputation for quality.

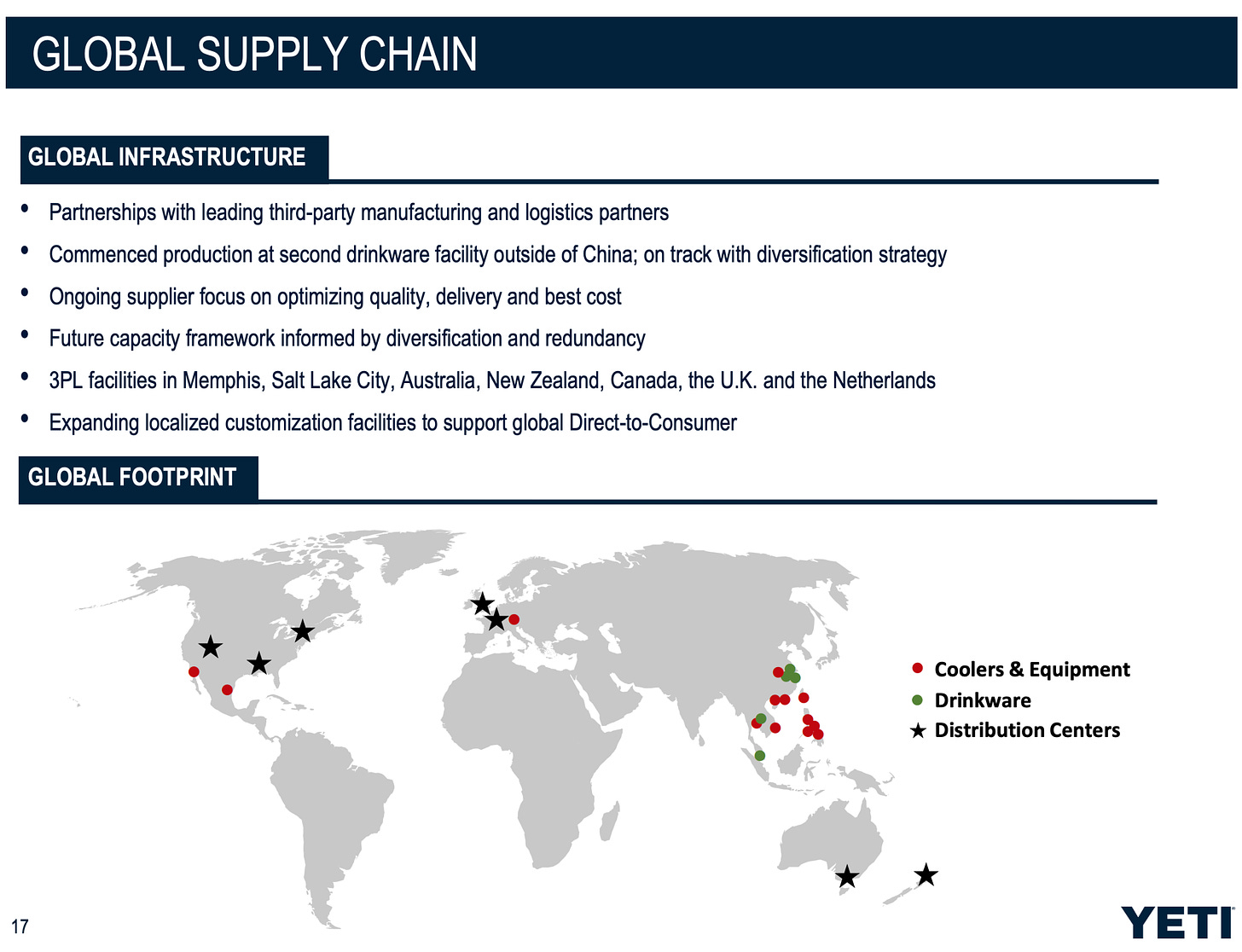

Supply Chain Dependencies: With 40% of production tied to China, Yeti is exposed to geopolitical risks and tariffs. The company is actively diversifying its manufacturing footprint to mitigate these vulnerabilities.

Market Saturation: The U.S. market is likely nearing saturation, making international growth critical for sustaining double-digit revenue growth.

Andrew summarized the risks succinctly:

“Yeti isn’t invincible, but its strong brand and customer loyalty provide a solid moat. The biggest risk would be mismanaging its reputation for quality.”

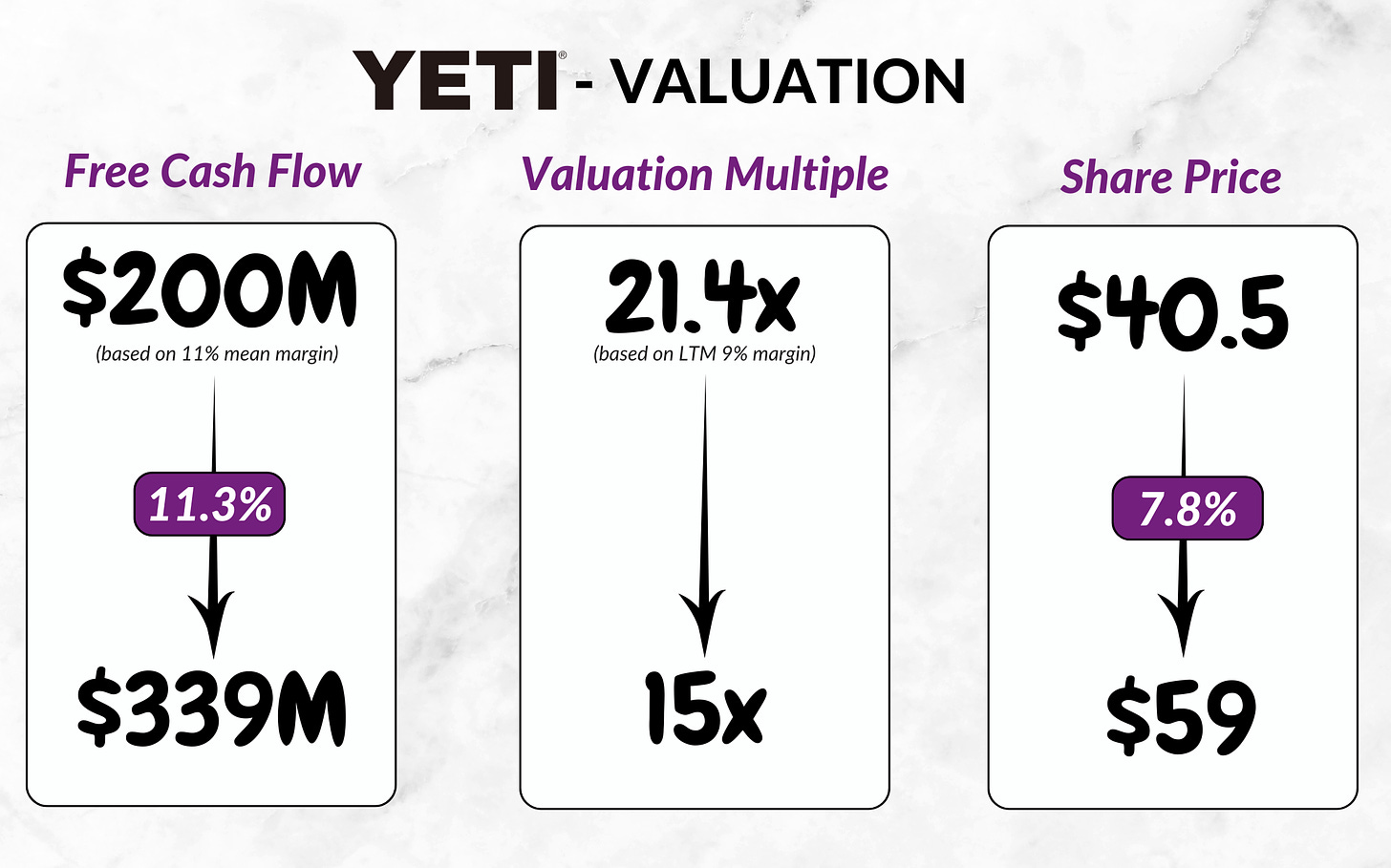

Valuation: Is Yeti a Buy?

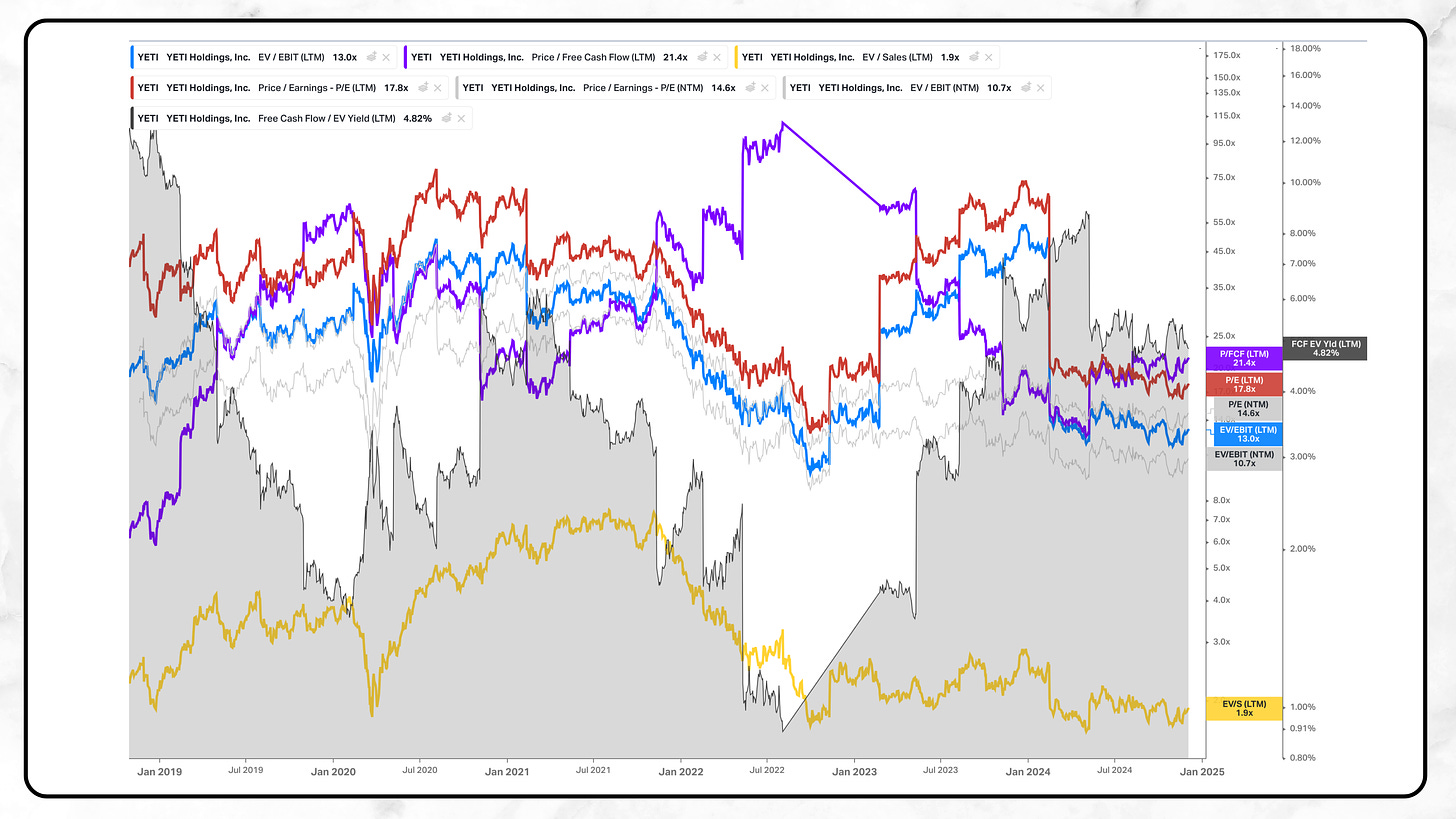

Yeti trades at approximately 18x forward earnings and 13x enterprise value to operating income. While not a deep-value stock, these multiples could suggest the market isn’t fully pricing in the company’s growth potential.

Using an exit multiple approach, I estimated that based on an 11% free cash flow margin and 12% annual growth in the next three years followed by 10% growth in years 4 and 5, there’s a 50% upside from current levels. This, however, only translates into a modest annualized return of 8%.

So while I like a lot of what I’m seeing, Yeti would need to trade at a lower multiple for ma to seriously considering investing in this slightly above-average company.

Andrew offered his perspective:

“The stock isn’t a 20-year compounder, but it’s a quality company trading below its intrinsic value. With a little multiple expansion, you could see double-digit returns over the next few years.”

Conclusion: A Balanced Opportunity

Yeti Holdings is a strong brand with significant growth opportunities, particularly in international markets and new product categories. While not without risks, the company’s loyal customer base, robust financials, and proven management team could make it a compelling investment for those with a medium-term horizon if the price drops around 20-30%.

For investors seeking a blend of quality and value, Yeti is worth a closer look.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a professional advisor before making investment decisions.